-

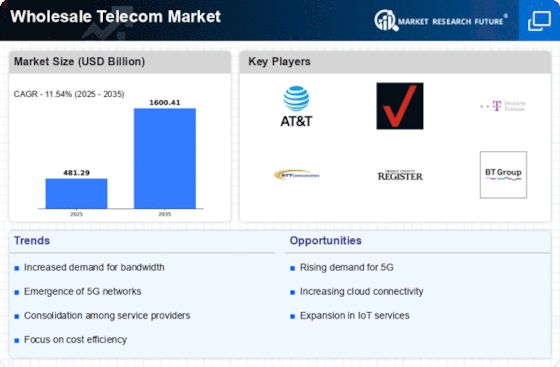

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

OVERVIEW

-

DATA FLOW

- DATA MINING PROCESS

-

PURCHASED DATABASE:

-

SECONDARY SOURCES:

- SECONDARY RESEARCH DATA FLOW:

-

PRIMARY RESEARCH:

- PRIMARY RESEARCH DATA FLOW:

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED

- PRIMARY RESEARCH: REGIONAL COVERAGE

-

APPROACHES FOR MARKET SIZE ESTIMATION:

- REVENUE ANALYSIS APPROACH

-

DATA FORECASTING

- DATA FORECASTING TECHNIQUE

-

DATA MODELING

- MICROECONOMIC FACTOR ANALYSIS:

- DATA MODELING:

-

TEAMS AND ANALYST CONTRIBUTION

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- INCREASING DEMAND FOR DATA, CLOUD AND DIGITAL SERVICES

- AFFORDABLE TARIFFS, WIDER AVAILABILITY, AND COST OF COMMUNICATION

-

RESTRAINTS

- DECLINE IN INTERNATIONAL VOICE TRAFFIC

- THE WHOLESALE BUSINESS IS OVERLY MATURE

- INFLATION- DRIVEN THREATS LEAD THE LIST OF EVOLVING EXTERNAL PRESSURES

- CHANGING REGULATORY LANDSCAPE

-

OPPORTUNITY

- INNOVATION IN VOICE AND DATA WHOLESALE

- INCREASING PROCESS AUTOMATION

- EXPANSION OF TELECOMMUNICATIONS INFRASTRUCTURE, CUSTOMER SERVICES, AND NEW BUSINESS MODELS

-

COVID-19 IMPACT ANALYSIS

-

MARKET FACTOR ANALYSIS

-

VALUE CHAIN ANALYSIS

- TELECOM WHOLESALE

- TELECOM SERVICE PROVIDERS

- SOLUTIONS

- END USERS ( TELECOM OPERATORS)

-

PORTER'S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

MARKET SWOT ANALYSIS

-

MARKET PESTEL ANALYSIS

-

MARKET AND TECHNOLOGY TREND ANALYSIS

- DIRECT- TO- SATELLITE CONNECTIVITY

- 5G SA ROAMING

- DIVERSIFICATION OF FIBER CONNECTIVITY – DARK FIBER, OPTICAL SPECTRUM, WAVELENGTH, AND ETHERNET

- INTEGRATION OF ARTIFICIAL INTELLIGENCE ( AI) ON TELECOM INDUSTRY

- IMPACT OF BLOCKCHAIN ON THE INDUSTRY

- NETWORK SLICING

- 5G MONETIZATION

- NEXT GENERATION ROAMING REVOLUTION

- FOCUS ON DIGITAL FRONT- END PLAY

- ENHANCING MANAGED SERVICES

-

USE CASE ANALYSIS

- BLOCKCHAIN USE CASES IN TELECOM INDUSTRY

- DATA ANALYTICS USE CASES IN TELECOM INDUSTRY

- RPA IN TELECOMMUNICATIONS INDUSTRY

- ARTIFICIAL INTELLIGENCE IN TELECOMMUNICATION

-

ECOSYSTEM ANALYSIS

- VENDORS

- FIXED & MOBILE TELECOM ENVIRONMENT

- BUSINESS

-

GLOBAL WHOLESALE TELECOM MARKET, BY SOLUTION

-

INTRODUCTION

-

GLOBAL WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE

-

INTRODUCTION

-

GLOBAL WHOLESALE TELECOM MARKET, BY END USER TYPE

-

INTRODUCTION

-

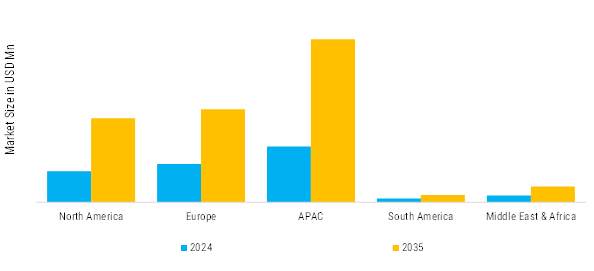

GLOBAL WHOLESALE TELECOM MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- UK

