-

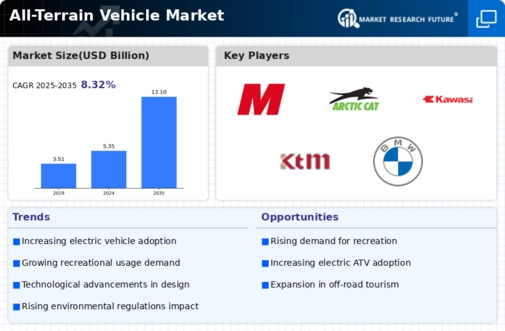

Executive Summary

-

2

-

Scope of the Report

-

Market Definition

- Definition

- Assumptions

-

2.2

-

Scope of the Study

-

2.2.2

-

Research Objective

-

2.2.4

-

Limitations

-

Research Process

- Secondary Research

-

2.3.1

-

Primary Research

-

2.4

-

Market size Estimation

-

Forecast Model

-

3

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining

- Threat of substitutes

- Bargaining Power of Buyers

-

power of buyers

-

3.1.4

-

Segment rivalry

-

Value Chain/Supply Chain Analysis

-

Market

-

Dynamics

-

Introduction

-

Market

-

Drivers

-

Market Restraints

-

Market

-

Opportunities

-

Market Trends

-

5

-

Global All-Terrain Vehicle Market, By Displacement

-

Introduction

-

Low

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

CC

-

5.2.2

-

Market Estimates & Forecast by Region, 2022-2030

-

5.3

-

Mid CC

-

High CC

- Market Estimates &

- Market Estimates & Forecast

-

Forecast, 2022-2030

-

by Region, 2022-2030

-

Global All-Terrain Vehicle

-

Market, By Application

-

Introduction

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

6.2

-

Sports

-

Entertainment

- Market Estimates

- Market Estimates & Forecast

-

& Forecast, 2022-2030

-

by Region, 2022-2030

-

Agriculture

- Market

-

6.4.1

-

Market Estimates & Forecast, 2022-2030

-

Estimates & Forecast by Region, 2022-2030

-

Military

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

6.5.2

-

Market Estimates & Forecast by Region, 2022-2030

-

6.6

-

Hunting

-

Others

- Market Estimates &

- Market Estimates & Forecast

-

Forecast, 2022-2030

-

by Region, 2022-2030

-

Global All-Terrain Vehicle Market,

-

By Vehicle Type

-

Introduction

-

Sports

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

Utility

-

Utility

- Market Estimates &

- Market Estimates & Forecast

-

Forecast, 2022-2030

-

by Region, 2022-2030

-

Recreational

- Market

-

7.4.1

-

Market Estimates & Forecast, 2022-2030

-

Estimates & Forecast by Region, 2022-2030

-

Sports

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Region, 2022-2030

-

7.5.2

-

Market Estimates & Forecast by Region, 2022-2030

-

7.6

-

Touring

-

Others

- Market Estimates &

- Market Estimates & Forecast

-

Forecast, 2022-2030

-

by Region, 2022-2030

-

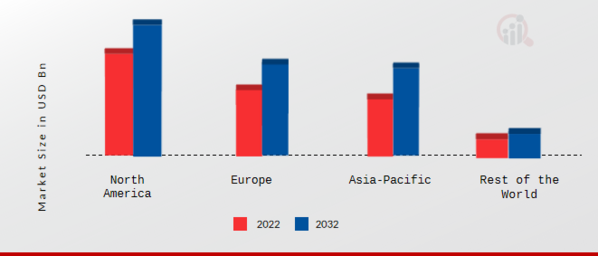

Global All-Terrain Vehicle

-

Market, By Region

-

Introduction

-

North

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Displacement, 2022-2030

- Market Estimates & Forecast by Application, 2022-2030

- Market Estimates & Forecast by Vehicle Type, 2022-2030

- U.S.

- Canada

- Market Estimates & Forecast, 2022-2030

- Market Estimates & Forecast by Displacement, 2022-2030

- Market Estimates & Forecast by Application, 2022-2030

- Market Estimates & Forecast by Vehicle Type, 2022-2030

- U.K.

