-

Introduction

-

DEFINITION

-

15

-

SCOPE OF THE STUDY 15

-

ASSUMPTIONS 15

-

MARKET

-

STRUCTURE 16

-

Research Methodology

-

RESEARCH PROCESS 17

-

3.2

-

PRIMARY RESEARCH 18

-

SECONDARY RESEARCH 18

-

MARKET

-

SIZE ESTIMATION 18

-

FORECAST MODEL 20

-

Market Dynamics

-

4.1

-

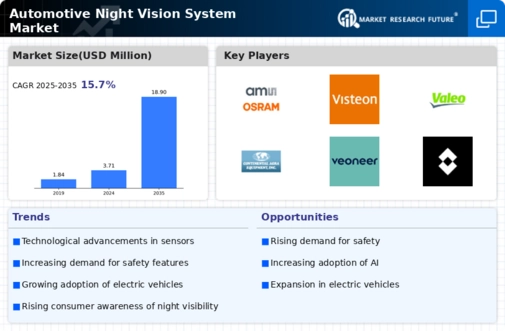

DRIVERS 21

-

IN SALES OF PREMIUM CARS 22

-

22

-

4.3

-

OPPORTUNITIES 23

-

FRONT LIGHTING SYSTEMS 23

-

4.4

-

CHALLENGES 23

-

INCREASED SAFETY AWARENESS 21

-

RISE

-

INCREASE IN GOVERNMENT INITIATIVES AND INSTITUTIONS

-

RESTRAINTS 22

- HIGH PRICE OF NIGHT VISION SYSTEMS 22

- INTEGRATION OF VEHICLE NIGHT VISION SYSTEM WITH ADAPTIVE

- TECHNOLOGICAL ADVANCEMENTS 23

- TECHNICAL AND INDUSTRY CHALLENGES 23

-

Market Factor

-

Analysis

-

PORTER’S FIVE FORCES ANALYSIS 24

- THREAT

- BARGAINING POWER OF SUPPLIERS 25

- BARGAINING POWER OF BUYERS 25

-

OF NEW ENTRANTS 24

-

5.1.3

-

THREAT OF SUBSTITUTES 25

-

5.1.5

-

RIVALRY 25

-

VALUE CHAIN ANALYSIS 26

- NIGHT VISION SYSTEM COMPONENTS

- MANUFACTURE & ASSEMBLY 26

- DISTRIBUTION

- END-USE 27

-

SUPPLY 26

-

26

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY TECHNOLOGY

-

INTRODUCTION 29

-

FAR INFRARED (FIR) 29

-

6.3

-

NEAR INFRARED (NIR) 29

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY COMPONENTS

-

INTRODUCTION 32

-

CONTROLLING UNIT 32

-

7.3

-

SENSORS 32

-

DISPLAY UNIT 32

-

GLOBAL AUTOMOTIVE NIGHT VISION

-

SYSTEM MARKET, BY SYSTEM

-

INTRODUCTION 35

-

ACTIVE NVS 35

-

8.3

-

PASSIVE NVS 35

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE

-

9.1

-

INTRODUCTION 38

-

PASSENGER CARS 38

-

COMMERCIAL VEHICLE 38

-

10

-

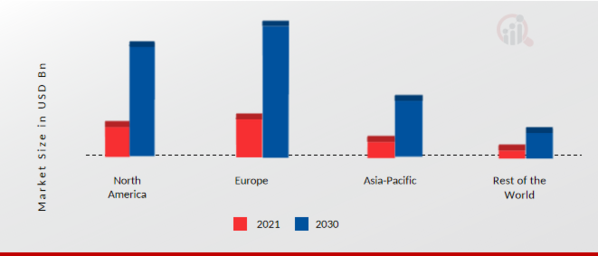

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY REGION

-

INTRODUCTION

-

41

-

NORTH AMERICA 43

- U.S 47

- CANADA

- MEXICO 53

-

50

-

EUROPE 56

- GERMANY 60

- RUSSIA 65

- FRANCE 68

-

10.3.2

-

U.K. 63

-

10.3.5

-

REST OF EUROPE 70

-

ASIA-PACIFIC 73

- CHINA 77

- INDIA 83

- REST OF ASIA-PACIFIC 86

- MIDDLE EAST & AFRICA 93

- LATIN AMERICA 96

-

10.4.2

-

JAPAN 80

-

10.5

-

REST OF WORLD 89

-

11

-

COMPETITIVE SCENARIO

-

COMPETITIVE LANDSCAPE 99

-

COMPANY

-

PROFILES

-

ROBERT BOSCH GMBH 100

- COMPANY OVERVIEW 100

- PRODUCT OFFERING 101

- STRATEGY

- SWOT ANALYSIS 102

-

12.1.2

-

FINANCIAL OVERVIEW 100

-

101

-

CONTINENTAL 103

- FINANCIAL OVERVIEW 103

- PRODUCT

- STRATEGY 104

- SWOT ANALYSIS 105

- COMPANY OVERVIEW 106

- FINANCIAL

- PRODUCT OFFERING 107

- STRATEGY 107

- COMPANY OVERVIEW 108

- FINANCIAL OVERVIEW 108

- STRATEGY 109

-

12.2.1

-

COMPANY OVERVIEW 103

-

OFFERING 104

-

12.3

-

DENSO CORPORATION 106

-

OVERVIEW 106

-

12.4

-

FLIR SYSTEMS 108

-

12.4.3

-

PRODUCT OFFERING 109

-

MAGNA INTERNATIONAL INC.

- COMPANY OVERVIEW 110

- FINANCIAL OVERVIEW 110

- STRATEGY 111

-

110

-

12.5.3

-

PRODUCT OFFERING 111

-

VALEO VISION SYSTEMS 112

- FINANCIAL OVERVIEW 112

- PRODUCT

- STRATEGY 113

- SWOT ANALYSIS 114

- COMPANY OVERVIEW 115

- FINANCIAL OVERVIEW 115

- STRATEGY 116

-

12.6.1

-

COMPANY OVERVIEW 112