- FRANCE

- ITALY

- SPAIN

- REST OF EUROPE

-

ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- REST OF ASIA PACIFIC

-

MIDDLE EAST & AFRICA

- SAUDI ARABIA

- UAE

- SOUTH AFRICA

- REST OF MIDDLE EAST & AFRICA

-

SOUTH AMERICA

- BRAZIL

- ARGENTINA

- REST OF MIDDLE EAST & AFRICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

MARKET SHARE ANALYSIS, 2022

-

COMPETITOR DASHBOARD

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT DEVELOPMENTS

- MERGER AND ACQUISITION

-

COMPANY PROFILES

-

VERIZON

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AT&T INC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

T‑MOBILE USA, INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

ORANGE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

DEUTSCHE TELEKOM

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

TELEFÓNICA S.A.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

SINGTEL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

NTT COMMUNICATIONS CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SOLUTIONS/SERVICES OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

BT WHOLESALE

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

ROGERS COMMUNICATIONS

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SWISSCOM

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

A1 GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

KDDI CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SAUDI TELECOM COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

DATA CITATIONS

-

LIST OF TABLES

-

TABLE 1

-

QFD MODELING FOR MARKET SHARE ASSESSMENT

-

TABLE 2

-

GLOBAL WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 3

-

GLOBAL WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 4

-

GLOBAL WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 5

-

GLOBAL WHOLESALE TELECOM MARKET, BY REGION, 2019-2032 (USD MILLION)

-

TABLE 6

-

NORTH AMERICA: WHOLESALE TELECOM MARKET, BY COUNTRY, 2019-2032 (USD MILLION)

-

TABLE 7

-

NORTH AMERICA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 8

-

NORTH AMERICA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 9

-

NORTH AMERICA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 10

-

US WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 11

-

US WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 12

-

US WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 13

-

CANADA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 14

-

CANADA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 15

-

CANADA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 16

-

MEXICO WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 17

-

MEXICO WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 18

-

MEXICO WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 19

-

EUROPE: WHOLESALE TELECOM MARKET, BY COUNTRY, 2019-2032 (USD MILLION)

-

TABLE 20

-

EUROPE WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 21

-

EUROPE WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 22

-

EUROPE WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 23

-

GERMANY WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 24

-

GERMANY WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 25

-

GERMANY WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 26

-

UK WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 27

-

UK WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 28

-

UK WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 29

-

FRANCE WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 30

-

FRANCE WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 31

-

FRANCE WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 32

-

ITALY WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 33

-

ITALY WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 34

-

ITALY WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 35

-

SPAIN WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 36

-

SPAIN WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 37

-

SPAIN WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 38

-

REST OF EUROPE WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 39

-

REST OF EUROPE WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 40

-

REST OF EUROPE WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 41

-

ASIA PACIFIC: WHOLESALE TELECOM MARKET, BY COUNTRY, 2019-2032 (USD MILLION)

-

TABLE 42

-

ASIA PACIFIC WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 43

-

ASIA PACIFIC WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 44

-

ASIA PACIFIC WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 45

-

CHINA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 46

-

CHINA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 47

-

CHINA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 48

-

JAPAN WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 49

-

JAPAN WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 50

-

JAPAN WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 51

-

INDIA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 52

-

INDIA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 53

-

INDIA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 54

-

SOUTH KOREA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 55

-

SOUTH KOREA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 56

-

SOUTH KOREA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 57

-

REST OF ASIA PACIFIC WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 58

-

REST OF ASIA PACIFIC WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 59

-

REST OF ASIA PACIFIC WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 60

-

MIDDLE EAST & AFRICA: WHOLESALE TELECOM MARKET, BY COUNTRY, 2019-2032 (USD MILLION)

