Growing Environmental Awareness

Growing environmental awareness among stakeholders is significantly influencing the Waste Disposal Regulations Drilling Mud Cutting Market. As public concern regarding environmental degradation increases, companies are compelled to adopt more sustainable practices in their waste disposal methods. This shift is not only driven by regulatory requirements but also by consumer preferences for environmentally friendly operations. In 2025, it is estimated that approximately 70% of drilling companies will prioritize sustainable waste disposal methods, reflecting a substantial change in industry practices. This trend is likely to create new opportunities for businesses that specialize in eco-friendly waste management solutions, thereby reshaping the competitive landscape of the market.

Increased Regulatory Compliance

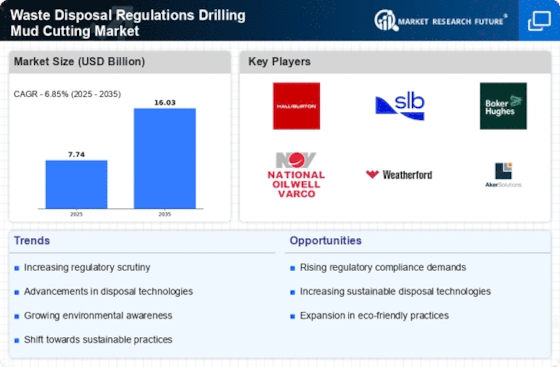

The Waste Disposal Regulations Drilling Mud Cutting Market is experiencing heightened regulatory compliance requirements. Governments are implementing stricter guidelines to ensure that drilling mud cuttings are disposed of in an environmentally responsible manner. This trend is driven by the need to protect natural resources and public health. As a result, companies are investing in technologies and processes that align with these regulations. The market is projected to grow as firms seek to avoid penalties associated with non-compliance, which can be substantial. In 2025, the estimated value of the market is expected to reach USD 1.5 billion, reflecting the increasing costs associated with adhering to these regulations. This compliance-driven growth is likely to shape the future landscape of the industry.

Collaboration with Regulatory Bodies

Collaboration with regulatory bodies is becoming increasingly important in the Waste Disposal Regulations Drilling Mud Cutting Market. Companies are recognizing the value of engaging with regulators to ensure compliance and to stay ahead of evolving regulations. This collaboration can lead to the development of best practices and innovative solutions that benefit both the industry and the environment. In 2025, it is anticipated that partnerships between drilling companies and regulatory agencies will increase by 30%, fostering a more proactive approach to waste management. Such collaborations may also facilitate knowledge sharing and the implementation of more effective waste disposal strategies, ultimately enhancing the industry's reputation.

Economic Incentives for Sustainable Practices

Economic incentives for sustainable practices are emerging as a key driver in the Waste Disposal Regulations Drilling Mud Cutting Market. Governments are increasingly offering financial incentives, such as tax breaks and grants, to companies that adopt environmentally friendly waste disposal methods. These incentives encourage businesses to invest in sustainable technologies and practices, thereby reducing their overall environmental footprint. In 2025, it is projected that the number of companies benefiting from such incentives will increase by 25%, reflecting a growing recognition of the economic advantages of sustainable waste management. This trend is likely to stimulate innovation and competition within the market, as companies strive to capitalize on these opportunities.

Technological Advancements in Waste Management

Technological advancements are playing a pivotal role in the Waste Disposal Regulations Drilling Mud Cutting Market. Innovations in waste management technologies, such as advanced separation techniques and treatment processes, are enhancing the efficiency of drilling mud disposal. These technologies not only reduce environmental impact but also lower operational costs for companies. For instance, the introduction of automated systems for monitoring waste disposal has improved compliance with regulations. The market is projected to grow at a compound annual growth rate of 6% from 2025 to 2030, driven by the increasing adoption of these technologies. As companies strive to optimize their waste management practices, the demand for innovative solutions is likely to rise.