Market Share

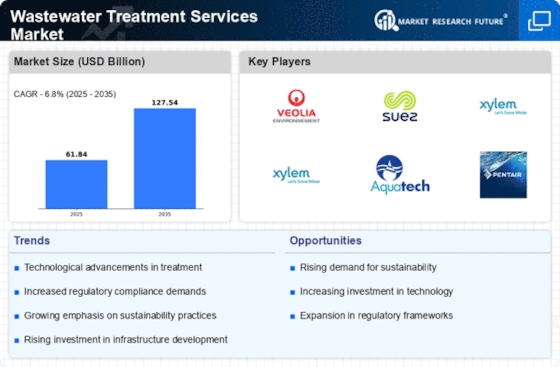

Wastewater Treatment Services Market Share Analysis

Market share positioning strategies in the wastewater treatment services market play a crucial role in determining the success and growth of companies operating in this sector. One of the primary strategies employed by companies is differentiation. By offering unique and innovative wastewater treatment solutions, companies can distinguish themselves from competitors and capture a larger share of the market. This could involve developing proprietary technologies or implementing sustainable practices that appeal to environmentally conscious consumers and businesses.

Another key strategy is cost leadership. Companies that can provide efficient and cost-effective wastewater treatment services are often able to attract a significant portion of the market share. This may involve investing in advanced equipment and technologies to streamline operations and reduce expenses, allowing companies to offer competitive pricing to their customers. Additionally, economies of scale can play a significant role in cost leadership, as larger companies may be able to spread their fixed costs over a larger volume of wastewater treatment projects.

Furthermore, market segmentation is an important aspect of market share positioning in the wastewater treatment services industry. By identifying specific target markets or customer segments with unique needs and preferences, companies can tailor their offerings to better meet those requirements. For example, companies may focus on serving industrial clients with specialized wastewater treatment needs or municipal governments seeking comprehensive solutions for water management. By understanding the distinct needs of different customer segments, companies can effectively position themselves to capture market share within those niches.

Additionally, strategic partnerships and alliances can play a vital role in market share positioning within the wastewater treatment services market. Collaborating with other companies, research institutions, or government agencies can provide access to complementary resources, expertise, and technologies that can enhance a company's competitive advantage. For example, partnerships with technology providers or academic institutions can facilitate the development of innovative wastewater treatment solutions, while collaborations with government agencies can help companies navigate regulatory requirements and secure contracts for public sector projects.

Moreover, branding and marketing efforts are essential components of market share positioning strategies in the wastewater treatment services industry. Establishing a strong brand identity and communicating key value propositions effectively can help companies differentiate themselves from competitors and attract customers. This may involve highlighting factors such as reliability, efficiency, sustainability, or customer service excellence. Additionally, targeted marketing campaigns can help raise awareness of a company's offerings and generate leads within specific market segments.

Furthermore, geographical expansion can be a key strategy for capturing market share in the wastewater treatment services industry. As urbanization and industrialization continue to drive demand for wastewater treatment solutions worldwide, companies may seek to expand their presence into new geographic markets to capitalize on growth opportunities. This could involve entering emerging markets with high demand for infrastructure development or expanding operations in established markets to serve new customer segments.

Leave a Comment