-

TABLE 61

-

MIDDLE EAST & AFRICA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 62

-

MIDDLE EAST & AFRICA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 63

-

MIDDLE EAST & AFRICA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 64

-

SAUDI ARABIA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 65

-

SAUDI ARABIA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 66

-

SAUDI ARABIA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 67

-

UAE WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 68

-

UAE WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 69

-

UAE WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 70

-

SOUTH AFRICA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 71

-

SOUTH AFRICA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 72

-

SOUTH AFRICA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 73

-

REST MIDDLE EAST & AFRICA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 74

-

REST MIDDLE EAST & AFRICA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 75

-

REST MIDDLE EAST & AFRICA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 76

-

SOUTH AMERICA: WHOLESALE TELECOM MARKET, BY COUNTRY, 2019-2032 (USD MILLION)

-

TABLE 77

-

SOUTH AMERICA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 78

-

SOUTH AMERICA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 79

-

SOUTH AMERICA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 80

-

BRAZIL WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 81

-

BRAZIL WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 82

-

BRAZIL WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 83

-

ARGENTINA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 84

-

ARGENTINA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 85

-

ARGENTINA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 86

-

REST OF SOUTH AMERICA WHOLESALE TELECOM MARKET, BY SOLUTION, 2019-2032 (USD MILLION)

-

TABLE 87

-

REST OF SOUTH AMERICA WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, 2019-2032 (USD MILLION)

-

TABLE 88

-

REST OF SOUTH AMERICA WHOLESALE TELECOM MARKET, BY END USER TYPE, 2019-2032 (USD MILLION)

-

TABLE 89

-

PRODUCT DEVELOPMENTS

-

TABLE 90

-

MERGER AND ACQUISITION

-

TABLE 91

-

VERIZON COMMUNICATIONS INC: PRODUCTS OFFERED

-

TABLE 92

-

AT&T INC: PRODUCTS OFFERED

-

TABLE 93

-

AT&T INC: KEY DEVELOPMENTS

-

TABLE 94

-

T‑MOBILE USA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

TABLE 95

-

T‑MOBILE USA, INC.: KEY DEVELOPMENTS

-

TABLE 96

-

ORANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

TABLE 97

-

ORANGE: KEY DEVELOPMENTS

-

TABLE 98

-

DEUTSCHE TELEKOM: PRODUCTS OFFERED

-

TABLE 99

-

DEUTSCHE TELEKOM: KEY DEVELOPMENTS

-

TABLE 100

-

TELEFÓNICA S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

TABLE 101

-

SINGTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

TABLE 102

-

NTT COMMUNICATIONS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

TABLE 103

-

BT WHOLESALE: PRODUCTS OFFERED

-

TABLE 104

-

ROGERS COMMUNICATIONS: PRODUCTS OFFERED

-

TABLE 105

-

SWISSCOM: PRODUCTS OFFERED

-

TABLE 106

-

A1 GROUP: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

-

TABLE 107

-

KDDI CORPORATION: PRODUCTS OFFERED

-

TABLE 108

-

KDDI CORPORATION: KEY DEVELOPMENTS

-

TABLE 109

-

SAUDI TELECOM COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

LIST OF FIGURES

-

FIGURE 1

-

GLOBAL WHOLESALE TELECOM MARKET: STRUCTURE

-

FIGURE 2

-

GLOBAL WHOLESALE TELECOM MARKET: MARKET GROWTH FACTOR ANALYSIS (2022-2032)

-

FIGURE 3

-

DRIVER IMPACT ANALYSIS (2022-2032)

-

FIGURE 4

-

RESTRAINT IMPACT ANALYSIS (2022-2032)

-

FIGURE 5

-

OPPORTUNITY IMPACT FORECAST

-

FIGURE 6

-

VALUE CHAIN: GLOBAL WHOLESALE TELECOM MARKET

-

FIGURE 7

-

PORTER'S FIVE FORCES ANALYSIS OF THE GLOBAL WHOLESALE TELECOM MARKET

-

FIGURE 8

-

GLOBAL WHOLESALE TELECOM MARKET, BY SOLUTION, 2022 (% SHARE)

