Shift Towards Value-Based Care

The shift towards value-based care is influencing the Vendor Neutral Archive (VNA) and PACS Market significantly. As healthcare systems move away from fee-for-service models, there is an increasing emphasis on delivering high-quality patient outcomes. VNA solutions that facilitate better data sharing and collaboration among healthcare providers are becoming essential in this context. By enabling comprehensive patient data access, VNA systems support coordinated care efforts, which are crucial for achieving value-based care objectives. This trend is likely to drive the adoption of VNA solutions, as healthcare organizations seek to enhance patient care while managing costs effectively.

Growing Importance of Telemedicine

The growing importance of telemedicine is reshaping the Vendor Neutral Archive (VNA) and PACS Market. As telehealth services expand, the need for efficient imaging data management becomes paramount. VNA solutions that support remote access to imaging data are increasingly sought after, as they enable healthcare providers to deliver care to patients regardless of location. The telemedicine market is expected to reach USD 459 billion by 2030, highlighting the potential for VNA systems to play a crucial role in this evolving landscape. By facilitating seamless access to imaging data, VNA solutions enhance the effectiveness of telemedicine, thereby driving their adoption in the healthcare sector.

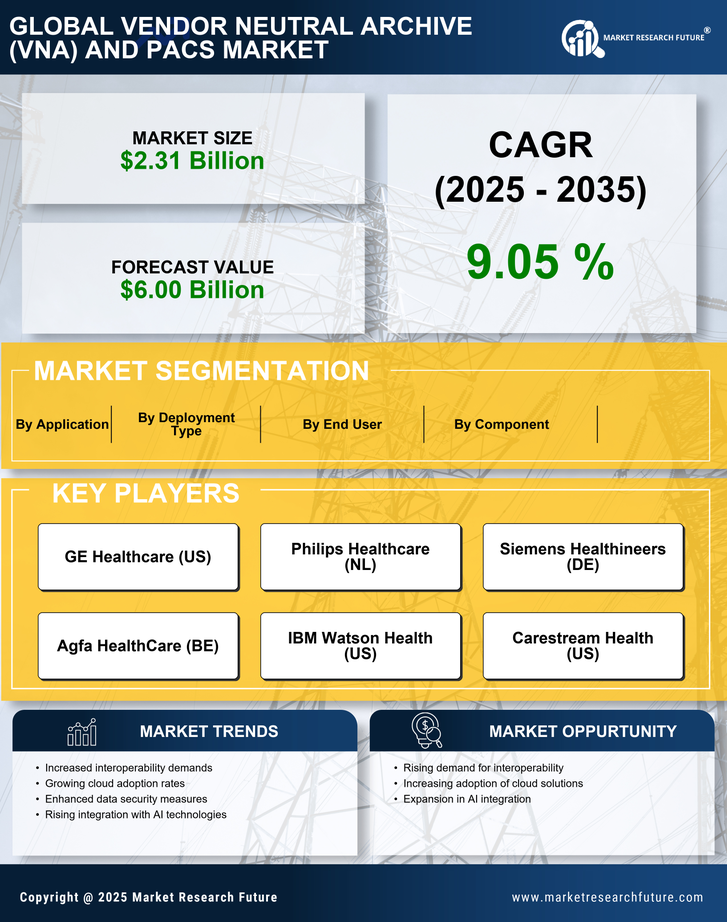

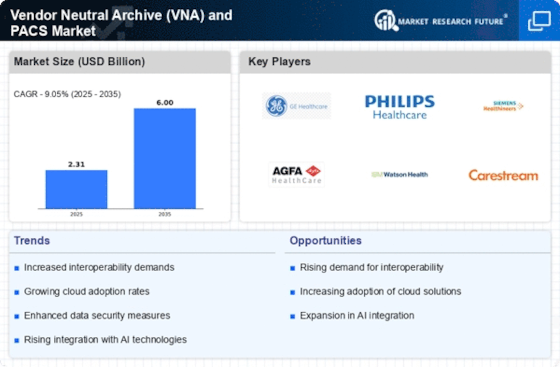

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) technologies into the Vendor Neutral Archive (VNA) and PACS Market is emerging as a transformative driver. AI applications in medical imaging, such as automated image analysis and predictive analytics, are gaining traction. These technologies enhance the capabilities of VNA systems by enabling faster and more accurate diagnoses. The market for AI in medical imaging is projected to reach USD 2 billion by 2025, indicating a significant opportunity for VNA providers to incorporate AI functionalities. This integration not only improves clinical outcomes but also streamlines workflows, making VNA solutions more appealing to healthcare organizations.

Regulatory Compliance and Data Security

In the Vendor Neutral Archive (VNA) and PACS Market, regulatory compliance and data security are becoming increasingly critical. Healthcare organizations are mandated to adhere to stringent regulations regarding patient data protection, such as HIPAA in the United States. This has led to a heightened focus on VNA solutions that offer robust security features, including encryption and access controls. The market is witnessing a shift towards solutions that not only comply with regulatory requirements but also provide advanced security measures to protect sensitive patient information. As healthcare providers prioritize data security, the demand for compliant VNA solutions is expected to grow, driving market expansion.

Rising Demand for Efficient Data Management

The Vendor Neutral Archive (VNA) and PACS Market is experiencing a notable increase in demand for efficient data management solutions. Healthcare organizations are increasingly recognizing the need to streamline their imaging data storage and retrieval processes. This trend is driven by the growing volume of medical imaging data, which is projected to reach 2.5 exabytes by 2025. As a result, healthcare providers are seeking VNA solutions that can effectively manage this influx of data while ensuring quick access and retrieval. The ability to consolidate imaging data from various sources into a single repository enhances operational efficiency and reduces costs, making VNA an attractive option for healthcare institutions.