-

OFFERING 113

-

12.7

-

AUTOLIV INC. 115

-

12.7.3

-

PRODUCT OFFERING 116

-

HELLA KGAA HUECK & CO.

- COMPANY OVERVIEW 117

- FINANCIAL OVERVIEW 117

- STRATEGY 118

- SWOT ANALYSIS 119

- COMPANY OVERVIEW 120

- FINANCIAL OVERVIEW 120

- STRATEGY 121

-

117

-

12.8.3

-

PRODUCT OFFERING 118

-

12.9

-

OSRAM 120

-

12.9.3

-

PRODUCT OFFERING 121

-

VISTEON 122

- FINANCIAL OVERVIEW 122

- PRODUCT

- STRATEGY 123

-

12.10.1

-

COMPANY OVERVIEW 122

-

OFFERING 123

-

LIST OF TABLES

-

TABLE

-

MARKET SYNOPSIS 14

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY TECHNOLOGY, 2022-2030 (USD MILLION) 30

-

GLOBAL AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 33

-

TABLE

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION)

-

36

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE,

-

GLOBAL AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY REGION, 2022-2030 (USD MILLION) 42

-

NORTH AMERICA: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY COUNTRY, 2022-2030 (USD MILLION) 44

-

TABLE

-

NORTH AMERICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030

-

(USD MILLION) 45

-

NORTH AMERICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY COMPONENTS, 2022-2030 (USD MILLION) 46

-

NORTH AMERICA: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 46

-

TABLE

-

NORTH AMERICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030

-

(USD MILLION) 47

-

U.S.: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY,

-

U.S.: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY COMPONENTS, 2022-2030 (USD MILLION) 49

-

U.S.: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 49

-

U.S.:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

50

-

CANADA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY,

-

CANADA: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 51

-

CANADA: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 52

-

CANADA:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

52

-

MEXICO: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY,

-

MEXICO: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 54

-

MEXICO: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 54

-

MEXICO:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

55

-

EUROPE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COUNTRY, 2022-2030

-

(USD MILLION) 57

-

EUROPE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY,

-

EUROPE: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 59

-

EUROPE: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 59

-

EUROPE:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

60

-

GERMANY: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY,

-

GERMANY: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 61

-

GERMANY: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 62

-

GERMANY:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

62

-

U.K.: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030

-

(USD MILLION) 63

-

U.K.: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS,

-

U.K.: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY SYSTEM, 2022-2030 (USD MILLION) 64