-

FIGURE 9

-

GLOBAL WHOLESALE TELECOM MARKET, BY ORGANIZATION SIZE, SEGMENT ATTARCTIVENESS ANALYSIS

-

FIGURE 10

-

GLOBAL WHOLESALE TELECOM MA–RKET, BY ORGANIZATION SIZE, 2022 (% SHARE)

-

FIGURE 11

-

GLOBAL WHOLESALE TELECOM MARKET, BY END USER TYPE, SEGMENT ATTARCTIVENESS ANALYSIS

-

FIGURE 12

-

GLOBAL WHOLESALE TELECOM MARKET, BY END USER TYPE, 2022 (% SHARE)

-

FIGURE 13

-

GLOBAL WHOLESALE TELECOM MARKET, BY REGION, 2022 (% SHARE)

-

FIGURE 14

-

NORTH AMERICA MARKET: SWOT ANALYSIS

-

FIGURE 15

-

NORTH AMERICA: WHOLESALE TELECOM MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

FIGURE 16

-

NORTH AMERICA: WHOLESALE TELECOM MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

FIGURE 17

-

EUROPE MARKET: SWOT ANALYSIS

-

FIGURE 18

-

EUROPE: WHOLESALE TELECOM MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

FIGURE 19

-

EUROPE: WHOLESALE TELECOM MARKET SIZE, BY COUNTRY, 2022 VS 2032(USD MILLION)

-

FIGURE 20

-

ASIA PACIFIC MARKET: SWOT ANALYSIS

-

FIGURE 21

-

ASIA PACIFIC: WHOLESALE TELECOM MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

FIGURE 22

-

ASIA PACIFIC: WHOLESALE TELECOM MARKET SIZE, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

FIGURE 23

-

MIDDLE EAST & AFRICA MARKET: SWOT ANALYSIS

-

FIGURE 24

-

MIDDLE EAST & AFRICA: WHOLESALE TELECOM MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

FIGURE 25

-

MIDDLE EAST & AFRICA: WHOLESALE TELECOM MARKET SIZE, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

FIGURE 26

-

SOUTH AMERICA MARKET: SWOT ANALYSIS

-

FIGURE 27

-

SOUTH AMERICA: WHOLESALE TELECOM MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

FIGURE 28

-

SOUTH AMERICA: WHOLESALE TELECOM MARKET SIZE, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

FIGURE 29

-

GLOBAL WHOLESALE TELECOM MARKET: COMPETITIVE ANALSIS, 2022

-

FIGURE 30

-

COMPETITOR DASHBOARD: GLOBAL WHOLESALE TELECOM MARKET

-

FIGURE 31

-

VERIZON COMMUNICATIONS INC: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 32

-

VERIZON COMMUNICATIONS INC: SWOT ANALYSIS

-

FIGURE 33

-

AT&T INC: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 34

-

AT&T INC: SWOT ANALYSIS

-

FIGURE 35

-

T‑MOBILE USA, INC: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 36

-

T‑MOBILE USA, INC.: SWOT ANALYSIS

-

FIGURE 37

-

ORANGE: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 38

-

ORANGE: SWOT ANALYSIS

-

FIGURE 39

-

DEUTSCHE TELEKOM: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 40

-

DEUTSCHE TELEKOM: SWOT ANALYSIS

-

FIGURE 41

-

TELEFÓNICA S.A.: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 42

-

TELEFÓNICA S.A.: SWOT ANALYSIS

-

FIGURE 43

-

SINGTEL: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 44

-

SINGTEL: SWOT ANALYSIS

-

FIGURE 45

-

NTT COMMUNICATIONS CORPORATION: SWOT ANALYSIS

-

FIGURE 46

-

BT WHOLESALE: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 47

-

BT WHOLESALE: SWOT ANALYSIS

-

FIGURE 48

-

ROGERS COMMUNICATIONS: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 49

-

ROGERS COMMUNICATIONS: SWOT ANALYSIS

-

FIGURE 50

-

SWISSCOM: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 51

-

SWISSCOM: SWOT ANALYSIS

-

FIGURE 52

-

A1 GROUP: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 53

-

A1 GROUP: SWOT ANALYSIS

-

FIGURE 54

-

KDDI CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 55

-

KDDI CORPORATION: SWOT ANALYSIS

-

FIGURE 56

-

SAUDI TELECOM COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 57

-

SAUDI TELECOM COMPANY: SWOT ANALYSIS

Leave a Comment