-

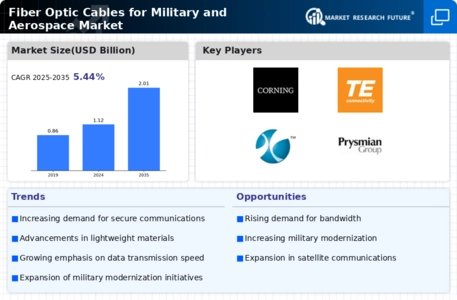

Executive Summary

-

1.1.

-

Market Attractiveness Analysis

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by Type

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by Application

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by End Use

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by Region

-

Market Introduction

-

Market Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Market Factor Indicator Analysis

-

Research Methodology

-

Research

-

Process

-

Primary Research

-

Secondary Research

-

Market

-

Size Estimation

-

Forecast Model

-

List of Assumptions

-

Market

-

Insights

-

Market Dynamics

-

Introduction

-

Drivers

- Increase in need for

- Rising focus of authorities on replacement of existing

- Drivers Impact Analysis

-

5.2.1.

-

Increasing demand for throughput and reliability

-

lightweight systems

-

old cables

-

Restraints

- Issues related

- Stringent regulatory norms

- Restraints Impact Analysis

-

5.3.1.

-

Complex maintenance and installation of fiber optic cables

-

to physical damage and transmission loss

-

Opportunities

-

Market/Technological

-

Trends

-

Patent Trends

-

Regulatory Landscape/Standards

-

6.

-

Market Factor Analysis

-

Supply Chain Analysis

- R&D

- Distribution & Sales

- Post-Sales Monitoring

-

6.1.2.

-

Manufacturing

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of Rivalry

-

Global Fiber

-

Optic Cables for Military and Aerospace Market, by Type

-

Introduction

-

Single-mode

-

Multi-mode

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by Application

-

Introduction

-

Avionics

-

Cabin Interiors

-

Communication Systems

-

Electronic Warfare

-

Flight Management Systems

-

In-Flight Entertainment (IFE) Systems

-

Radar Systems

-

Others

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by End Use

-

Introduction

-

Commercial

-

Military

-

Space

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by Region

-

Introduction

-

North America

- US

- Canada

-

Europe

- UK

- France

- Italy

- Russia

-

10.3.2.

-

Germany

-

10.3.6.

-

Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Middle East & Africa

-

10.5.

-

Rest of the World

-

Competitive Landscape

-

Competitive Overview

-

Competitor

-

Dashboard

-

Major Growth Strategies in the Global Fiber Optic Cables for

-

Military and Aerospace Market

-

Competitive Benchmarking

-

Market

-

Share Analysis

-

Leading Player in Terms of Number of Developments in the

-

Global Fiber Optic Cables for Military and Aerospace Market

-

Key Developments

- Product Launches/Service Deployments

- Joint Ventures

-

& Growth Strategies

-

11.7.2.

-

Mergers & Acquisitions

-

Company Profiles

-

Key Market Players

-

(Company overview, products & services offered,

-

financial overview, key developments, SWOT analysis, and key strategies to be covered

-

for public companies)

-

Amphenol Corporation

-

Raytheon Technologies

-

Corporation

-

Carlisle Interconnect Technologies

-

Corning Incorporated

-

Finisar Corporation

-

W. L. Gore & Associates, Inc.

-

12.8.

-

OFS Fitel, LLC

-

AFL

-

Optical Cable Corporation

-

12.11.

-

TE Connectivity

-

Radiall

-

Prysmian Group

-

Timbercon,

-

Inc.

-

Appendix

-

References

-

Related Reports

-

13.3.

-

List of Abbreviations

-

-

List of Tables

-

List of Assumptions

-

Major Patents Granted for Fiber Optic Cables Market for Military and Aerospace

-

(2020–2030)

-

Global Fiber Optic Cables for Military and Aerospace

-

Market, by Type, 2020–2030 (USD Million)

-

Global Fiber Optic Cables

-

for Military and Aerospace Market, by Application, 2020–2030(USD Million)

-

Global Fiber Optic Cables for Military and Aerospace Market, By End Use,

-

Global Fiber Optic Cables for Military

-

and Aerospace Market, by Region, 2020–2030 (USD Million)

-

North

-

America: Fiber Optic Cables for Military and Aerospace Market, by Country, 2020–2030(USD

-

Million)

-

North America: Fiber Optic Cables for Military and Aerospace

-

Market, by Type, 2020–2030 (USD Million)

-

North America: Fiber

-

Optic Cables for Military and Aerospace Market, by Application, 2020–2030

-

(USD Million)

-

North America: Fiber Optic Cables for Military and Aerospace

-

Market, By End Use, 2020–2030 (USD Million)

-

US: Fiber Optic

-

Cables for Military and Aerospace Market, by Type, 2020–2030 (USD Million)

