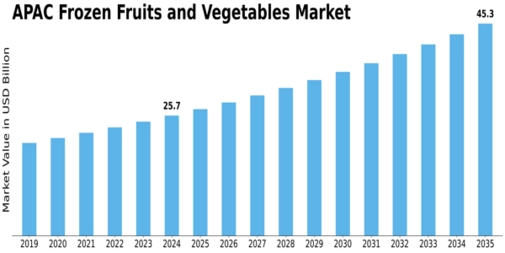

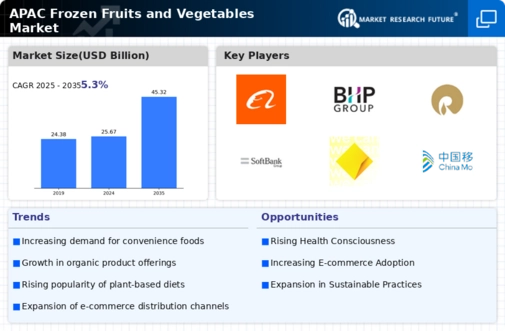

Apac Frozen Fruits Vegetables Size

APAC Frozen Fruits Vegetables Market Growth Projections and Opportunities

Several factors contribute to the growth and development of the frozen fruits and vegetables market in APAC. First, changes in consumer lifestyles and eating habits are the main determinants of the situation in this market. With urbanization increasing in Asia-Pacific countries, consumers are increasingly leading fast-paced lives which results into a rise for convenient food and ready- to - eat meals. Frozen fruits as well as vegetables provide a fast, easy solution to individuals looking for on-the-go meals that do not compromise quality or freshness. As such they have become associated with health consciousness, and concerns about food safety, since they are picked at their peak ripeness and immediately flash-frozen keeping its nutritional value intact.

Moreover, demographic factors like population growth rate, rising disposable incomes and changing household structures affect market dynamics within APAC region. The increase in disposable income along with urbanization gives consumers more money for buying high-quality foods inclusive those frozen fruits as well as vegetables. Similarly, households’ structural changes such as smaller family sizes due to increasing numbers single persons and working professionals demand small pack sizes of five-piece servings hence reducing food wastage while providing convenience for fewer members.

Furthermore, increased adoption of Western dietary patterns among APAC people is also driving demand in the frozen fruits and vegetables market. This has resulted from exposure by Asia-Pacific consumers through travel, international media dissemination ,and globalization of western cuisine trends thus fostering unmet needs for locally produced frozen fruits commonly used in western dishes.Some of the consumers want to consume berries,broccoli mixed vegetable spinach among other items that were used while preparing western dishes at homes elicited by their huge popularity resulting growing diversification in this trade.

Therefore, advances made with respect to freezing techniques as well as preservation technologies foster market expansion besides product innovation within this sector of the economy .A good number of manufacturers employ innovative freezing technologies such IQF (Individual Quick Freezing) or Cryogenic Freezing so as to keep the texture, taste and nutritional values of fresh fruits and vegetables for a pretty long time. On top of that, vacuum-sealed bags, modified atmosphere packaging (MAP) among other types of packaging technologies aid in preservation of product features as well as its freshness during storage or transportation therefore widening market access and consumer acceptance.

In addition, importance is attached to food safety regulations and quality standards that have a significant impact on the APAC frozen fruits and vegetables market. The compliance with strict food safety regulations and quality policies is necessary to ensure consumer safety and trustworthiness in the case of manufacturers specializing in frozen foods. Specifically, there are regulatory trends pertaining to labeling, packaging as well as storage requirements governing such aspects like product display, advertising and distribution which shape consumer behavior hence affecting product positioning.

Leave a Comment