Top Industry Leaders in the Wastewater Treatment Services Market

Wastewater Treatment Services Market

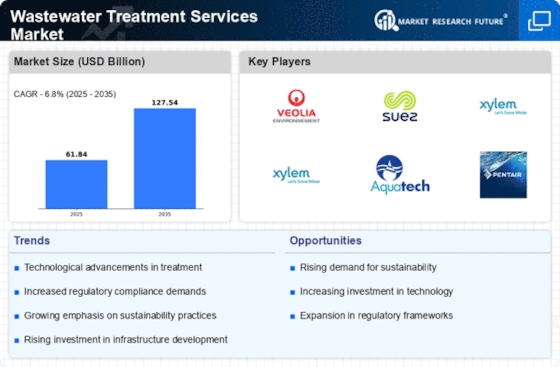

The wastewater treatment services market growth is fueled by stringent environmental regulations, rising concerns about water scarcity, and increasing industrial activity. However, navigating this dynamic landscape necessitates understanding the key players, their strategies, and the evolving market trends.

Key Players and their Strategies:

-

Global Giants: Veolia Environment, Suez, and Xylem Inc. dominate the market with comprehensive service offerings, robust geographic reach, and strong financial resources. They focus on strategic acquisitions, technological advancements, and expanding their operational footprints. For example, Veolia acquired Suez's North American waste and recycling business in 2022, strengthening its market position. -

Regional Players: Companies like Evoqua Water Technologies, Severn Trent Plc, and China's Beijing Enterprises Water Group hold strong regional sway. They focus on tailoring solutions to local regulations and developing cost-effective technologies. Evoqua, for instance, launched new membrane bioreactor technology targeting smaller municipalities. -

Niche Specialists: Focused players like Aquatech and W.E. O'Brien address specific segments like industrial wastewater treatment or membrane technologies. They leverage their expertise and deep customer relationships to carve out a niche. W.E. O'Brien, for example, specializes in treating complex industrial wastewater for the oil & gas industry.

Factors Influencing Market Share:

-

Technological Innovation: Companies that offer advanced and sustainable treatment solutions like membrane bioreactors, zero liquid discharge (ZLD) technologies, and digital automation gain a competitive edge. Xylem's IntelliFlux smart water management platform is an example. -

Geographical Footprint: A wide geographical presence allows companies to cater to diverse needs and tap into emerging markets. Veolia's global operations are a prime illustration. -

Financial Strength: Strong financial resources enable companies to invest in research and development, infrastructure upgrades, and strategic acquisitions. Suez's focus on cost optimization and debt reduction exemplifies this. -

Customer Service and Relationships: Building strong client relationships and delivering reliable, value-added services fosters loyalty and repeat business. Aquatech's emphasis on customized solutions and long-term partnerships demonstrates this approach.

Key Players

- Veolia (France)

- SUEZ Worldwide (France)

- DuPont (U.S.)

- 3M (U.S.)

- Xylem (U.S.)

- Kemira (Finland)

- Evoqua Water Technologies LLC (U.S.)

- Pentair PLC (U.K.)

- Ecolab (U.S.)

- American Water (U.S.)

- Acciona (Spain)

- Hydro International (U.K.)

- Aquatech International LLC (U.S.)

- Trojan Technologies (Canada)

- BioMicrobics Inc. (U.S.)

- Kurita Water Industries Ltd. (Japan)

- ASIO (Czech Republic)

Recent Developments

-

August 2023: The US Environmental Protection Agency (EPA) announced stricter wastewater discharge limits for the textile industry, driving demand for advanced treatment solutions. -

September 2023: Suez and Veolia secured major contracts for wastewater treatment plants in Saudi Arabia and India, highlighting the growing market in developing economies. -

October 2023: Xylem unveiled a new line of compact wastewater treatment systems targeting small communities and remote locations. -

November 2023: The World Bank approved a $500 million loan for wastewater infrastructure development in Vietnam, indicating significant investment opportunities in emerging markets. -

December 2023: Aquatech partnered with a leading food processing company to optimize its wastewater treatment plant, showcasing the trend towards collaborative solutions.