Wind Turbine Gearbox Size

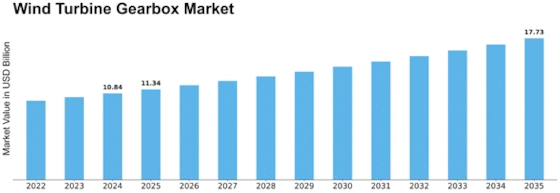

Wind Turbine Gearbox Market Growth Projections and Opportunities

Multiple factors shape the market dynamics of wind turbine gearbox including One key factor is the global need to harness renewable and clean energy sources. Considering the global effort to minimize carbon footprint and shift towards clean energy, wind power has seen a tremendous increase in demand. This growing need directly affects the wind turbine gearbox market as these gearboxes are essential in converting energy into electricity because of increasing demand. Government policies and regulations are the most important driving factors of wind turbine gearbox market. Policies, directed towards supporting such as subsidies and incentives for projects related to renewable energy ensure that there is investment in the wind power infrastructure which ultimately drives demand of wind turbine gearboxes. On the other hand, shifts in regulations or uncertainty of government support can create hurdles to market growth. Technological developments also play a major role in the market of wind turbine gearbox. Continuous innovations and developments in gearbox design & materials make gear boxes efficient, reliable as well as long-lived. In their efforts to invest in research and development of more sophisticated and competitive gearboxes, the market witnesses changes with regards to product types as well competition. Another important factor that influences the wind turbine gearbox market is globally and regionally overall economic environment. Economic stability creates the enabling environment for investment in renewable energy projects which increases demand of wind turbine gearboxes. On the other hand, project delays or cancellations due to economic recessions tend to have a negative impact on the market. Variations in the wind turbine gearbox market are greatly influenced by supply chain dynamics. Raw material availability and price, in the form of steel and alloys manufacturing costs largely influence. Furthermore, changes in supply chain involved with natural disasters or geopolitical tension can cause unstable prices and availability of gearbox. Market of wind turbine gearbox is influenced by the global energy prices, especially those associated with fossil fuels. When traditional energy prices are high there is a greater incentive for investment in renewable forms of power like wind power. On the other hand, a sharp decline in fossil fuel prices can initially reduce wind energy solutions adoption. Environmental awareness and public perceptions are becoming major market drivers. The need for sustainable options increases as awareness of climate change and the effect such traditional sources have on nature rises. The continuously increasing positive perception of wind energy in the public draws numerous governments, companies, and individuals into investing on wind power projects which consequently spurs demand for application within Wind Farm Turbine Gearboxes.

Leave a Comment