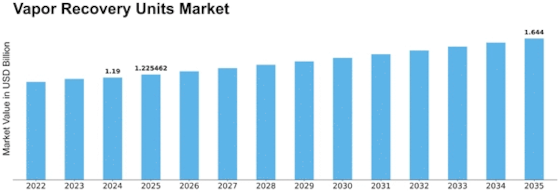

Vapor Recovery Units Size

Vapor Recovery Units Market Growth Projections and Opportunities

The storage of oil within the oil and gas industry offers a significant opportunity for the market of vapor recovery units. These units play a crucial role when installed on onshore oil storage tanks, as they help recover volatile organic compound (VOC) emissions from the tanks. This process is essential for both environmental and economic reasons. In simple terms, the vapor recovery units function by drawing out hydrocarbon vapors from the oil storage tanks under low pressure, typically ranging from 4 ounces to 2 pounds per square inch (psi). Once extracted, these vapors are directed to a separator suction scrubber, also known as a knock-out pot. This scrubber serves the purpose of separating any liquids that may be concentrated in the piping network. From the knock-out pot, the vapors then pass through a compressor that facilitates the low-pressure suction for the entire system. The vapor recovery units are designed with a control pilot to prevent the formation of a vacuum in the top of the storage tank. This is a critical safety measure to ensure the stability of the entire system. After passing through the compressor, the vapors are metered and removed from the system. There are two main destinations for these recovered vapors: pipeline sale or onsite fuel supply. This means that the hydrocarbon vapors, which would otherwise contribute to environmental pollution, are efficiently captured and repurposed for further use, contributing to sustainable practices within the industry. One notable feature of vapor recovery units is their high efficiency. These units are capable of recovering more than 95% of the hydrocarbon vapors from the storage tanks. This not only helps in environmental conservation by preventing the release of harmful compounds into the atmosphere but also has economic benefits by reclaiming valuable hydrocarbons that can be utilized in various applications. In the context of geographical usage, several countries in the Middle East, including Saudi Arabia, the UAE, and Qatar, have embraced the adoption of vapor recovery units. This trend is particularly prominent because these countries are key players in the global oil and gas industry. By incorporating vapor recovery units into their oil storage facilities, they demonstrate a commitment to sustainable and responsible practices in the extraction and storage of oil. The widespread use of vapor recovery units in these regions can be attributed to the presence of significant market players in the oil and gas industry. These companies recognize the importance of implementing advanced technologies to minimize the environmental impact of their operations. vapor recovery units play a crucial role in the oil and gas industry, especially in the storage of oil. By efficiently capturing and repurposing hydrocarbon vapors, these units contribute to both environmental preservation and economic sustainability. The high efficiency of vapor recovery units, recovering over 95% of the vapors, makes them a valuable asset in mitigating the environmental impact of the oil and gas sector. The adoption of these units in key regions such as the Middle East signifies a positive shift towards responsible and sustainable practices within the industry.

Leave a Comment