-

U.K.: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION) 65

-

TABLE

-

RUSSIA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD

-

MILLION) 66

-

RUSSIA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS,

-

RUSSIA: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 67

-

RUSSIA: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION) 67

-

TABLE

-

FRANCE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD

-

MILLION) 68

-

FRANCE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS,

-

FRANCE: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 69

-

FRANCE: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION) 70

-

TABLE

-

REST OF EUROPE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030

-

(USD MILLION) 71

-

REST OF EUROPE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY COMPONENTS, 2022-2030 (USD MILLION) 71

-

REST OF EUROPE: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 72

-

TABLE

-

REST OF EUROPE: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030

-

(USD MILLION) 72

-

ASIA-PACIFIC: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY COUNTRY, 2022-2030 (USD MILLION) 74

-

ASIA-PACIFIC: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION) 75

-

TABLE

-

ASIA-PACIFIC: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030

-

(USD MILLION) 76

-

ASIA-PACIFIC: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY SYSTEM, 2022-2030 (USD MILLION) 76

-

ASIA-PACIFIC: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION) 77

-

TABLE

-

CHINA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

-

78

-

CHINA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030

-

(USD MILLION) 79

-

CHINA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY SYSTEM,

-

CHINA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY VEHICLE TYPE, 2022-2030 (USD MILLION) 80

-

JAPAN: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION) 81

-

TABLE

-

JAPAN: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030 (USD MILLION)

-

82

-

JAPAN: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY SYSTEM, 2022-2030

-

(USD MILLION) 82

-

JAPAN: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE

-

TYPE, 2022-2030 (USD MILLION) 83

-

INDIA: AUTOMOTIVE NIGHT VISION

-

SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION) 84

-

INDIA:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 84

-

TABLE

-

INDIA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION)

-

85

-

INDIA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE,

-

REST OF ASIA-PACIFIC: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION) 86

-

TABLE

-

REST OF ASIA-PACIFIC: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030

-

(USD MILLION) 87

-

REST OF ASIA-PACIFIC: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 87

-

REST OF ASIA-PACIFIC:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

88

-

ROW: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY REGION, 2022-2030

-

(USD MILLION) 90

-

ROW: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY,

-

ROW: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY COMPONENTS, 2022-2030 (USD MILLION) 92

-

ROW: AUTOMOTIVE NIGHT

-

VISION SYSTEM MARKET, BY SYSTEM, 2022-2030 (USD MILLION) 92

-

ROW:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION)

-

93

-

MIDDLE EAST & AFRICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY TECHNOLOGY, 2022-2030 (USD MILLION) 94

-

MIDDLE EAST & AFRICA:

-

AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTS, 2022-2030 (USD MILLION) 94

-

TABLE

-

MIDDLE EAST & AFRICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY SYSTEM, 2022-2030

-

(USD MILLION) 95

-

MIDDLE EAST & AFRICA: AUTOMOTIVE NIGHT VISION SYSTEM

-

MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION) 95

-

LATIN AMERICA: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION) 96

-

TABLE

-

LATIN AMERICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET, BY COMPONENTSS, 2022-2030

-

(USD MILLION) 97

-

LATIN AMERICA: AUTOMOTIVE NIGHT VISION SYSTEM MARKET,

-

BY SYSTEM, 2022-2030 (USD MILLION) 97

-

LATIN AMERICA: AUTOMOTIVE

-

NIGHT VISION SYSTEM MARKET, BY VEHICLE TYPE, 2022-2030 (USD MILLION) 98

-

TABLE

-

ROBERT BOSCH GMBH: PRODUCT OFFERING 101

-

CONTINENTAL AG: PRODUCT

-

OFFERING 104

-

DENSO CORPORATION: PRODUCT OFFERING 107

-

TABLE

-

FLIR SYSTEMS: PRODUCT OFFERING 109

-

MAGNA INTERNATIONAL INC.:

-

PRODUCT OFFERING 111

-

VALEO VISION SYSTEMS: PRODUCT OFFERING

-

113

-

AUTOLIV INC.: PRODUCT OFFERING 116

-

-

style="font-family: arial, helvetica, sans-serif; font-size: 10.5p

Leave a Comment