Top Industry Leaders in the Water Soluble Vitamins Minerals Feed Market

Global Water-Soluble Vitamins & Minerals in Feed Market :

Global Water-Soluble Vitamins & Minerals in Feed Market :

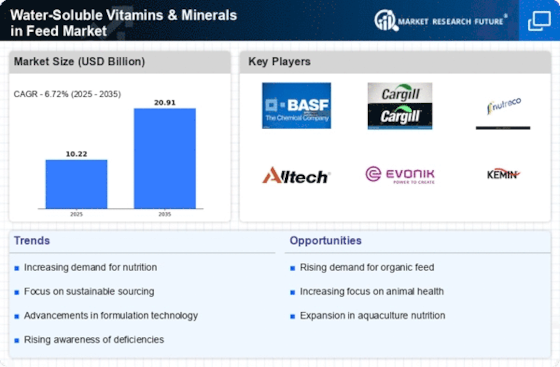

The water-soluble vitamins and minerals in the feed market have witnessed significant growth in recent years, driven by increasing awareness about animal nutrition and the demand for high-quality animal products. The competitive landscape of this market is dynamic, marked by the presence of key players, each employing diverse strategies to gain a competitive edge. This comprehensive analysis delves into the strategies adopted by key players, factors influencing market share, the emergence of new companies, industry news, and current investment trends, offering insights into the overall competitive scenario.

Key Players and Market Dominance:

- Lonza Group (Switzerland)

- Koninklijke DSM N.V. (Netherlands)

- Nutreco N.V. (Netherlands)

- BASF SE (Germany)

- Archer Daniels Midland Company (US)

- Dansk Landbrugs Grovva

Strategies Adopted by Key Players:

Key players in the market have employed various strategies to maintain and enhance their market share. Product innovation stands out as a crucial strategy, with companies investing heavily in research and development to introduce novel formulations with improved bioavailability and efficacy. Additionally, strategic partnerships and collaborations have become increasingly common, allowing companies to leverage complementary strengths and expand their market presence. Market leaders are also focusing on mergers and acquisitions to gain access to new technologies and strengthen their competitive position.

Factors Influencing Market Share Analysis:

Several factors contribute to the market share dynamics within the water-soluble vitamins and minerals in feed industry. One of the primary influencers is the ability to offer a diverse and comprehensive product portfolio. Companies that provide a wide range of nutritional solutions, tailored to the specific needs of different animal species, have a competitive advantage. Moreover, the geographical reach and distribution capabilities play a crucial role, ensuring products are readily available to a global customer base. Quality control measures, adherence to regulatory standards, and sustainable practices also contribute significantly to building and maintaining market share.

New and Emerging Companies:

The market is witnessing the emergence of new and innovative companies that are disrupting the traditional landscape. Start-ups like NutriFuture and NutraBlend are gaining traction with their focus on sustainable and eco-friendly solutions. These companies often leverage advanced technologies, such as precision nutrition and biotechnology, to develop cutting-edge products. While their market share might be relatively small compared to industry giants, their agility and innovative approaches make them formidable contenders, and they are attracting attention from investors seeking high-growth opportunities.

Industry News and Market Dynamics:

Recent industry news reflects a growing emphasis on sustainability and the role of water-soluble vitamins and minerals in achieving environmentally friendly and ethical farming practices. The push towards reducing the environmental impact of livestock production has spurred research and development in alternative protein sources and supplements. Additionally, regulatory changes and evolving consumer preferences are driving companies to adapt their strategies and formulations to align with these shifting dynamics. Industry players are closely monitoring these trends to stay ahead of the curve.

Current Company Investment Trends:

Investment trends within the water-soluble vitamins and minerals in feed market indicate a sustained focus on research and development. Companies are allocating significant resources to explore new formulations, improve existing products, and enhance production processes. Furthermore, strategic investments in marketing and branding activities are aimed at creating awareness and establishing a strong market presence. Investors are showing a keen interest in companies that demonstrate a commitment to sustainability, innovation, and ethical practices, reflecting a broader trend towards responsible investing.

Overall Competitive Scenario:

The overall competitive scenario in the water-soluble vitamins and minerals in feed market is characterized by a delicate balance between established industry leaders and nimble newcomers. Key players continue to invest in innovation, partnerships, and acquisitions to maintain their dominance, while new entrants challenge the status quo with disruptive technologies and sustainable practices. The market's future trajectory will likely be shaped by ongoing advancements in nutritional science, regulatory developments, and evolving consumer preferences. As the industry navigates these challenges and opportunities, the competitive landscape is expected to witness further transformation, creating a dynamic environment for players across the spectrum.

Recent News :

DSM, for instance, has been a pioneer in developing innovative nutritional solutions, while BASF's commitment to sustainability has resonated well with environmentally conscious consumers. Archer Daniels Midland Company, with its strategic acquisitions and partnerships, has fortified its market position.

BASF:

January 12, 2024: Launched its innovative "VitaSmart Plus" range of water-soluble vitamins and minerals in India, offering enhanced bioavailability and tailored solutions for specific animal needs.

November 17, 2023: Partnered with a leading biotechnology company to develop novel forms of vitamin D for animal feed, promising improved stability and absorption.

DSM Nutritional Products:

December 20, 2023: Unveiled its new line of chelated trace minerals for swine feed, promoting optimal mineral utilization and reducing environmental impact.

September 25, 2023: Announced the expansion of its vitamin production facility in China, catering to the rising demand for high-quality feed additives in the Asian market.

Evonik Nutrition & Care:

January 5, 2024: Received regulatory approval in the US for its new vitamin E product for poultry feed, offering improved antioxidant protection and shelf life extension.

October 20, 2023: Collaborated with a research institute to develop sustainable methods for producing essential minerals for animal feed, minimizing environmental footprint.

- Beta

Beta feature