Market Analysis

In-depth Analysis of Drug Discovery Services Market Industry Landscape

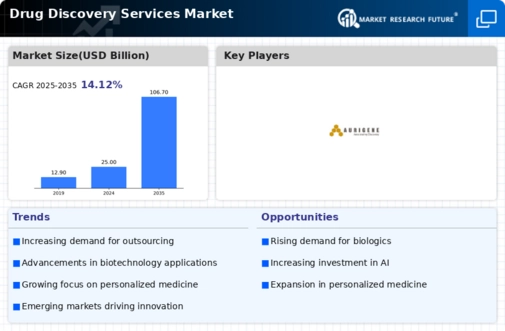

The market dynamics of the drug discovery services sector embody a complex interplay of factors that influence its growth, trends, and evolution. At its core, the drug discovery services market is driven by the increasing demand for innovative therapeutics, propelled by rising incidences of chronic diseases and the pursuit of more effective treatments. Pharmaceutical companies, biotech firms, and research institutions heavily rely on drug discovery services to identify and develop promising drug candidates.One of the primary drivers shaping the market dynamics is the continual advancement in technology and scientific knowledge. Breakthroughs in genomics, proteomics, high-throughput screening, and artificial intelligence have revolutionized the drug discovery process, enabling more efficient target identification, lead optimization, and preclinical testing. Consequently, companies offering cutting-edge technologies and expertise in these areas gain a competitive edge, driving the evolution of the market.

Moreover, the increasing complexity of diseases and the need for personalized medicine drive demand for specialized drug discovery services. Tailored approaches, such as precision medicine and biomarker discovery, require sophisticated platforms and expertise, fostering collaborations between pharmaceutical companies and service providers. This trend not only expands the scope of drug discovery services but also fosters innovation and differentiation among market players.

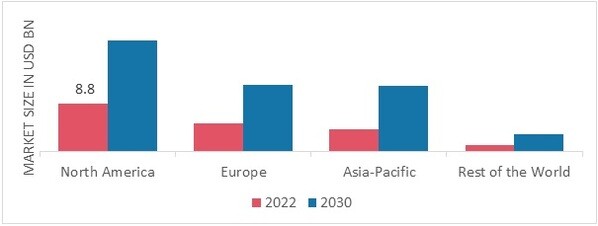

Furthermore, globalization and the outsourcing trend have reshaped the landscape of drug discovery services. Pharmaceutical companies seek to leverage cost efficiencies, access specialized expertise, and accelerate the drug development process by outsourcing various stages of drug discovery. As a result, contract research organizations (CROs) and academic research centers play a pivotal role in providing end-to-end services, ranging from target validation to IND-enabling studies. This outsourcing trend fosters a highly competitive market environment, characterized by consolidation, strategic partnerships, and geographic expansion.

However, the drug discovery services market is not without its challenges and uncertainties. Regulatory complexities, intellectual property issues, and stringent quality standards pose significant hurdles for market players. Moreover, the inherent risks associated with drug development, including high failure rates and lengthy development timelines, necessitate substantial investments in R&D and infrastructure. Market participants must navigate these challenges while remaining agile and adaptive to changing market dynamics.

In addition, the COVID-19 pandemic has exerted profound impacts on the drug discovery services market. The urgent need for therapeutics and vaccines has accelerated research and development efforts, driving demand for contract research services and innovative technologies. Virtual collaborations, remote monitoring, and digital platforms have become essential tools for conducting research amidst lockdowns and travel restrictions. While the pandemic has presented challenges, it has also catalyzed innovation and collaboration within the drug discovery ecosystem.

Looking ahead, the drug discovery services market is poised for robust growth, fueled by increasing investments in biopharmaceutical R&D, technological advancements, and the pursuit of novel therapies. Emerging trends such as gene editing, RNA therapeutics, and cell-based therapies hold immense promise for transforming drug discovery and addressing unmet medical needs. Market players must remain attuned to these trends, capitalize on emerging opportunities, and prioritize agility and innovation to thrive in an ever-evolving landscape.

Leave a Comment