安全数字卡市场 摘要

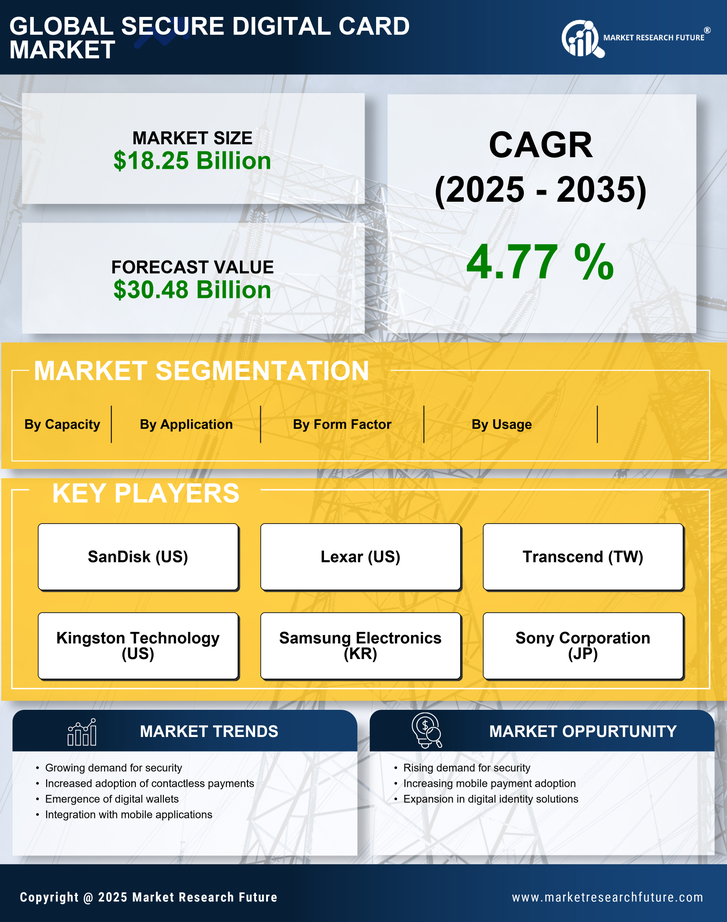

根据MRFR分析,安全数字卡市场规模在2024年估计为182.5亿美元。安全数字卡行业预计将从2025年的191.2亿美元增长到2035年的304.8亿美元,预计在2025年至2035年的预测期内,年均增长率(CAGR)为4.77。

主要市场趋势和亮点

安全数字卡市场正经历强劲增长,受到技术进步和不断变化的消费者偏好的推动。

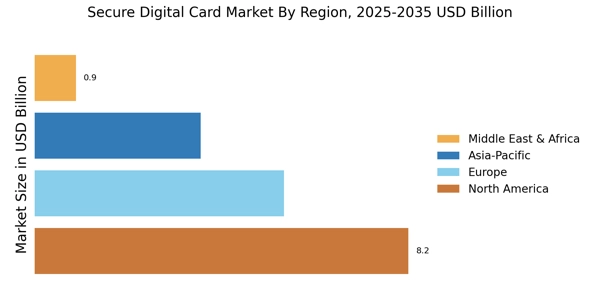

- 北美仍然是安全数字卡的最大市场,主要受到对网络安全和数字支付解决方案的强烈重视。

- 亚太地区正迅速崛起为增长最快的市场,这得益于智能手机普及率的提高和移动支付的采用。

- 移动电话在安全数字卡市场中占据最大份额,而数据传输领域由于对高效数据管理的需求上升,正经历最快的增长。

- 关键市场驱动因素包括对无接触支付的需求上升和卡片安全技术的进步,这些因素正在塑造消费者偏好。

市场规模与预测

| 2024 Market Size | 182.5亿美元 |

| 2035 Market Size | 304.8(亿美元) |

| CAGR (2025 - 2035) | 4.77% |

主要参与者

闪迪(美国)、雷克沙(美国)、 transcend(台湾)、金士顿科技(美国)、三星电子(韩国)、索尼公司(日本)、PNY科技(美国)、东芝(日本)、ADATA科技(台湾)