-

US: Fiber Optic Cables for Military and Aerospace Market, by Application,

-

US: Fiber Optic Cables for Military

-

and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

Canada:

-

Fiber Optic Cables for Military and Aerospace Market, by Type, 2020–2030 (USD

-

Million)

-

Canada: Fiber Optic Cables for Military and Aerospace Market,

-

by Application, 2020–2030 (USD Million)

-

Canada: Fiber Optic

-

Cables for Military and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

Europe: Fiber Optic Cables for Military and Aerospace Market, by Country,

-

Europe: Fiber Optic Cables for Military

-

and Aerospace Market, by Type, 2020–2030 (USD Million)

-

Europe:

-

Fiber Optic Cables for Military and Aerospace Market, by Application, 2020–2030

-

(USD Million)

-

Europe: Fiber Optic Cables for Military and Aerospace

-

Market, by End Use, 2020–2030 (USD Million)

-

UK: Fiber Optic

-

Cables for Military and Aerospace Market, by Type, 2020–2030 (USD Million)

-

UK: Fiber Optic Cables for Military and Aerospace Market, by Application,

-

UK: Fiber Optic Cables for Military

-

and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

Germany:

-

Fiber Optic Cables for Military and Aerospace Market, by Type, 2020–2030 (USD

-

Million)

-

Germany: Fiber Optic Cables for Military and Aerospace Market,

-

by Application, 2020–2030 (USD Million)

-

Germany: Fiber Optic

-

Cables for Military and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

France: Fiber Optic Cables for Military and Aerospace Market, by Type,

-

France: Fiber Optic Cables for Military

-

and Aerospace Market, by Application, 2020–2030 (USD Million)

-

TABLE 29

-

France: Fiber Optic Cables for Military and Aerospace Market, by End Use, 2020–2030

-

(USD Million)

-

Italy: Fiber Optic Cables for Military and Aerospace

-

Market, by Type, 2020–2030 (USD Million)

-

Italy: Fiber Optic

-

Cables for Military and Aerospace Market, by Application, 2020–2030 (USD Million)

-

Italy: Fiber Optic Cables for Military and Aerospace Market, by End Use,

-

Russia: Fiber Optic Cables for Military

-

and Aerospace Market, by Type, 2020–2030 (USD Million)

-

Russia:

-

Fiber Optic Cables for Military and Aerospace Market, by Application, 2020–2030

-

(USD Million)

-

Russia: Fiber Optic Cables for Military and Aerospace

-

Market, by End Use, 2020–2030 (USD Million)

-

Rest of Europe:

-

Fiber Optic Cables for Military and Aerospace Market, by Type, 2020–2030 (USD

-

Million)

-

Rest of Europe: Fiber Optic Cables for Military and Aerospace

-

Market, by Application, 2020–2030 (USD Million)

-

Rest of Europe:

-

Fiber Optic Cables for Military and Aerospace Market, by End Use, 2020–2030

-

(USD Million)

-

Asia-Pacific: Fiber Optic Cables for Military and Aerospace

-

Market, by Country, 2020–2030 (USD Million)

-

Asia-Pacific: Fiber

-

Optic Cables for Military and Aerospace Market, by Type, 2020–2030 (USD Million)

-

Asia-Pacific: Fiber Optic Cables for Military and Aerospace Market, by

-

Application, 2020–2030 (USD Million)

-

Asia-Pacific: Fiber Optic

-

Cables for Military and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

China: Fiber Optic Cables for Military and Aerospace Market, by Type,

-

China: Fiber Optic Cables for Military

-

and Aerospace Market, by Application, 2020–2030 (USD Million)

-

TABLE 45

-

China: Fiber Optic Cables for Military and Aerospace Market, by End Use, 2020–2030

-

(USD Million)

-

India: Fiber Optic Cables for Military and Aerospace

-

Market, by Type, 2020–2030 (USD Million)

-

India: Fiber Optic

-

Cables for Military and Aerospace Market, by Application, 2020–2030 (USD Million)

-

India: Fiber Optic Cables for Military and Aerospace Market, by End Use,

-

Japan: Fiber Optic Cables for Military

-

and Aerospace Market, by Type, 2020–2030 (USD Million)

-

Japan:

-

Fiber Optic Cables for Military and Aerospace Market, by Application, 2020–2030

-

(USD Million)

-

Japan: Fiber Optic Cables for Military and Aerospace

-

Market, by End Use, 2020–2030 (USD Million)

-

South Korea: Fiber

-

Optic Cables for Military and Aerospace Market, by Type, 2020–2030 (USD Million)

-

South Korea: Fiber Optic Cables for Military and Aerospace Market, by

-

Application, 2020–2030 (USD Million)

-

South Korea: Fiber Optic

-

Cables for Military and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

Rest of Asia-Pacific: Fiber Optic Cables for Military and Aerospace Market,

-

by Type, 2020–2030 (USD Million)

