Market Analysis

In-depth Analysis of Veterinary POC Diagnostic Market Industry Landscape

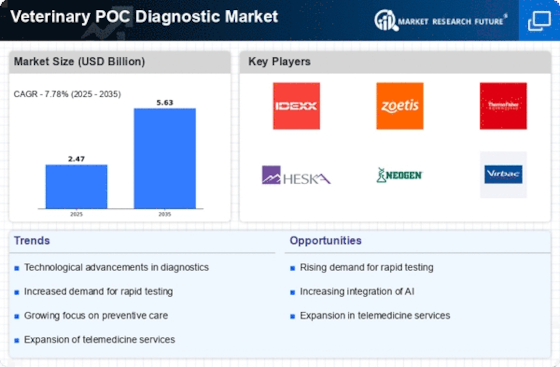

The Veterinary POC Diagnostic market is a pivotal segment within the veterinary healthcare industry, providing rapid and on-site diagnostic solutions for the timely detection of diseases in animals. These diagnostics play a crucial role in veterinary practices, enabling quick decision-making and facilitating immediate treatment interventions. The growth in the area of domestic animal ownership and focus on companion animal care, continued pet owner behavior and pace are a few factors that strongly impact market dynamics. In addition, more persons are beginning to look at pets as real family members which means the demand for speedy and quick diagnostics services for the management of their animals’ health is growing too. Market dynamics are also largely influenced by continuous technological breakthroughs. Modern POC diagnostic devices for veterinary application which include handheld analyzers and portable test kits improve currently disease detection efficiency, accuracy and speed, ascribe to the competitors profiles. The incidence of zoonosis diseases, transmitted from animals and people thus influence market dynamics. As veterinary practices are dealing with a critical need for fast and reachable diagnostics to allow early identification and prevention of conditions that have a certain public health impact. Livestock farming and production boost market dynamics. Veterinary POC diagnostics used in agricultural location enable farmers to rapidly evaluate the status of livestock health, make decisions based on this assessment, and effectively contain disease outbreaks. The globalization of the animal industry impacts the dynamics of the Veterinary POC Diagnostic market. Bordering the movement of animals increases the predicament that disease transmission, diagnostic applications should be adopted in the widespread. The environment of the market is influenced by the rate of adoption and being trained in this field, as a professional veterinarian. Initiatives towards education and training for the effective utilization of POC diagnostics, also aid in overall market growth as user know-how and confidence is boosted with such support. In terms of market dynamics, integration of Veterinary POC diagnostics into EHR systems affects such dynamics. Flawless interconnected-ness enables agile data control, real-date reporting and better cross-professional association, as the drivers behind market microphenomen. Ongoing research and development initiatives contribute to market dynamics. Investments in the development of novel diagnostic technologies, assays, and testing methodologies influence the competitive landscape and the evolution of the Veterinary POC Diagnostic market.

Leave a Comment