Market Share

Web3 Payments Market Share Analysis

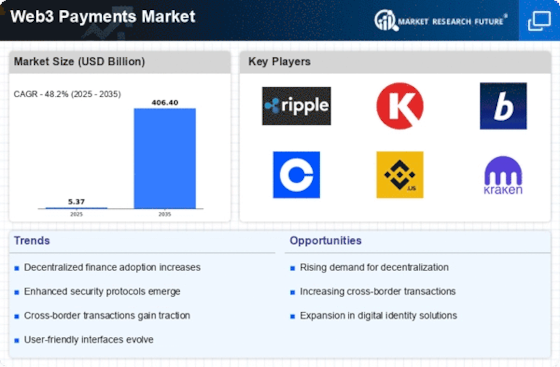

The Web3 Payments business is seeing revolutionary trends driven by blockchain technology, decentralized finance (DeFi), and the need for more efficient and comprehensive monetary frameworks. The rise of blockchain-based decentralized payment systems is notable. Web3 Payments modify decentralization standards to use shared exchanges without middlemen. This pattern reclassifies advanced payments by providing customers more control over their assets, lowering exchange costs, and increasing monetary inclusiveness.

Stablecoins and cryptocurrencies lead Web3 Payments. Bitcoin and Ethereum allow decentralized, borderless money transfers. Stablecoins, tied to government-issued money, provide stability for decentralized exchanges. Digital currencies and stablecoins are becoming more popular as a means of commerce, which is boosting the Web3 Payments sector and giving clients more options for the computerized economy.

Combining decentralized financial standards with Web3 Payments is crucial. Blockchain-based DeFi platforms allow lending, buying, and yield growing. Web3 Payments benefits from DeFi by allowing users to earn money on their computers, access decentralized lending markets, and perform other financial transactions from their sophisticated wallets. This pattern shows how decentralized settings may combine payment and financial services.

Web3 Payments changes cross-line settlements. Traditional cross-line exchanges have long cycles, expensive fees, and cash transformation issues. Blockchain-powered Web3 Payments enable faster, smarter, and simpler cross-border transactions. This trend affects those seeking to smooth global payments and reduce the erosion of existing monetary systems.

Decentralized payment gateways and architecture are key to Web3 Payments. These routes enable shippers to accept cryptographic money and computerized resources, integrating with existing payment systems. As more companies use decentralized payment arrangements, Web3 Payments' foundation improves, giving easy-to-use points of engagement and compatibility with traditional payment methods.

Non-fungible tokens (NFTs) are affecting Web3 Payments, notably for electronic material and collectibles. Managing computerized resources with NFTs is a popular kind of enhanced articulation and ownership. Web3 Payments make buying and selling NFTs easy, letting customers own and exchange digital material decentralized. This pattern includes advice for producers, specialists, and the advanced economy. Web3 Payments patterns emphasize blockchain organization-payment framework interoperability. Interoperability allows clients to execute across businesses in the Web3 biological system, which uses many blockchain protocols. Cross-tie installment arrangements remove barriers across blockchain networks, making Web3 Payments more linked and user-friendly.

Decentralized prophets for certifiable information in Web3 Payments reflect the need for accurate and reliable data in blockchain transactions. With decentralized prophets feeding smart agreements, Web3 Payments can work with real events, charges, and conditions. This technique enhances blockchain-based installment structures.

Leave a Comment