Market Share

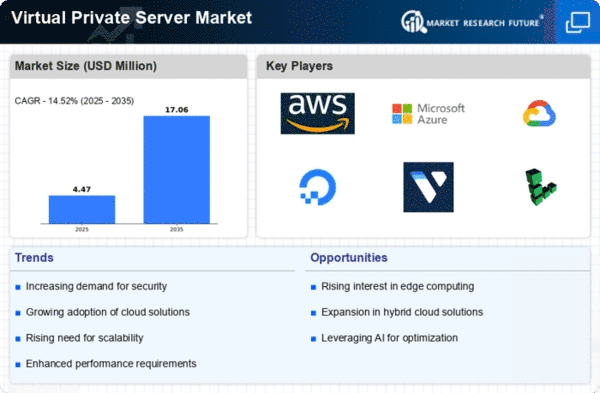

Virtual Private Server Market Share Analysis

Market share positioning techniques are used by organizations to keep ahead of their competitors and tailor themselves for the ever-changing Virtual Private Server (VPS) industry. One common strategy is to differentiate one's own offering of a virtual private server (VPS) from the competition by giving customers extras others don't These include robust security mechanisms, established customer support teams, and optimized configurations resulting in maximum performance. To attract premium or specialized VPS services, companies highlight these special features. Market segmentation is one of the most important strategies in the VPS industry. Businesses target different subsets of consumers, and match things to the tastes or needs of each. It could also be focusing on large-scale clients with advanced infrastructure and high-performance capabilities, or supplying economical, scalable virtual private server solutions to small enterprises. Using segmentation, providers can customize their marketing and service offerings to more effectively meet the unique needs of each group. To break into the virtual private server (VPS) market, businessmen need to have strong alliances and close cooperation. VPS providers can enhance their service capabilities and extend the scope of this market by establishing strategic partnerships with software developers, data center operators or other tech firms. As another example, offering pre-configured software stacks or seamlessly supporting popular content management systems will help humanize VPS solutions and increase market share. Those techniques of positioning market share in the VPS industry are all pushed by innovation. Money invested in R&D means providers are able to look ahead and prepare for new trends or technological developments. To this end, you may have to utilize the latest in virtualization techniques; install high-level security devices; add new features and automation tasks which enhance usability. Thus virtual private server suppliers may entice those who want to be on the cutting edge by portraying themselves as innovators. Recently, customer-centered concepts have become commonplace in the VPS industry. To make clients happy, providers try to offer fast answers, user-friendly interfaces and easy pricing structures. Retaining current customers and cultivating favorable word-of-mouth marketing help generate a reputation for excellent customer service, which can greatly influence potential consumers' purchasing decisions.

Leave a Comment