Whey Permeate Size

Market Size Snapshot

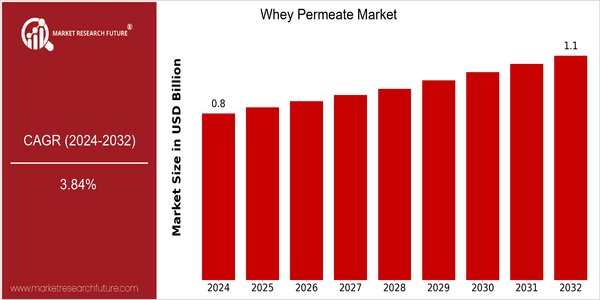

| Year | Value |

|---|---|

| 2024 | USD 0.81 Billion |

| 2032 | USD 1.1 Billion |

| CAGR (2024-2032) | 3.84 % |

Note – Market size depicts the revenue generated over the financial year

The whey permeate market is expected to grow at a steady rate, with a current market size of $ 81 million in 2024, projected to reach $ 1.1 billion by 2032. This represents a CAGR of 3.84 % for the forecast period. The increasing demand for whey permeate, mainly due to its applications in the food and beverage industry and in dietary supplements, is a clear sign of its importance in the market. The growing awareness of health among consumers has led to an increase in the demand for products rich in essential nutrients. The use of whey permeate in food products, especially in dietary supplements, is expected to grow steadily, which is a positive sign for the market. Several factors are driving this upward trend, such as technological advances that increase the quality and functionality of whey permeate. Also, the development of new applications in various industries, such as bakery and dairy, plays a crucial role. In this context, major players such as Lactalis Ingredients and Arla Foods are actively engaged in strategic initiatives, such as collaborations and the launch of new products, to meet the evolving needs of consumers. These efforts not only strengthen the competitiveness of the companies but also contribute to the overall growth of the whey permeate market.

Regional Market Size

Regional Deep Dive

Whey permeate market is experiencing a dynamic growth across different regions. The market is mainly driven by the growing demand for dairy-based ingredients in food and beverage applications. North America is characterized by the growing trend of fortification of food and beverage products with whey. Europe is characterized by a strong focus on the environment and clean labeling. Asia-Pacific is characterized by a growing demand for nutritional supplements from consumers with high health awareness. Middle East and Africa are gradually adopting whey permeate as awareness of its benefits increases. Latin America is taking advantage of its agricultural strength to increase production capacity.

Europe

- In Europe, the trend towards plant-based diets is influencing the whey permeate market, with companies like Arla Foods exploring hybrid products that combine whey permeate with plant proteins.

- The European Union's stringent regulations on food safety and labeling are prompting manufacturers to invest in quality assurance processes, enhancing the overall market credibility.

Asia Pacific

- The Asia-Pacific region is experiencing a rise in health awareness, with companies like Fonterra and Saputo expanding their whey permeate offerings to cater to the growing demand for protein-rich foods.

- Government initiatives promoting dairy consumption in countries like India are expected to boost the whey permeate market as it is increasingly recognized for its nutritional benefits.

Latin America

- Latin America is leveraging its strong agricultural base, with companies like Grupo Lala focusing on enhancing whey permeate production to support the growing dairy sector.

- The region's economic growth is leading to increased disposable income, which is expected to drive demand for high-quality dairy ingredients, including whey permeate.

North America

- The North American market is seeing significant innovation with companies like Lactalis Ingredients and Hilmar Cheese Company developing new whey permeate products tailored for sports nutrition and functional foods.

- Regulatory changes, such as the FDA's updated guidelines on food labeling, are pushing manufacturers to adopt cleaner ingredient profiles, which is beneficial for whey permeate as a natural ingredient.

Middle East And Africa

- In the Middle East and Africa, the market is being shaped by increasing imports of dairy products, with companies like Almarai investing in local production of whey permeate to meet regional demand.

- Cultural shifts towards healthier eating habits are driving interest in whey permeate as a versatile ingredient in various food applications.

Did You Know?

“Whey permeate is not only a cost-effective ingredient but also contains lactose, which can be beneficial for individuals looking to increase their carbohydrate intake post-exercise.” — Dairy Foods Magazine

Segmental Market Size

Whey permeate is a growing part of the dairy industry, primarily used as a cost-effective ingredient in various foods. The increased demand is driven by the growing popularity of high-protein diets and the rising demand for functional food ingredients. Whey permeate is also in high demand as a result of the trend towards cleaner labels. At present, the whey permeate industry is well established, with companies such as Lactalis Ingredients and Arla Foods leading the way in terms of both production and innovation. Its key applications include sports nutrition products, bakery products and dairy-based beverages, where it is used to improve the flavour, texture and nutritional value. Also, macro-economic trends such as increased focus on health and the environment are driving growth in this sector. Whey permeate is refined by means of membrane filtration and spray drying, which ensures the quality and functionality of the finished product.

Future Outlook

From 2024 to 2032, the Whey Permeate market is expected to grow steadily at a CAGR of 3.84%. The increasing demand for high-quality ingredients in food and beverage products, especially in the health and wellness sector, is driving this market growth. As consumers become more interested in the nutritional value of the products they consume, the role of whey permeate as a cost-effective source of protein and as a nutritional supplement is expected to increase, thereby increasing its market penetration. Whey permeate is expected to have a penetration of up to 14% in the Whey Protein market by 2032. Also, a number of important technological and policy drivers are expected to shape the future of the Whey Permeate market. The development of filtration and spray-drying techniques is expected to improve the quality and yield of whey permeate, which will further increase the attractiveness of the industry. In addition, the growing regulatory support for dairy by-products and sustainable initiatives will increase the demand for whey permeate, which will fit in with the general trend towards resource conservation and the reduction of waste. Moreover, the increasing popularity of plant-based diets and the increasing role of whey permeate in the production of health-promoting foods will increase the demand for whey permeate, making it a key ingredient in the future of food and nutrition.

Leave a Comment