Market Share

Auto Parts Market Share Analysis

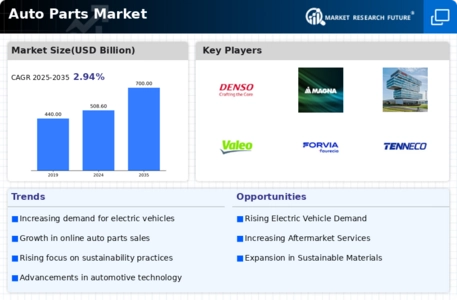

The auto parts market is navigating several key trends that are shaping the industry landscape and influencing consumer preferences. One significant trend is the increasing focus on electric vehicles (EVs) and the subsequent demand for electric auto parts. As governments worldwide push for a transition to cleaner energy sources, automotive manufacturers are investing heavily in the development of electric powertrains, batteries, and other components. This shift towards electrification is reshaping the traditional auto parts market, with a growing emphasis on advanced technologies that support EV infrastructure and enhance electric vehicle performance.

In addition to the rise of electric vehicles, there is a growing trend in the adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies. As vehicles become more technologically sophisticated, the demand for sensors, cameras, radar systems, and other components that enable automation and enhance safety features is on the rise. Auto parts manufacturers are responding by developing and supplying cutting-edge technologies to meet the increasing requirements of modern vehicles, paving the way for the future of autonomous and connected transportation.

Another notable trend is the growing importance of sustainability in the auto parts market. Consumers and regulatory bodies are increasingly concerned about the environmental impact of automotive production and usage. This has led to a surge in demand for eco-friendly materials, recyclable components, and energy-efficient manufacturing processes within the auto parts industry. Companies are investing in research and development to create sustainable alternatives and reduce the carbon footprint associated with the production and disposal of auto parts.

Furthermore, the aftermarket segment of the auto parts market is experiencing a shift towards e-commerce. Online platforms and digital channels are becoming popular avenues for consumers to purchase replacement parts, accessories, and performance upgrades. The convenience of online shopping, coupled with the ability to compare prices and access a broader range of products, has led to the steady growth of e-commerce in the auto parts sector. As a result, auto parts retailers are adapting their business models to cater to the evolving preferences of consumers who seek a seamless online shopping experience.

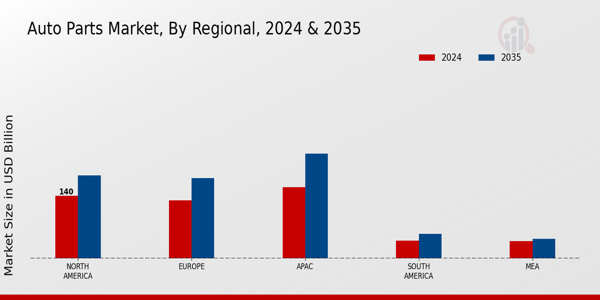

Supply chain resilience and localization are also emerging as critical trends in the auto parts market. The disruptions caused by the COVID-19 pandemic highlighted vulnerabilities in global supply chains, prompting companies to reevaluate their sourcing strategies. Many auto parts manufacturers are considering a more localized approach to production and sourcing to enhance supply chain resilience, reduce lead times, and mitigate risks associated with geopolitical and economic uncertainties.

Moreover, the increasing complexity of vehicles, with a multitude of sensors and electronic components, is driving demand for specialized diagnostic tools and software in the auto parts market. Mechanics and service technicians require advanced equipment to diagnose and repair modern vehicles effectively. As a result, there is a growing market for diagnostic tools, software solutions, and training programs that support the maintenance and repair of technologically advanced automobiles.

While these trends present opportunities for growth in the auto parts market, challenges such as regulatory complexities, the need for skilled labor, and the high cost of research and development in emerging technologies persist. Additionally, the transition period between traditional internal combustion engine vehicles and electric vehicles poses challenges for auto parts manufacturers to cater to both markets effectively.

In conclusion, the auto parts market is in a state of transformation, driven by the surge in electric vehicles, advancements in technology, sustainability concerns, e-commerce adoption, and the need for resilient supply chains. As the automotive industry continues to evolve, auto parts manufacturers and suppliers are adapting to these trends, shaping the future of the market and contributing to a more sustainable, connected, and technologically advanced automotive ecosystem.

Leave a Comment