Wafer Level Packaging Size

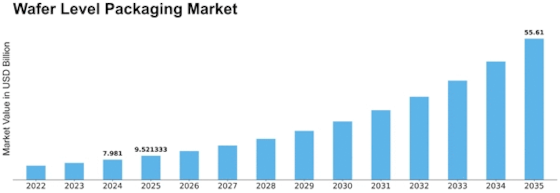

Wafer Level Packaging Market Growth Projections and Opportunities

WLP's market for wafer back-end production and other related products is constantly under numerous kinds of impetus, with various factors defining the direction of it all; this affects demand, technology development and semiconductor industry growth. Wafer-level packaging is closely linked to the miniaturization trend sweeping across electronics. With electronic devices getting increasingly smaller and more compact, even higher-level packaging technologies such as wafer level packaging are required to keep up with the changing form factors. Connecting a number of functions and components in one semiconductor package is an important force behind wafer-level packaging. Selecting an interlayer spacing based on these considerations is one way to glean the best performance out of a chip. It also allows for shorter lengths in wiring connections and greater speed throughout electronic devices, thereby increasing efficiency overall. Portable and wearable electronic devices, from smartphones to IoT (Internet of Things) are increasingly popular in the market. So wafer-level packaging is also stimulated by greater demand for these applications. Because these applications require compact and lightweight packages, WLP is essential to semiconductor manufacturers. The development and adoption of wafer-level packaging is also influenced by advances in semiconductor manufacturing technologies such as advanced lithography, improved materials. Innovative manufacturing processes also help to make WLP solutions scalable and cost effective. The arrival of 5G boosts the need for high-performance semiconductors with greater processing speeds. Whether in 5G applications or elsewhere, performance requirements are very demanding. Wafer-level packaging can improve signal integrity and reduce parasitic effects. The demand for interconnection between networked devices and the proliferation of Internet of Things (IoT) applications fuel this market. WLP can produce compact, low-energy consuming semiconductor devices for a wide range of IoT applications from smart home products to industrial sensors. However, fan-out wafer-level packaging (FO-WLP) is a great step forward in the market. Increased flexibility in placing semiconductor components, better heat dissipation and electrical characteristics: these are reasons why fo-wlp is increasingly gaining importance for high performance applications. As the automotive industry's use of electronics and semiconductor components continues to increase, demand for wafer-level packaging also grows. WLP solutions are designed to satisfy the demanding needs of automotive applications: dependability, miniaturization and long service life in extreme conditions. As environmental issues and regulations affect the wafer-level packaging market, customers progressively turn to lead-free packaging solutions. In choosing materials and manufacturing processes, manufacturers and end-users are both looking for environmentally friendly packaging solutions. Design and packaging trends in the global semiconductor industry, among other factors such as mergers and acquisitions or technological alliances, form a competitive environment for wafer-level packaging. These include strategic collaborations and industry developments that affect market dynamics.

Leave a Comment