Research Methodology on Whey Permeate Market

The purpose of this research is to provide an analysis of the Whey Permeate Market and to determine its growth prospects in the coming years. Market Research Future (MRFR) employed a rigorous research methodology which included primary and secondary data sources to arrive at some of the key findings which are individually presented in this report.

PRIMARY DATA

Primary data for this research was collected through both primary qualitative and quantitative approaches. Primary data was collected from interviews with market experts such as manufacturers, key opinion leaders, processors, distributors, and retailers. The interviews were conducted to get an in-depth understanding of the market and to validate the findings from the secondary research.

SECONDARY DATA

Secondary research was conducted using various sources which include Whitepapers, annual and quarterly reports of listed companies, internal and external proprietary databases, World Bank Database, Securities Exchange Commission Filings, relevant patent and regulatory databases, and other sources. Statistical analysis was performed to obtain estimates of the market size.

SCOPE OF THE REPORT

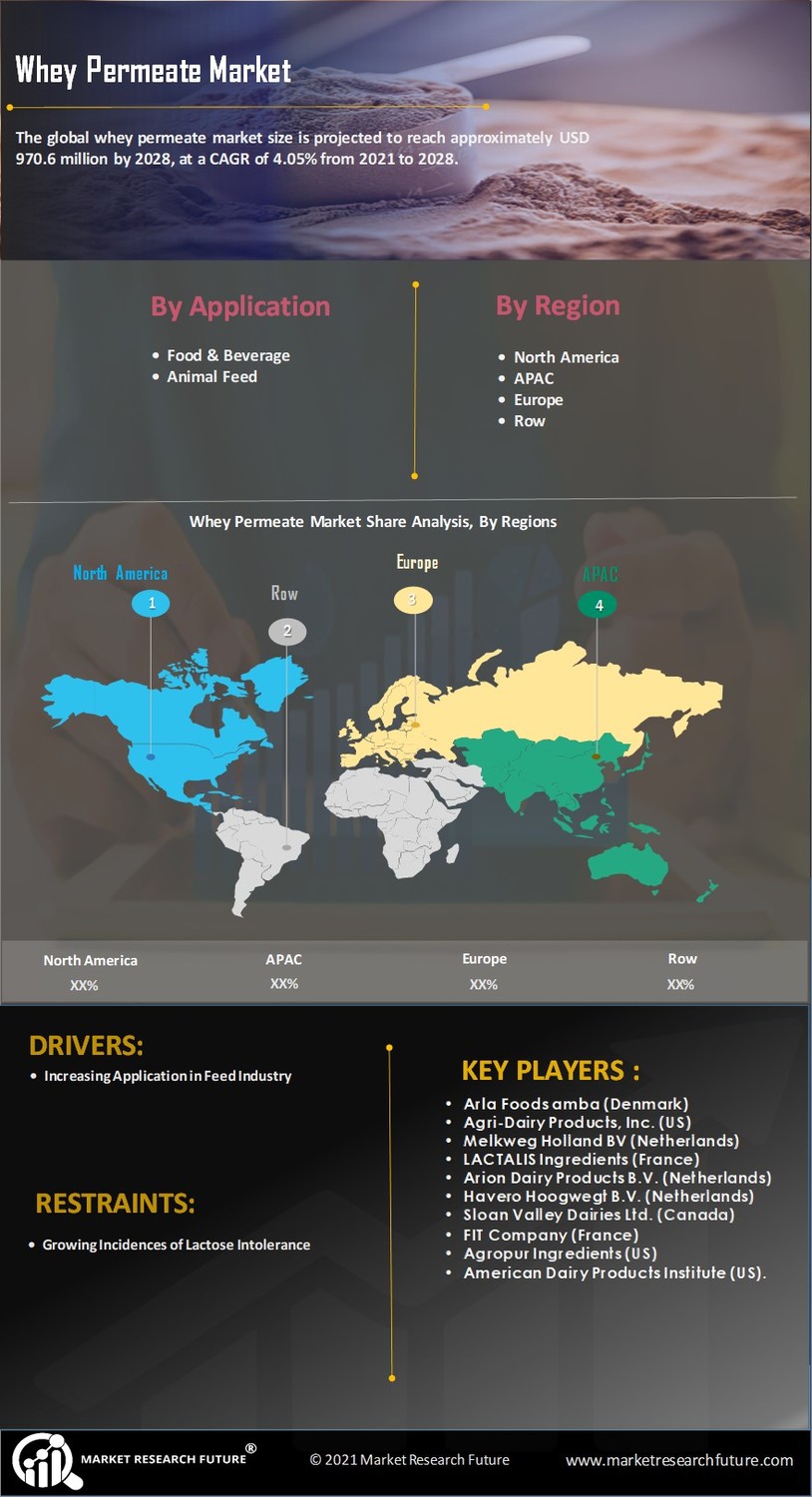

This report covers a comprehensive analysis of the Whey Permeate Market and includes key market indicators such as value, market share, growth rate, segmentation, production value, consumption value, etc. The report also provides a regional-level comparison of the market size and an analysis of the global market dynamics such as market drivers, restraints, opportunities, and challenges.

MARKET TAXONOMY

The Whey Permeate Market was analyzed based on various market taxonomy. The market was categorized based on product type, distribution channel, and region.

By Product Type, the market is segmented into:

- Whey Permeate

- Whey Protein Isolate

- Others

By Distribution Channel, the market is segmented into:

- Direct Sales

- Retail Stores

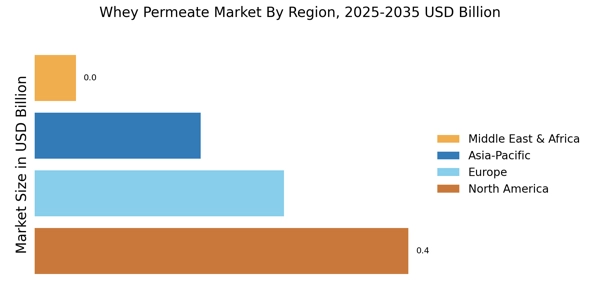

By Region, the market is segmented into:

- North America: US, Canada, and Mexico

- Europe: Germany, France, the UK, Italy, Spain, and the Rest of Europe

- Asia-Pacific: Japan, China, India, South Korea, Australia, and Rest of Asia-Pacific

- Rest of the World (ROW): South America, Middle East, and Africa

MARKET ESTIMATION

The market estimates were calculated using various analysis tools such as Supply-Demand Graph Analysis, Global Production Analysis, Y-o-Y Growth Analysis, Porter’s Five Force Analysis, and Market Share Analysis.

RESEARCH DURABILITY

The research formulation was built to be as exhaustive as possible, including all relevant sources required to provide an accurate and complete analysis of the Whey Permeate Market.

KEY MARKET INSIGHTS

The analysis provided some key insights which have been mentioned below:

- The demand for Whey Permeate is increasing due to its increasing usage in the processing industry, especially in the confectionery industry.

- The major factor driving the growth of the market is its rising popularity in the food and beverage industry.

- The Asia- Pacific region is expected to be the fastest-growing region in the Whey Permeate market, due to the growing industrial and technological developments taking place in the region.

- The increase in health consciousness among consumers is also likely to propel the growth of the Whey Permeate market over the forecast period 2023 to 2030.