-

EXECUTIVE SUMMARY

-

MARKET ATTRACTIVENESS ANALYSIS 15

- GLOBAL

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE 15

-

GLOBAL

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED 16

-

GLOBAL DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY FUNCTION 17

-

GLOBAL DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY REGION 18

-

MARKET INTRODUCTION

-

2.1

-

DEFINITION 20

-

SCOPE OF THE STUDY 20

-

MARKET STRUCTURE 20

-

RESEARCH METHODOLOGY

-

RESEARCH PROCESS 21

-

PRIMARY RESEARCH

-

22

-

SECONDARY RESEARCH 23

-

MARKET SIZE ESTIMATION 23

-

TOP-DOWN

-

and BOTTOM-up APPROACH 24

-

FORECAST MODEL 25

-

LIST OF ASSUMPTIONS

-

26

-

MARKET INSIGHTS

-

MARKET DYNAMICS

-

Introduction

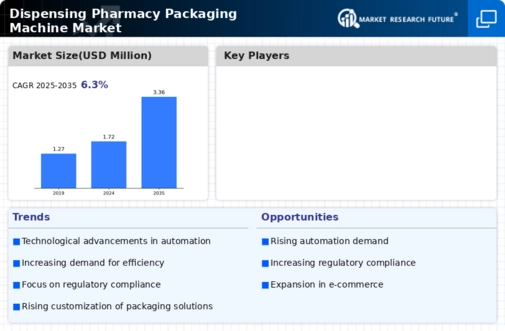

- Drivers 30

- Growing Demand for Automation in the Pharmaceutical

- Growth of the Pharmaceutical Industry 31

- DRIVERS

- Restraints 33

- Lack of Skilled Labor 33

- High Installation and Maintenance Costs 33

- RESTRAINT IMPACT ANALYSIS,

- Opportunity 35

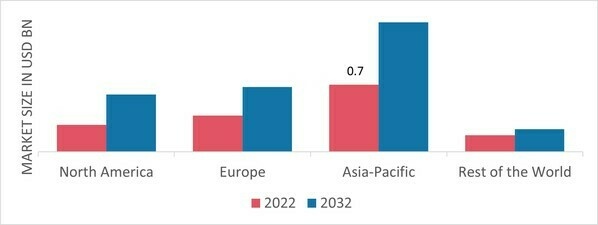

- Scope of Growth in Asia-Pacific 35

-

29

-

Industry 30

-

IMPACT ANALYSIS, 32

-

34

-

MARKET FACTOR ANALYSIS

-

Supply Chain Analysis 36

- Raw Material

- Manufacturing & Assembly 37

- Aftersales Service 37

-

& Component Supply 36

-

6.1.3

-

End Use 37

-

Market Factor Analysis

-

Porter’s Five Forces Model 38

- Threat of New Entrants 39

- Bargaining Power of Suppliers 39

- Bargaining Power of Buyers 39

- Threat of Substitutes 39

- Rivalry 39

-

GLOBAL DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY Product Type

-

OVERVIEW 40

- semi-automatic 41

-

8.1.1

-

FULLY AUTOMATIC 41

-

GLOBAL DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY SPEED

-

OVERVIEW 43

- LOW SPEED 44

- sTANDARD sPEED 44

- HIGH SPEED 44

-

GLOBAL DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, By FUNCTION

-

OVERVIEW 46

-

GLOBAL

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY REGION

-

OVERVIEW 48

- Global Dispensing Pharmacy Packaging Machine Market, by Region, 2020-2027

-

49

-

EUROPE 51

- EUROPE: Dispensing Pharmacy Packaging Machine

-

Market, by country, 2020-2027 52

-

EUROPE: Dispensing Pharmacy Packaging

-

Machine Market, by Product Type, 2020-2027 53

-

EUROPE: Dispensing Pharmacy

-

Packaging Machine Market, by SPEED, 2020-2027 53

-

11.2.4.1

-

Germany 54

-

GERMANY: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027

-

54

-

GERMANY: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED,

-

France 56

-

FRANCE: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 56

-

FRANCE: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 57

-

11.2.6.1

-

UK 58

-

UK: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 58

-

59

-

UK: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027

-

Spain 60

-

SPAIN: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY PRODUCT TYPE, 2020-2027 60

-

SPAIN: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY SPEED, 2020-2027 61

-

11.2.8.1

-

Rest of Europe 61

-

REST OF EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027

-

62

-

SPEED, 2020-2027 62

-

REST OF EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY

-

NORTH AMERICA 64

- NORTH AMERICA: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY COUNTRY, 2020-2027 64

