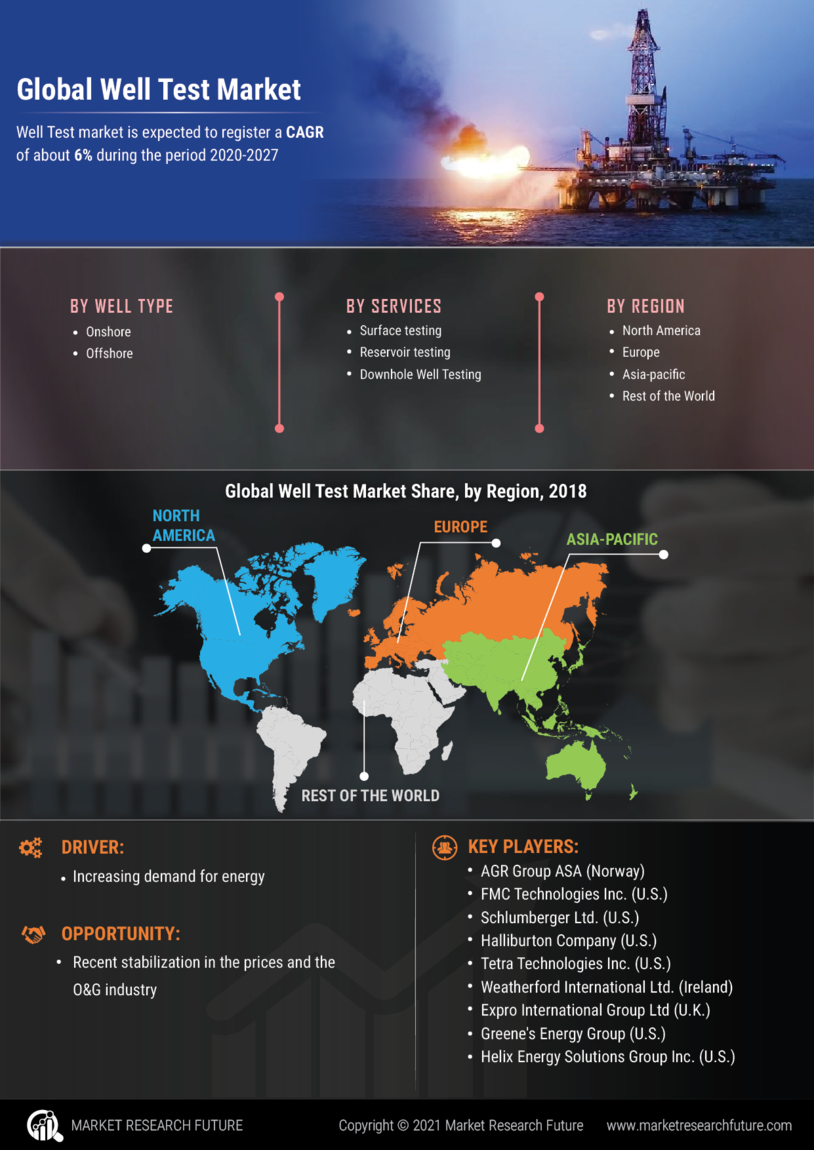

Increasing Demand for Energy Resources

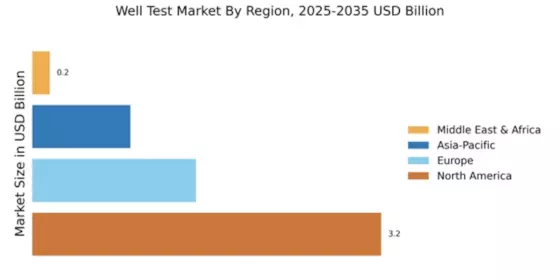

The Well Test Market is experiencing a surge in demand for energy resources, driven by the growing global population and industrialization. As nations strive to meet energy needs, the exploration and production of oil and gas become paramount. This trend is reflected in the projected market value of 5.76 USD Billion in 2024, which is expected to grow to 11.3 USD Billion by 2035. The compound annual growth rate of 6.31% from 2025 to 2035 indicates a robust expansion in well testing services, essential for optimizing production and ensuring resource sustainability.

Focus on Enhanced Oil Recovery Techniques

The Well Test Market is witnessing a growing emphasis on enhanced oil recovery (EOR) techniques, which require precise well testing to evaluate the effectiveness of various methods. As operators aim to optimize recovery rates from mature fields, well testing becomes essential for assessing reservoir performance and implementing EOR strategies. This focus on maximizing output from existing wells is expected to drive demand for well testing services, contributing to the projected market growth. The integration of well testing in EOR initiatives highlights its critical role in the sustainable management of oil resources.

Technological Advancements in Well Testing

Technological innovations play a crucial role in the Global Well Test Market, enhancing the efficiency and accuracy of well testing processes. Advanced technologies such as real-time data acquisition, automated testing systems, and improved analytical tools facilitate better decision-making for operators. These advancements not only reduce operational costs but also increase the reliability of test results. As companies adopt these technologies, the market is likely to witness significant growth, aligning with the overall upward trajectory projected for the industry through 2035.

Rising Investments in Oil and Gas Exploration

Investment in oil and gas exploration remains a key driver of the Well Test Industry. As companies seek to discover new reserves and enhance production from existing fields, well testing becomes an integral part of the exploration process. The anticipated growth in market value from 5.76 USD Billion in 2024 to 11.3 USD Billion by 2035 reflects the increasing capital allocation towards exploration activities. This investment trend is likely to bolster the demand for well testing services, ensuring that operators can maximize the potential of their resources.

Regulatory Compliance and Environmental Concerns

The Well Test Market is influenced by stringent regulatory frameworks aimed at ensuring environmental protection and safety in oil and gas operations. Compliance with these regulations necessitates thorough well testing to assess the environmental impact and operational safety. As governments worldwide enforce stricter regulations, the demand for well testing services is expected to rise. This trend underscores the importance of well testing in maintaining compliance and minimizing environmental risks, thereby contributing to the market's growth in the coming years.