Growing Aging Population

The Global Dispensing Pharmacy Packaging Machine Market Industry is significantly influenced by the growing aging population. As individuals age, the prevalence of chronic diseases increases, leading to a higher demand for prescription medications. This demographic shift necessitates efficient packaging solutions that cater to the unique needs of elderly patients, such as easy-to-open packaging and clear labeling. Consequently, pharmacies are investing in advanced dispensing machines that can accommodate these requirements. The increasing number of elderly patients is likely to drive market growth, as pharmacies seek to provide tailored solutions that enhance medication adherence.

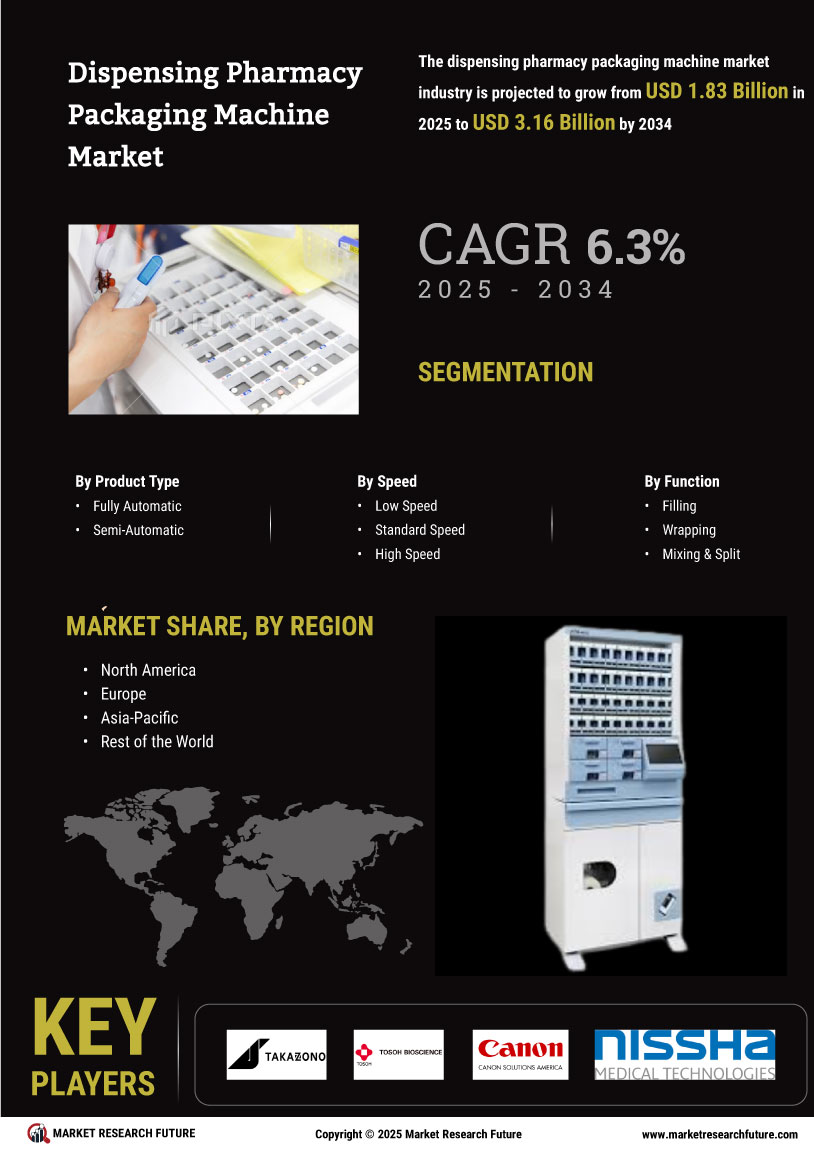

Market Growth Projections

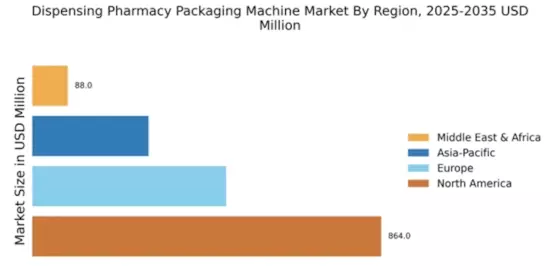

The Global Dispensing Pharmacy Packaging Machine Market Industry is poised for substantial growth, with projections indicating an increase from 1.72 USD Billion in 2024 to 3.36 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 6.27% from 2025 to 2035. Such figures underscore the increasing reliance on automated dispensing solutions within the pharmacy sector, driven by factors such as technological advancements, patient safety concerns, and demographic shifts. The market's expansion reflects the evolving landscape of pharmaceutical packaging, where efficiency and safety are paramount.

Rising Demand for Automation

The Global Dispensing Pharmacy Packaging Machine Market Industry experiences a notable surge in demand for automation solutions. As pharmacies strive to enhance operational efficiency and reduce human error, automated dispensing machines become increasingly essential. This trend is evidenced by the projected market growth from 1.72 USD Billion in 2024 to 3.36 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.27% from 2025 to 2035. Automation not only streamlines the packaging process but also ensures compliance with regulatory standards, thereby fostering a safer environment for medication dispensing.

Increasing Focus on Patient Safety

Patient safety remains a paramount concern within the Global Dispensing Pharmacy Packaging Machine Market Industry. The implementation of advanced packaging technologies, such as tamper-evident and child-resistant packaging, is becoming more prevalent. These innovations are designed to minimize medication errors and enhance the overall safety of pharmaceutical products. As regulatory bodies emphasize stringent safety standards, pharmacies are compelled to invest in sophisticated packaging solutions. This shift not only protects patients but also bolsters the reputation of pharmacies, ultimately driving growth in the market.

Expansion of Retail Pharmacy Chains

The expansion of retail pharmacy chains is a driving force in the Global Dispensing Pharmacy Packaging Machine Market Industry. As these chains proliferate, the demand for efficient and reliable dispensing solutions intensifies. Retail pharmacies are increasingly adopting automated packaging machines to streamline their operations and meet the growing consumer expectations for quick and accurate service. This trend is expected to contribute to the market's growth trajectory, as larger pharmacy chains seek to enhance their competitive edge through improved operational efficiency and customer satisfaction.

Technological Advancements in Packaging

Technological advancements play a crucial role in shaping the Global Dispensing Pharmacy Packaging Machine Market Industry. Innovations such as smart packaging, which incorporates QR codes and RFID technology, facilitate better tracking and management of medications. These technologies enhance inventory control and reduce waste, aligning with the industry's sustainability goals. As pharmacies increasingly adopt these cutting-edge solutions, the market is expected to expand significantly. The integration of technology not only improves operational efficiency but also enhances the customer experience, thereby attracting more consumers to automated dispensing solutions.