-

NORTH AMERICA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY product type, 2020-2027 65

-

11.3.3

-

NORTH AMERICA: Dispensing Pharmacy Packaging Machine Market, by SPEED, 2020-2027

-

66

-

BY PRODUCT TYPE, 2020-2027 67

-

US 67

-

US: DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

US: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY SPEED, 2020-2027 68

-

Canada 69

-

CANADA: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 69

-

CANADA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 70

-

ASIA-PACIFIC

- ASIA-PACIFIC: Dispensing Pharmacy Packaging Machine Market, by country,

- ASIA-PACIFIC: Dispensing Pharmacy Packaging

-

71

-

Machine Market, by Product Type, 2020-2027 (USD MILLION) 73

-

ASIA-PACIFIC:

-

Dispensing Pharmacy Packaging Machine Market, by SPEED, 2020-2027 73

-

11.4.4

-

CHINA 74

-

TYPE, 2020-2027 74

-

BY SPEED, 2020-2027 75

-

CHINA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT

-

CHINA: DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

Japan 76

-

JAPAN: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 76

-

JAPAN: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 77

-

BY SPEED, 2020-2027 79

-

Taiwan 78

-

TAIWAN: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE,

-

TAIWAN: DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

South Korea 80

-

SOUTH KOREA: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 80

-

SOUTH

-

KOREA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 81

-

11.4.8

-

Rest of Asia Pacific 82

-

REST OF ASIA PACIFIC: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 82

-

REST OF ASIA

-

PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 83

-

Rest of WOrld 84

- SOUTH AMERICA 84

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 85

-

11.5.1.2

-

SOUTH AMERICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, by SPEED, 2020-2027

-

85

-

MIDDLE EAST & AFRICA 86

-

MIDDLE EAST & AFRICA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 86

-

11.5.2.2

-

MIDDLE EAST & AFRICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED,

-

COMPETITIVE LANDSCAPE

-

COMPETITIVE OVERVIEW

-

88

-

COMPETITIVE BENCHMARKING 89

-

MARKET SHARE ANALYSIS 90

-

Company Profiles

-

Takazono Corporation 91

- COMPANY OVERVIEW

- company information 91

- PRODUCTS OFFERED 91

- COMPANY OVERVIEW 93

- COMPANY INFORMATION

- PRODUCTS OFFERED 93

-

91

-

13.2

-

YUYAMA CO., LTD 93

-

93

-

Tosho. Co. Inc. 100

- COMPANY

- PRODUCTS/SERVICES OFFERED 100

-

OVERVIEW 100

-

Canon Lifecare

- COMPANY OVERVIEW 102

- COMPANY INFORMATION

- PRODUCTS OFFERED 102

-

Solutions Inc. 102

-

102

-

Yung chung machinery co., Ltd 104

- COMPANY OVERVIEW 104

- PRODUCTS offered 104

-

Heqian

- COMPANY OVERVIEW 106

- company information

- PRODUCTS OFFERED 107

-

industry co., Ltd 106

-

106

-

Nisshin Medical Device Co., Ltd.

- COMPANY OVERVIEW 108

- company information 108

-

108

-

13.7.3

-

PRODUCTS OFFERED 109

-

FU ENTERPRISE CO. LTD 110

- COMPANY OVERVIEW

- PRODUCTS OFFERED 110

-

110

-

INDUSTRY INSIGHTS

-

Japan

-

Pharmaceutical Industry Outlook 111

-

APPENDIX

-

REFERENCES 115

-

RELATED REPORTS 116

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS

-

26

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT

-

TYPE, 2020-2027 (USD MILLION) 42

-

GLOBAL DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 42

-

GLOBAL DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 45

-

TABLE

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS)

-

45

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY FUNCTION,

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY REGION, 2020-2027 (USD MILLION) 49

-

GLOBAL DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY REGION, 2020-2027 (UNITS) 50

-

EUROPE: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 52

-

TABLE

-

EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY COUNTRY, 2020-2027 (UNITS)

-

52

-

EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT

-

TYPE, 2020-2027 (USD MILLION) 53

-

EUROPE: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 53

-

EUROPE: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 53

-

TABLE

-

EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS)

-

54

-

GERMANY: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT

-

TYPE, 2020-2027 (USD MILLION) 54

-

GERMANY: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 55

-

GERMANY: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 55

-

TABLE

-

GERMANY: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS)

-

55

-

FRANCE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT

-

TYPE, 2020-2027 (USD MILLION) 56

-

FRANCE: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 56

-

FRANCE: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 USD MILLION) 57

-

TABLE

-

FRANCE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS)

