Rising Water Quality Concerns

The increasing awareness regarding water quality issues is a primary driver for the Water Testing and Analysis Market. As populations grow and industrial activities expand, the potential for water contamination rises. Reports indicate that nearly 2 billion people lack access to safe drinking water, which amplifies the demand for effective water testing solutions. This heightened concern over waterborne diseases and pollutants has led to a surge in investments in water testing technologies. Consequently, municipalities and industries are prioritizing water quality assessments to ensure compliance with health standards. The Water Testing and Analysis Market is thus experiencing robust growth as stakeholders seek reliable testing methods to safeguard public health and the environment.

Growing Industrial Applications

The expansion of industrial activities is significantly influencing the Water Testing and Analysis Market. Industries such as pharmaceuticals, food and beverage, and manufacturing require stringent water quality testing to meet operational standards and regulatory requirements. The increasing focus on process optimization and waste management in these sectors has led to a heightened demand for advanced water testing solutions. Market data suggests that the industrial segment accounts for a substantial share of the overall market, with projections indicating continued growth as industries seek to enhance their sustainability practices. This trend underscores the critical role of water testing in ensuring compliance and operational efficiency within the Water Testing and Analysis Market.

Increased Regulatory Frameworks

The establishment of stringent regulatory frameworks is a crucial driver for the Water Testing and Analysis Market. Governments and regulatory bodies are implementing more rigorous standards for water quality, necessitating regular testing and analysis. For example, the Safe Drinking Water Act mandates that public water systems conduct regular testing to ensure compliance with health standards. This regulatory pressure compels industries and municipalities to invest in comprehensive water testing solutions to avoid penalties and ensure public safety. As a result, the Water Testing and Analysis Market is witnessing a surge in demand for compliance-driven testing services, which is expected to continue as regulations evolve and become more stringent.

Public Awareness and Education Initiatives

Public awareness campaigns and educational initiatives are emerging as vital drivers for the Water Testing and Analysis Market. As communities become more informed about the implications of water quality on health and the environment, there is a growing demand for accessible testing solutions. Educational programs aimed at promoting water safety and quality are encouraging individuals and organizations to take proactive measures in testing their water sources. This shift in consumer behavior is likely to stimulate market growth, as more people seek reliable testing services and products. The Water Testing and Analysis Market is thus positioned to benefit from this increased public engagement and the resulting demand for comprehensive water testing solutions.

Technological Innovations in Testing Methods

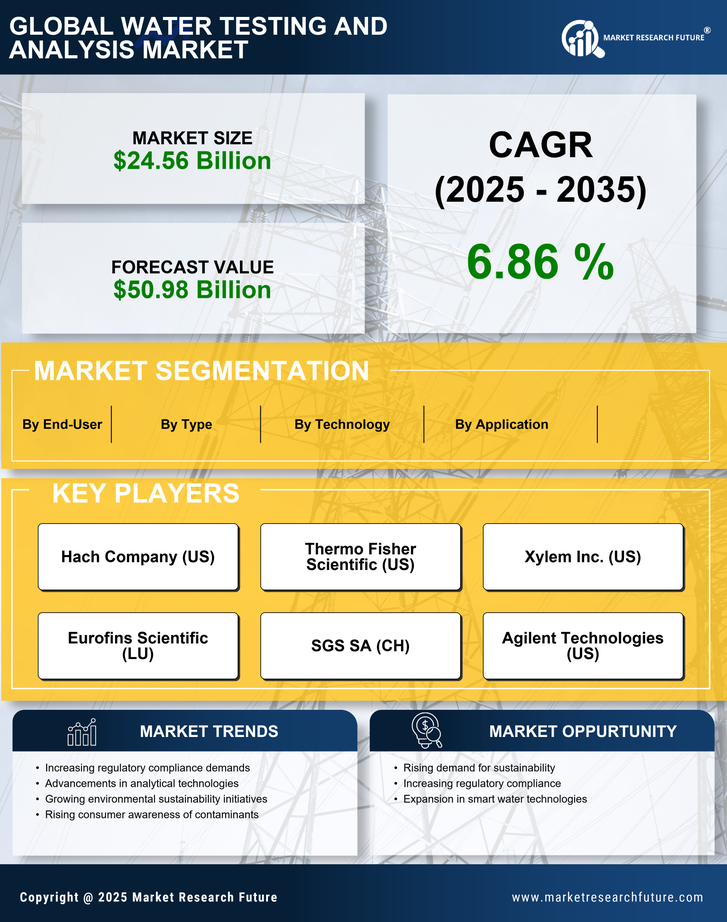

Technological advancements are reshaping the Water Testing and Analysis Market, introducing innovative testing methods that enhance accuracy and efficiency. The integration of IoT devices and smart sensors allows for real-time monitoring of water quality, which is becoming increasingly essential for both residential and industrial applications. For instance, portable testing kits equipped with advanced analytical capabilities are gaining traction among consumers and businesses alike. The market for these technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates a shift towards more sophisticated and user-friendly testing solutions, thereby driving the overall growth of the Water Testing and Analysis Market.