-

Rest of Asia-Pacific: Fiber

-

Optic Cables for Military and Aerospace Market, by Application, 2020–2030

-

(USD Million)

-

Rest of Asia-Pacific: Fiber Optic Cables for Military

-

and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

Rest

-

of the World: Fiber Optic Cables for Military and Aerospace Market, by Region, 2020–2030

-

(USD Million)

-

Rest of the World: Fiber Optic Cables for Military and

-

Aerospace Market, by Type, 2020–2030 (USD Million)

-

Rest of the

-

World: Fiber Optic Cables for Military and Aerospace Market, by Application, 2020–2030

-

(USD Million)

-

Rest of the World: Fiber Optic Cables for Military and

-

Aerospace Market, by End Use, 2020–2030 (USD Million)

-

Latin

-

America: Fiber Optic Cables for Military and Aerospace Market, by Type, 2020–2030

-

(USD Million)

-

Latin America: Fiber Optic Cables for Military and Aerospace

-

Market, by Application, 2020–2030 (USD Million)

-

Latin America:

-

Fiber Optic Cables for Military and Aerospace Market, by End Use, 2020–2030

-

(USD Million)

-

Middle East & Africa: Fiber Optic Cables for Military

-

and Aerospace Market, by Type, 2020–2030 (USD Million)

-

Middle

-

East & Africa: Fiber Optic Cables for Military and Aerospace Market, by Application,

-

Middle East & Africa: Fiber Optic

-

Cables for Military and Aerospace Market, by End Use, 2020–2030 (USD Million)

-

The Most Active Players in the Global Fiber Optic Cables for Military

-

and Aerospace Market

-

Contracts & Agreements

-

Mergers

-

& Acquisitions

-

Product/Service Developments

-

Expansions

-

& Investments

-

Joint Ventures & Partnerships

-

-

List of Figures

-

Market Synopsis

-

Global Fiber Optic

-

Cables for Military and Aerospace Market: Market Attractiveness Analysis

-

Figure

-

Global Fiber Optic Cables for Military and Aerospace Market Analysis, by Type

-

Global Fiber Optic Cables for Military and Aerospace Market Analysis,

-

by Application

-

Global Fiber Optic Cables for Military and Aerospace

-

Market Analysis, by End Use

-

Global Fiber Optic Cables for Military

-

and Aerospace Market Analysis, by Region

-

Global Fiber Optic Cables

-

for Military and Aerospace Market: Market Structure

-

Key Buying Criteria

-

for Fiber Optic Cables Market for Military and Aerospace Technologies

-

Figure

-

Research Process of MRFR

-

North America: Market Size & Market

-

Share, by Country, 2020 vs 2030

-

Europe: Market Size & Market

-

Share, by Country, 2020 vs 2030

-

Asia-Pacific: Market Size & Market

-

Share, by Country, 2020 vs 2030

-

Rest of the World: Market Size &

-

Market Share, by Region, 2020 vs 2030

-

Market Dynamics Overview

-

Drivers Impact Analysis: Global Fiber Optic Cables for Military and

-

Aerospace Market

-

Restraints Impact Analysis: Global Fiber Optic Cables

-

for Military and Aerospace Market

-

Porter’s Five Forces Analysis

-

of the Global Fiber Optic Cables for Military and Aerospace Market

-

Figure 18

-

Supply Chain: Global Fiber Optic Cables for Military and Aerospace Market

-

Figure

-

Global Fiber Optic Cables for Military and Aerospace Market Share, by Type, 2020

-

(% Share)

-

Global Fiber Optic Cables for Military and Aerospace Market

-

Share, by Application, 2020 (% Share)

-

Global Fiber Optic Cables for

-

Military and Aerospace Market Share, by End Use, 2020 (% Share)

-

Global

-

Fiber Optic Cables for Military and Aerospace Market Share, by Region, 2020 (% Share)

-

North America: Fiber Optic Cables for Military and Aerospace Market

-

Share, by Country, 2020 (% Share)

-

Europe: Fiber Optic Cables for

-

Military and Aerospace Market Share, by Country, 2020 (% Share)

-

Asia-Pacific:

-

Fiber Optic Cables for Military and Aerospace Market Share, by Country, 2020 (%

-

Share)

-

Rest of the World: Fiber Optic Cables for Military and Aerospace

-

Market Share, by Region, 2020 (% Share)

-

Competitor Dashboard: Global

-

Fiber Optic Cables for Military and Aerospace Market

-

Capital Market

-

Ratio and Financial Matrix

-

Contracts & Agreements: The Major

-

Strategy Adopted by Key Players in the Global Fiber Optic Cables for Military and

-

Aerospace Market

-

Benchmarking of Major Competitors

-

Figure 31

-

Major Service Providers Market Share Analysis, 2020

Leave a Comment