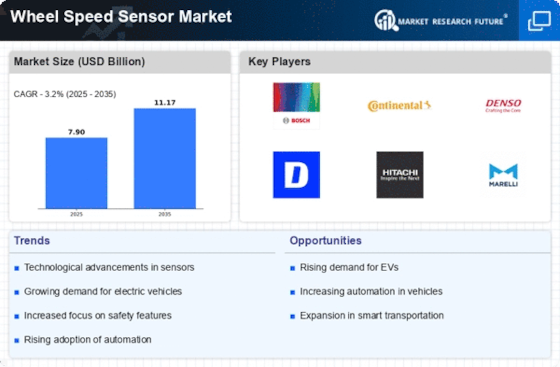

Leading market players are putting a lot of money in R&D to expand their product lines, which will help the wheel speed sensor market continue to grow. Additionally, market players are engaging in a range of calculated initiatives to increase their worldwide presence, with important market developments involving the introduction of new products, contracts, M&A transactions, increased investment, and cooperation with other enterprises. To grow and endure in an increasingly cutthroat and dynamic market, Wheel Speed Sensor industry must provide reasonably priced goods.

One of the main business strategies employed by manufacturers is to manufacture locally in order to reduce operating expenses in the global Wheel Speed Sensor industry to help customers and expand the market segment. In recent years, the Wheel Speed Sensor industry has provided some of the biggest benefits to medicine. Major players in the Wheel Speed Sensor Market, including Bosch, Continental, MOBIS, ZF TRW, AISIN, Delphi, WABCO, Knorr-Bremse, MHE, Hitachi Metal, and others, are engaging in research and development activities in an effort to boost market demand.

Robert Bosch LLC is a well-known international engineering and technology corporation. With a rich history spanning more than a century, it was founded in 1886. Automotive, industrial, consumer goods, energy and building technologies are just a few of the industries in which Bosch is a global leader in supplying cutting-edge solutions. Power tools, smart home solutions, industrial automation technology, and automotive components are all part of its vast offering. Bosch is a global leader in technology-driven breakthroughs, with an emphasis on cutting-edge innovation. In 2021, Bosch unveiled the "PowerTube 625," a battery pack designed to interface seamlessly with electric bicycles.

Although the product's exact introduction date is unknown, it showed Bosch's commitment to developing environmentally friendly mobility solutions.

Continental AG, also referred to as Continental or simply as Conti, is a leader in the production of tires, brake systems, vehicle electronics, automotive safety, powertrain, chassis components, tachographs, and other parts for the transportation and automotive industries. Chassis and Safety, Powertrain, Interior, Tires, ContiTech, and ADAS (Advanced Driver Assistance Systems) are the six departments that make up Continental. Lower Saxony's Hanover serves as its headquarters. As the fourth-biggest tire manufacturer in the world, Continental is the third-biggest car supplier globally.

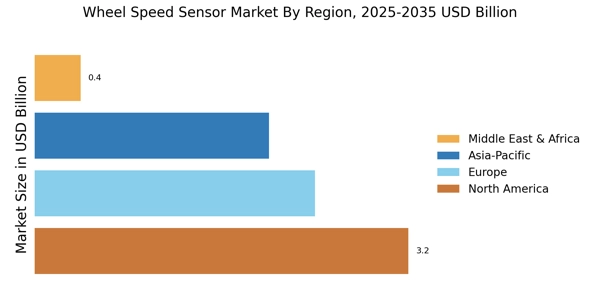

In August the development of Continental AG's Manesar facility in India is planned.

This allows the company to satisfy the increasing demand brought on by new safety and emission regulations in India by increasing its capacity to create wheel speed sensors.