Top Industry Leaders in the Wheel Speed Sensor Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Wheel Speed Sensor industry are:

Bosch

Continental

MOBIS

ZF TRW

AISIN

Delphi

WABCO

Knorr-Bremse

MHE

Hitachi Metal.

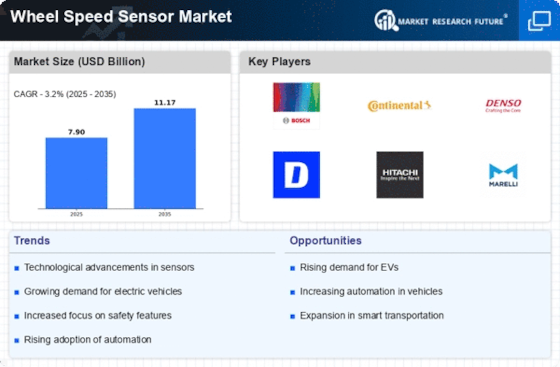

Bridging the Gap by Exploring Top Leaders Competitive Landscape of the Wheel Speed Sensor Market

The wheel speed sensor market hums with the engine of competition. This critical automotive component, playing a vital role in safety features like ABS and traction control, attracts a diverse range of players vying for market dominance. Understanding their strategies, analyzing key factors for market share assessment, and identifying emerging trends becomes crucial for navigating this dynamic landscape.

Key Players and their Strategies:

• Global Giants: Bosch, Continental, Denso, Delphi Automotive, and TDK Corporation hold significant market share. These established players rely on their extensive R&D capabilities, broad product portfolios catering to diverse vehicle segments, and strong original equipment manufacturer (OEM) partnerships. Bosch, for instance, focuses on miniaturization and integration of sensors with other functionalities, while Continental emphasizes sensor-to-cloud connectivity for advanced driver-assistance systems (ADAS).

• Tier 2 Suppliers: NXP Semiconductors, Infineon Technologies, and TE Connectivity position themselves as reliable, cost-effective alternatives. They capitalize on their strengths in semiconductor technology and sensor manufacturing, often targeting aftermarket and budget-conscious consumers. NXP Semiconductors, for example, leverages its expertise in mixed-signal integrated circuits to offer high-performance, low-power sensors.

• Emerging Players: Start-ups like Sensata Technologies and Analog Devices are disrupting the market with innovative technologies and niche offerings. Sensata focuses on sensor fusion platforms for autonomous vehicles, while Analog Devices champions advanced magnetic sensor technologies for enhanced accuracy and reliability. These players often partner with established companies or target specific vehicle segments for rapid growth.

Factors Influencing Market Share Analysis:

• Technological Advancements: The quest for miniaturization, improved accuracy, and integration with other systems remains a key driver. The adoption of magnetoresistive and Hall-effect sensors over traditional active and passive variants reflects this trend. Companies with strong R&D and innovation pipelines hold an edge.

• Regional Demand: The Asia Pacific region, particularly China and India, fuels market growth due to rising vehicle production and increasing focus on automotive safety regulations. Players with strong regional presence and localized offerings stand to benefit.

• OEM Partnerships: Securing long-term contracts with major car manufacturers guarantees a significant market share. Continental's partnership with Volkswagen and Bosch's collaboration with Toyota exemplify this strategy.

New and Emerging Trends:

• Sensor Fusion: Integrating wheel speed sensors with other data sources like LiDAR and radar is gaining traction for precise vehicle positioning and enhanced ADAS functions. Companies like Sensata are at the forefront of this development.

• Wireless Communication: Replacing traditional wired connections with wireless technology for data transmission between sensors and control units improves efficiency and reduces weight. NXP Semiconductors' low-power wireless sensor solutions showcase this trend.

• Predictive Maintenance: Advanced sensor technology that monitors wear and tear allows for pre-emptive maintenance, reducing downtime and costs. Companies like Analog Devices are exploring this emerging space.

Overall Competitive Scenario:

The wheel speed sensor market is poised for steady growth, driven by increasing vehicle production, stringent safety regulations, and technological advancements. The competitive landscape is characterized by a mix of established giants, cost-effective players, and innovative startups, each jostling for market share. Success hinges on adapting to dynamic technological shifts, forging strategic partnerships, and catering to evolving regional demands. Companies offering advanced sensor technologies, focusing on integration and connectivity, and catering to specific niches stand to capitalize on this exciting market trajectory.

Latest Company Updates:

Bosch:

• July 2023: Announced a collaboration with HERE Technologies to improve real-time traffic data accuracy using wheel sensor data. (Source: Bosch press release)

Continental:

• May 2023: Acquired Elektro Mobil, a specialist in sensor fusion for autonomous vehicles, strengthening its ADAS technology portfolio. (Source: Continental press release)

Delphi: Recently acquired by Aptiv, the combined company focuses on sensor technology for autonomous vehicles and expects significant growth in the wheel speed sensor market. (Source: Aptiv press release)

WABCO: Acquired by ZF Friedrichshafen in 2021, the combined entity strengthens its position in commercial vehicle braking systems and wheel speed sensor technology. (Source: ZF press release)

Knorr-Bremse: Investing heavily in research and development of intelligent braking systems for commercial vehicles, utilizing advanced wheel speed sensor technology. (Source: Knorr-Bremse press release)