Aging Wind Turbine Fleet

The aging wind turbine fleet presents both challenges and opportunities for the Wind Turbine Maintenance, Repair, and Overhaul MRO Market. Many turbines installed in the early 2000s are reaching the end of their operational life, necessitating extensive maintenance, repair, or even replacement. This situation creates a substantial demand for MRO services as operators seek to ensure the continued efficiency and safety of their assets. Furthermore, the need for retrofitting older turbines with modern technology can drive additional revenue streams within the Wind Turbine Maintenance, Repair, and Overhaul MRO Market, as companies offer specialized services to upgrade aging equipment.

Regulatory Support and Incentives

Regulatory support and incentives for renewable energy projects are pivotal in shaping the Wind Turbine Maintenance, Repair, and Overhaul MRO Market. Governments worldwide are implementing policies that promote the installation and maintenance of wind energy systems. For example, tax credits and subsidies for renewable energy projects encourage investment in wind farms, which in turn drives the need for comprehensive MRO services. As a result, the Wind Turbine Maintenance, Repair, and Overhaul MRO Market is likely to benefit from increased funding and support, facilitating the development of more efficient maintenance practices and technologies.

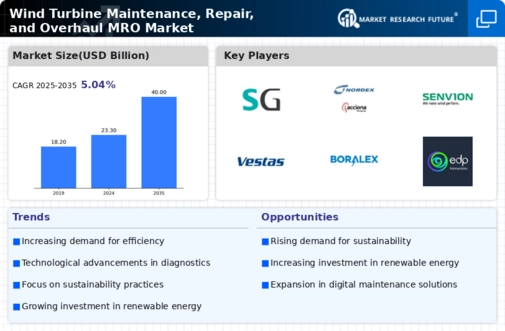

Increasing Demand for Renewable Energy

The escalating demand for renewable energy sources is a primary driver for the Wind Turbine Maintenance, Repair, and Overhaul MRO Market. As nations strive to meet energy targets and reduce carbon emissions, investments in wind energy infrastructure are surging. According to recent data, the wind energy sector is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth necessitates a robust MRO framework to ensure the reliability and efficiency of wind turbines. Consequently, the Wind Turbine Maintenance, Repair, and Overhaul MRO Market is likely to experience heightened activity as operators seek to optimize performance and extend the lifespan of their assets.

Technological Advancements in Turbine Design

Technological advancements in turbine design are significantly influencing the Wind Turbine Maintenance, Repair, and Overhaul MRO Market. Innovations such as larger rotor diameters and enhanced blade materials are improving energy capture and efficiency. However, these advancements also introduce complexities in maintenance protocols. For instance, the introduction of smart sensors and IoT technology allows for real-time monitoring of turbine performance, which can lead to predictive maintenance strategies. This shift is expected to increase the demand for specialized MRO services, as operators will require expertise in managing these advanced systems. The Wind Turbine Maintenance, Repair, and Overhaul MRO Market must adapt to these changes to remain competitive.

Growing Focus on Sustainability and Environmental Impact

The growing focus on sustainability and environmental impact is reshaping the Wind Turbine Maintenance, Repair, and Overhaul MRO Market. As stakeholders increasingly prioritize eco-friendly practices, there is a heightened emphasis on maintaining wind turbines to minimize their environmental footprint. This trend is prompting operators to invest in MRO services that not only enhance turbine performance but also align with sustainability goals. The Wind Turbine Maintenance, Repair, and Overhaul MRO Market is thus likely to evolve, incorporating green technologies and practices that reduce waste and energy consumption, ultimately contributing to a more sustainable energy landscape.