-

57

-

UK: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE,

-

UK: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 58

-

UK: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 59

-

UK:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS) 59

-

SPAIN: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE,

-

SPAIN: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 60

-

SPAIN: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 61

-

SPAIN:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS) 61

-

REST OF EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT

-

TYPE, 2020-2027 (USD MILLION) 62

-

REST OF EUROPE: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 62

-

REST

-

OF EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD

-

MILLION) 62

-

REST OF EUROPE: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY SPEED, 2020-2027 (UNITS) 63

-

NORTH AMERICA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 64

-

NORTH

-

AMERICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY COUNTRY, 2020-2027 (UNITS)

-

65

-

NORTH AMERICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY

-

PRODUCT TYPE, 2020-2027 (USD MILLION) 65

-

NORTH AMERICA: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 66

-

TABLE

-

NORTH AMERICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027

-

(USD MILLION) 66

-

NORTH AMERICA: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY SPEED, 2020-2027 (UNITS) 67

-

+US: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION) 67

-

US: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 68

-

TABLE

-

US: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION)

-

68

-

US: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027

-

(UNITS) 68

-

CANADA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY

-

PRODUCT TYPE, 2020-2027 (USD MILLION) 69

-

CANADA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 69

-

CANADA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION)

-

70

-

CANADA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED,

-

ASIA-PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 72

-

ASIA-PACIFIC: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY COUNTRY, 2020-2027 (UNITS) 72

-

TABLE 51

-

ASIA-PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027

-

(USD MILLION) 73

-

ASIA-PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 73

-

ASIA-PACIFIC: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 73

-

TABLE

-

ASIA-PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027

-

(UNITS) 74

-

CHINA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY

-

PRODUCT TYPE, 2020-2027 (USD MILLION) 74

-

CHINA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 75

-

CHINA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION)

-

75

-

CHINA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED,

-

JAPAN: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION) 76

-

JAPAN: DISPENSING

-

PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 77

-

TABLE

-

JAPAN: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD

-

MILLION) 77

-

JAPAN: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY

-

SPEED, 2020-2027 (UNITS) 77

-

TAIWAN: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION) 78

-

TAIWAN:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS)

-

78

-

TAIWAN: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED,

-

TAIWAN: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY SPEED, 2020-2027 (UNITS) 79

-

SOUTH KOREA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION) 80

-

TABLE

-

SOUTH KOREA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027

-

(UNITS) 80

-

SOUTH KOREA: DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

BY SPEED, 2020-2027 (USD MILLION) 81

-

SOUTH KOREA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS) 81

-

REST OF ASIA

-

PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027

-

(USD MILLION) 82

-

REST OF ASIA PACIFIC: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS) 83

-

REST OF ASIA

-

PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (USD

-

MILLION) 83

-

REST OF ASIA PACIFIC: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY SPEED, 2020-2027 (UNITS) 83

-

SOUTH AMERICA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION) 85

-

TABLE

-

SOUTH AMERICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE,

-

SOUTH AMERICA: DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY SPEED, 2020-2027 (USD MILLION) 85

-

SOUTH AMERICA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS) 86

-

MIDDLE EAST & AFRICA: DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

BY PRODUCT TYPE, 2020-2027 (USD MILLION) 86

-

MIDDLE EAST & AFRICA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY PRODUCT TYPE, 2020-2027 (UNITS)

-

87

-

MIDDLE EAST & AFRICA: DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET, BY SPEED, 2020-2027 (USD MILLION) 87

-

MIDDLE EAST & AFRICA:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020-2027 (UNITS) 87

-

TAKAZONO CORPORATION: PRODUCTS OFFERED 91

-

YUYAMA CO., LTD:

-

PRODUCTS OFFERED 93

-

TOSHO. CO. INC.: PRODUCTS OFFERED 100

-

TABLE

-

CANON LIFECARE SOLUTIONS INC.: PRODUCTS OFFERED 102

-

YUNG CHUNG

-

MACHINERY CO., LTD: PRODUCTS OFFERED 104

-

HEQIAN INDUSTRY CO., LTD.:

-

COMPANY INFORMATION 106

-

HEQIAN INDUSTRY CO., LTD: PRODUCTS OFFERED

-

107

-

NISSHIN MEDICAL DEVICE CO., LTD.: COMPANY INFORMATION 108

-

TABLE

-

NISSHIN MEDICAL DEVICE CO., LTD.: PRODUCTS OFFERED 109

-

FU ENTERPRISE

-

CO. LTD: PRODUCTS OFFERED 110

-

NUMBER OF DISPENSING PHARMACIES IN JAPAN

-

113

-

PRICING TREND ANALYSIS BY REGION, USD/UNIT 113

-

PACKAGING

-

MATERIAL FOR PHARMACEUTICALS INDUSTRY, MARKET OVERVIEW, (‘000 TONNES) 113

-

CHINA: PACKAGING MATERIAL FOR PHARMACEUTICALS INDUSTRY, MARKET OVERVIEW,

-

(‘000 TONNES) 113

-

JAPAN: PACKAGING MATERIAL FOR PHARMACEUTICALS

-

INDUSTRY, MARKET OVERVIEW, (‘000 TONNES) 113

-

TAIWAN: PACKAGING

-

MATERIAL FOR PHARMACEUTICALS INDUSTRY, MARKET OVERVIEW, (‘000 TONNES) 114

-

SOUTH KOREA: PACKAGING MATERIAL FOR PHARMACEUTICALS INDUSTRY, MARKET

-

OVERVIEW, (‘000 TONNES) 114

-

LIST OF FIGURES

-

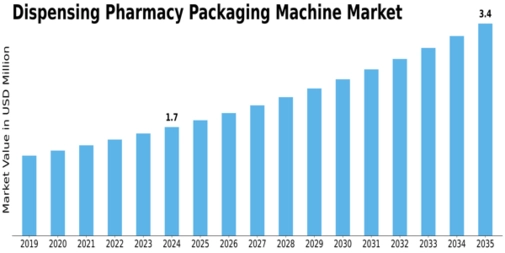

MARKET

-

SYNOPSIS 14

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET ANALYSIS,

-

BY PRODUCT TYPE 15

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET

-

ANALYSIS, BY SPEED 16

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE

-

MARKET ANALYSIS, FUNCTION 17

-

GLOBAL DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET ANALYSIS, BY REGION 18

-

GLOBAL DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET: MARKET STRUCTURE 20

-

RESEARCH PROCESS OF MRFR 21

-

ASIA PACIFIC MARKET SIZE & MARKET SHARE, BY COUNTRY (2020-2027) 27

-

EUROPE MARKET SIZE & MARKET SHARE, BY COUNTRY (2020-2027) 27

-

FIGURE

-

NORTH AMERICA MARKET SIZE & MARKET SHARE, BY COUNTRY (2020-2027) 28

-

FIGURE

-

MARKET DYNAMICS: GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET 29

-

FIGURE

-

TOTAL HEALTH SPENDING, (%) OF GDP, 2020 31

-

DRIVERS IMPACT ANALYSIS:

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET 32

-

RESTRAINT

-

IMPACT ANALYSIS: GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET 34

-

FIGURE

-

SUPPLY CHAIN ANALYSIS: GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET 36

-

PORTER''S FIVE FORCES ANALYSIS: GLOBAL DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET 38

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

BY PRODUCT TYPE, 2020 (% SHARE) 40

-

GLOBAL DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION) 41

-

FIGURE 19

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2020 (% SHARE) 43

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY SPEED, 2017–2025

-

(USD MILLION) 44

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET,

-

BY FUNCTION, 2020 (% SHARE) 46

-

GLOBAL DISPENSING PHARMACY PACKAGING

-

MACHINE MARKET, BY FUNCTION, 2020 –2027 (USD MILLION) 46

-

GLOBAL

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY REGION, 2020 TO 2027 (USD MILLION)

-

48

-

GLOBAL DISPENSING PHARMACY PACKAGING MACHINE MARKET, BY REGION,

-

EUROPE: DISPENSING PHARMACY PACKAGING MACHINE MARKET

-

SHARE, BY COUNTRY, 2020 (% SHARE) 51

-

NORTH AMERICA: DISPENSING PHARMACY

-

PACKAGING MACHINE MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 64

-

ASIA-PACIFIC:

-

DISPENSING PHARMACY PACKAGING MACHINE MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 71

-

BENCHMARKING OF MAJOR COMPETITORS 89

-

MAJOR MANUFACTURER

-

MARKET SHARE ANALYSIS, 2020 (%) 90

-

TAKAZONO CORPORATION: COMPANY

-

INFORMATION 91

-

YUYAMA CO., LTD: COMPANY INFORMATION 93

-

FIGURE

-

TOSHO. CO. INC.: COMPANY INFORMATION 100

-

CANON LIFECARE SOLUTIONS

-

INC.: COMPANY INFORMATION 102

-

JAPAN PHARMACEUTICAL MARKET, 2020–2027

-

(USD BILLION) 112

Leave a Comment