- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

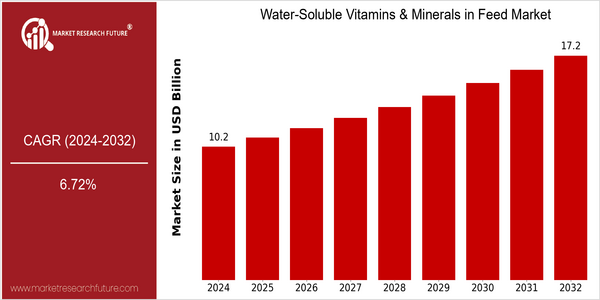

| Year | Value |

|---|---|

| 2024 | USD 10.222 Billion |

| 2032 | USD 17.2 Billion |

| CAGR (2024-2032) | 6.72 % |

Note – Market size depicts the revenue generated over the financial year

Water-soluble vitamins and minerals in feeds are experiencing a high growth rate. The current market size of $ 10.2 billion in 2024 is projected to reach $ 17.2 billion by 2032. The annual growth rate is high at 6.8 percent. The high demand for high-quality feed due to the rising population and the resulting need for improved livestock productivity is driving the market. The growing awareness of animal health and nutrition, coupled with advances in feed formulation technology, will also lead to further market growth. The major players, such as BASF SE, DSM, and Archer Daniels Midland Company, are actively pursuing growth strategies. These companies are investing heavily in R & D to develop new products to meet the changing nutritional needs of livestock. Also, more and more companies are forming alliances and forming partnerships to expand their distribution network and thus increase their market share. The industry is evolving. The integration of sustainable practices and the development of fortified feeds will play an important role in shaping the future of the water-soluble vitamins and minerals in feed market.

Regional Market Size

Regional Deep Dive

The market for soluble vitamins and minerals in animal feed is growing at a fast pace in many regions. This growth is mainly driven by the increasing demand for high-quality animal nutrition and the growing awareness of the health benefits of these nutrients. In North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America, the market is influenced by trends in livestock production, regulations, and consumer preferences for sustainable and healthy animal products. Each region offers opportunities and challenges of its own, but the trend is for the development of feed formulations and the emphasis on animal health and productivity to shape the market.

Europe

- The market is influenced by strict regulations on animal health and the safety of feed. The European Food Safety Authority (EFSA) is an important organization in the field of setting guidelines for the use of vitamins and minerals in animal feed.

- The rise of precision livestock farming technologies is enabling farmers to optimize feed efficiency and nutrient absorption, leading to increased adoption of water-soluble vitamins and minerals in feed formulations.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in livestock production, particularly in countries like China and India, which is driving the demand for water-soluble vitamins and minerals to enhance animal health and productivity.

- Innovations in feed additives, such as the development of multi-nutrient premixes by companies like Adisseo and Alltech, are gaining traction, as they offer tailored solutions to meet the specific nutritional needs of various livestock species.

Latin America

- Latin America is witnessing a shift towards more sustainable livestock practices, with countries like Brazil and Argentina focusing on improving feed efficiency and animal health through the use of water-soluble vitamins and minerals.

- The region's agricultural policies are increasingly supporting the use of innovative feed solutions, with government programs aimed at enhancing livestock productivity and food security.

North America

- North America is a market which is characterized by a strong demand for organic and non-GMO feed supplements. In order to meet these requirements, companies such as DSM and BASF are developing new water-soluble vitamin formulations.

- Regulatory changes, particularly the FDA's focus on improving animal feed safety standards, are prompting manufacturers to invest in advanced quality control measures and traceability systems, thereby enhancing market credibility and consumer trust.

Middle East And Africa

- In the Middle East and Africa, the market is characterized by a growing awareness of the importance of animal nutrition, with initiatives from organizations like the African Union promoting better livestock management practices.

- Economic factors, such as rising disposable incomes and urbanization, are leading to increased meat consumption, thereby boosting the demand for high-quality feed enriched with water-soluble vitamins and minerals.

Did You Know?

“Did you know that water-soluble vitamins play a crucial role in enhancing the immune response of livestock, which can lead to improved overall health and productivity?” — Animal Nutrition Journal

Segmental Market Size

The market for water-soluble vitamins and minerals in animal feed is an important part of the animal nutrition industry and is currently growing at a steady pace. The demand for these products is mainly driven by an increasing awareness among livestock breeders of the importance of good nutrition for their animals, as well as by stricter regulations that encourage the use of essential nutrients in animal feed. These factors are further supported by the development of new feed formulations that increase the bioavailability of these vitamins and minerals, which increases their market share. The use of water-soluble vitamins and minerals in animal feed has reached a maturity level. Leading companies such as DSM and BASF are offering innovations in this area. These products are mainly used in the feed for poultry, pigs and fish, where they play an important role in the growth and health of the animals. A growing interest in sustainable farming and an increasing demand for organic animal products are driving the growth of this market. Also, the use of microencapsulation and fermentation technology has contributed to the evolution of water-soluble vitamins and minerals, increasing their stability and efficacy in the feed.

Future Outlook

Water-soluble vitamins and minerals in the feed market will grow at a robust CAGR of 6.76% from 2024 to 2032. The growth is driven by the growing demand for high-quality animal nutrition, particularly in the livestock and aquaculture industries where health and productivity are the top priority. The use of water-soluble vitamins and minerals in the feed is expected to become a standard practice to enhance the nutrient intake and health of animals. The development of new water-soluble vitamins and minerals with higher efficiency and improved delivery systems is also expected to drive the growth. Moreover, the supportive government policies promoting animal health and welfare standards will create a conducive environment for the market. Also, the increasing popularity of organic and natural feed ingredients will be a major trend to watch out for as feed producers try to meet the demand for clean label products. Water-soluble vitamins and minerals in the feed will reach a new level of penetration by 2032, making them an essential part of modern animal nutrition.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 9.5 Billion |

| Growth Rate | 6.72% (2024-2032) |

Water Soluble Vitamins Minerals Feed Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.