Research Methodology Web Hosting Services Market

Introduction:

Research Methodology Overview:

Research methodology is a process through which the data is collected, organized and analyzed to answer questions and test hypotheses. It is an organized, systematic and logical approach to research objectives. In this report, a comprehensive research methodology is outlined to analyze the Web hosting services market report by Market Research Future.

Research Objectives:

The main objectives of this research are to provide detailed information about the Web hosting services market, identify the key drivers of this market, analyze the trends of this market, and forecast the market size for the next five years, 2023-2030.

Data Collection and Analysis:

The data for the research is collected from multiple sources such as industry reports, newspaper and magazine articles, journal articles, case studies, company websites and interviews. Secondary data sources such as published reports from industry analysts and government statistics are also used to verify and validate the primary data.

The research process is further carried out by analyzing the data and opinions collected. This included data compilation techniques such as data normalization, data analysis, data modelling and data interpretation. The collected data was further consolidated using various research techniques such as PESTLE analysis and SWOT analysis. A correlation and regression analysis is done to identify the trends in the data.

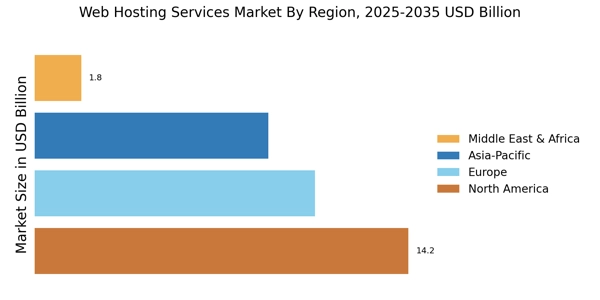

The collected data is further consolidated by making use of a variety of infographics, charts and graphs to make it simpler to comprehend the results.

Research Framework:

The research framework used for this report is a multi-disciplinary approach focusing on three key areas; market drivers, market trends and market size. The research is focused on the key market drivers such as economic, social and technological factors, and the trends associated with them. The market size is estimated using a combination of primary and secondary data.

Research Assumptions:

The research is conducted under the assumption that the demand for web hosting services will grow at a steady rate over the five years of 2023-2030. It is also assumed that the current technology trends in the industry continue during this period.

Conclusion:

This comprehensive research methodology provides a clear overview of how this report was conducted, from data collection processes and analysis to the assumptions made and the limitations encountered. The research is focused on identifying the key market drivers of this market and analyzing the trends associated with them. The results are then used to estimate the market size for the period 2023-2030.