- Germany

- Italy

- Rest of Europe

-

America

-

Forecast, 2022-2030

-

by Displacement, 2022-2030

-

Forecast by Application, 2022-2030

-

& Forecast by Vehicle Type, 2022-2030

-

8.2.6.2

-

Market Estimates & Forecast by Displacement, 2022-2030

-

8.2.6.3

-

Market Estimates & Forecast by Application, 2022-2030

-

8.2.6.4

-

Market Estimates & Forecast by Vehicle Type, 2022-2030

-

8.3

-

Europe

-

Forecast, 2022-2030

-

by Displacement, 2022-2030

-

Forecast by Application, 2022-2030

-

& Forecast by Vehicle Type, 2022-2030

-

8.3.6.2

-

Market Estimates & Forecast by Displacement, 2022-2030

-

8.3.6.3

-

Market Estimates & Forecast by Application, 2022-2030

-

8.3.6.4

-

Market Estimates & Forecast by Vehicle Type, 2022-2030

-

8.3.7

-

France

-

& Forecast, 2022-2030

-

Forecast by Displacement, 2022-2030

-

& Forecast by Application, 2022-2030

-

& Forecast by Vehicle Type, 2022-2030

-

& Forecast by Displacement, 2022-2030

-

by Application, 2022-2030

-

Type, 2022-2030

-

Asia Pacific

- Market

- Market

- Market

- China

- India

- Rest of Asia

-

8.4.1

-

Market Estimates & Forecast, 2022-2030

-

Estimates & Forecast by Displacement, 2022-2030

-

Estimates & Forecast by Application, 2022-2030

-

Estimates & Forecast by Vehicle Type, 2022-2030

-

8.4.5.2

-

Market Estimates & Forecast by Displacement, 2022-2030

-

8.4.5.3

-

Market Estimates & Forecast by Application, 2022-2030

-

8.4.5.4

-

Market Estimates & Forecast by Vehicle Type, 2022-2030

-

8.4.6

-

Japan

-

& Forecast, 2022-2030

-

Forecast by Displacement, 2022-2030

-

& Forecast by Application, 2022-2030

-

& Forecast by Vehicle Type 2022-2030

-

Pacific

-

Rest of the World

- Market Estimates

- Market Estimates & Forecast

- Market Estimates & Forecast

- Market Estimates & Forecast

-

& Forecast, 2022-2030

-

by Displacement, 2022-2030

-

by Application, 2022-2030

-

by Vehicle Type, 2022-2030

-

Competitive Landscape

-

Company Profile

-

Honda Motor Company,

- Company

- Products/Services Offering

- Key Developments

- SWOT Analysis

- Company Overview

- Products/Services Offering

- Financial

- Key Developments

- SWOT Analysis

- Company

- Products/Services Offering

- Key Developments

- SWOT Analysis

- Company

- Products/Services Offering

- Key Developments

- SWOT Analysis

- Company Overview

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Ltd. (Japan)

-

Overview

-

10.1.3

-

Financial Overview

-

10.1.5

-

Strategy

-

10.2

-

Polaris Industries Inc. (U.S.)

-

Overview

-

10.2.5

-

Strategy

-

10.3

-

Yamaha Motor Company Limited (Japan)

-

Overview

-

10.3.3

-

Financial Overview

-

10.3.5

-

Strategy

-

10.4

-

Bombardier Recreational Products (Canada)

-

Overview

-

10.4.3

-

Financial Overview

-

10.4.5

-

Strategy

-

10.5

-

Arctic Cat (U.S.)

-

10.5.2

-

Products/Services Offering

-

Kawasaki Heavy

- Company Overview

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Industries Ltd. (Japan)

-

10.6.2

-

Products/Services Offering

-

Suzuki Motor

- Company Overview

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Corporation (Japan)

-

10.7.2

-

Products/Services Offering

-

CFMOTO

- Company Overview

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

Powersports Inc. (U.S.)

-

10.8.2

-

Products/Services Offering

-

KTM AG

- Company Overview

- Financial Overview

- Key Developments

- Strategy

- SWOT Analysis

-

(Austria)

-

10.9.2

-

Products/Services Offering

-

BMW (Germany)

- Company Overview

- Products/Services

- Financial Overview

- Strategy

-

Offering

-

10.10.4

-

Key Developments

-

10.10.6

-

SWOT Analysis

-

List of Tables

-

Table 1

-

Global All-Terrain Vehicle Market: By Region, 2022-2030

-

Table

-

North America All-Terrain Vehicle Market:

-

By Country, 2022-2030

-

Europe

-

All-Terrain Vehicle Market: By Country, 2022-2030

-

Table 4

-

Asia Pacific All-Terrain Vehicle Market: By Country, 2022-2030

-

RoW All-Terrain Vehicle

-

Market: By Country, 2022-2030

-

Global All-Terrain

-

Vehicle Market, By Displacement, By Regions, 017-2023

-

Table 7

-

North America All-Terrain Vehicle Market, By Displacement, By Country, 2022-2030

-

Europe All-Terrain Vehicle Market, By Displacement,

-

By Country, 2022-2030

-

Asia Pacific All-Terrain

-

Vehicle Market by Displacement, By Country, 2022-2030

-

Table 10

-

RoW All-Terrain Vehicle Market by Displacement, By Country, 2022-2030

-

Global All-Terrain Vehicle by Vehicle Type Market:

-

By Regions, 2022-2030

-

North America All-Terrain

-

Vehicle Market by Vehicle Type: By Country, 2022-2030

-

Table 13

-

Europe All-Terrain Vehicle Market by Vehicle Type: By Country, 2022-2030

-

Asia Pacific All-Terrain Vehicle Market by Vehicle

-

Type: By Country, 2022-2030

-

RoW All-Terrain

-

Vehicle Market by Vehicle Type: By Country, 2022-2030

-

Table 16

-

Global All-Terrain Vehicle by Vehicle Type Market: By Regions, 2022-2030

-

North America All-Terrain Vehicle Market by Vehicle

-

Type: By Country, 2022-2030

-

Europe All-Terrain

-

Vehicle Market by Vehicle Type: By Country, 2022-2030

-

Table 19

-

Asia Pacific All-Terrain Vehicle Market by Vehicle Type: By Country, 2022-2030

-

RoW All-Terrain Vehicle Market by Vehicle

-

Type: By Country, 2022-2030

-

Global All-Terrain

-

Vehicle by Vehicle Type Market: By Regions, 2022-2030

-

Table 22

-

North America All-Terrain Vehicle Market by Vehicle Type: By Country, 2022-2030

-

Europe All-Terrain Vehicle Market by Vehicle

-

Type: By Country, 2022-2030

-

Asia Pacific

-

All-Terrain Vehicle Market by Vehicle Type: By Country, 2022-2030

-

Table

-

RoW All-Terrain Vehicle Market by Vehicle Type: By Country,

-

Global All-Terrain Vehicle Market:

-

By Region, 2022-2030

-

Global All-Terrain Vehicle

-

Market: By Displacement, 2022-2030

-

Global

-

All-Terrain Vehicle Market: By Application, 2022-2030

-

Table 29

-

Global All-Terrain Vehicle Market: By Vehicle Type, 2022-2030

-

Table

-

North America All-Terrain Vehicle Market, By Country

-

North America All-Terrain Vehicle Market, By Displacement

-

North America All-Terrain Vehicle Market, By Application

-

North America All-Terrain Vehicle Market, By Vehicle

-

Type

-

Europe: All-Terrain Vehicle Market,

-

By Country

-

Europe: All-Terrain Vehicle

-

Market, By Displacement

-

Europe: All-Terrain

-

Vehicle Market, By Application

-

Europe: All-Terrain

-

Vehicle Market, By Vehicle Type

-

Asia Pacific:

-

All-Terrain Vehicle Market, By Country

-

Asia

-

Pacific: All-Terrain Vehicle Market, By Displacement

-

Table 40

-

Asia Pacific: All-Terrain Vehicle Market, By Application

-

Table

-

Asia Pacific: All-Terrain Vehicle Market, By Vehicle

-

Type

-

RoW: All-Terrain Vehicle Market,

-

By Region

-

RoW All-Terrain Vehicle Market, By Displacement

-

RoW All-Terrain Vehicle Market, By Application

-

RoW All-Terrain Vehicle Market, By Vehicle Type

-

List of Figures

-

Research Process of MRFR

-

Top down & Bottom up Approach

-

FIGURE 3

-

Market Dynamics

-

Impact analysis: market drivers

-

Impact analysis: market restraints

-

FIGURE 6

-

Porter’s five forces analysis

-

Value

-

chain analysis

-

Global All-Terrain Vehicle Market

-

Share, By Displacement, 2022 (%)

-

Global All-Terrain

-

Vehicle Market, By Displacement, 2022-2030 (USD MILLION)

-

FIGURE 10

-

Global All-Terrain Vehicle Market Share, By Application, 2022 (%)

-

FIGURE

-

Global All-Terrain Vehicle Market, By Application, 2022-2030

-

(USD MILLION)

-

Global All-Terrain Vehicle Market

-

Share, By Vehicle Type, 2022 (%)

-

Global All-Terrain

-

Vehicle Market, By Vehicle Type, 2022-2030 (USD MILLION)

-

FIGURE 14

-

Global All-Terrain Vehicle Market Share, By Vehicle Type, 2022 (%)

-

FIGURE

-

Global All-Terrain Vehicle Market, By Vehicle Type, 2022-2030

-

(USD MILLION

-

Global All-Terrain Vehicle Market

-

Share (%), BY REGION, 2022

-

Global All-Terrain Vehicle

-

Market, BY REGION, 2022-2030 (USD MILLION)

-

North

-

America All-Terrain Vehicle Market Share (%), 2022

-

North

-

America All-Terrain Vehicle Market BY Country, 2022-2030 (USD MILLION)

-

FIGURE

-

Europe All-Terrain Vehicle Market Share (%), 2022

-

FIGURE

-

Europe All-Terrain Vehicle Market BY Country, 2022-2030 (USD

-

MILLION)

-

Asia Pacific All-Terrain Vehicle Market

-

Share (%), 2022

-

Asia Pacific All-Terrain Vehicle

-

Market BY Country, 2022-2030 (USD MILLION)

-

Rest

-

of the World All-Terrain Vehicle Market Share (%), 2022

-

FIGURE 25

-

Rest of the World All-Terrain Vehicle Market BY Country, 2022-2030 (USD MILLION)H

Leave a Comment