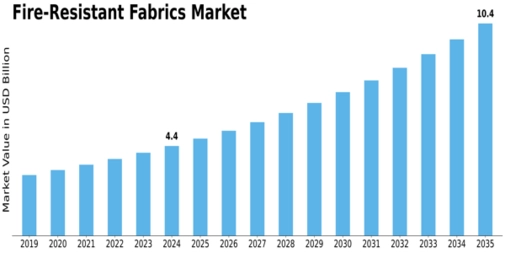

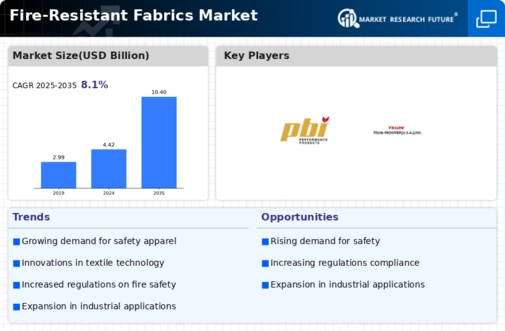

Fire Resistant Fabrics Size

Fire Resistant Fabrics Market Growth Projections and Opportunities

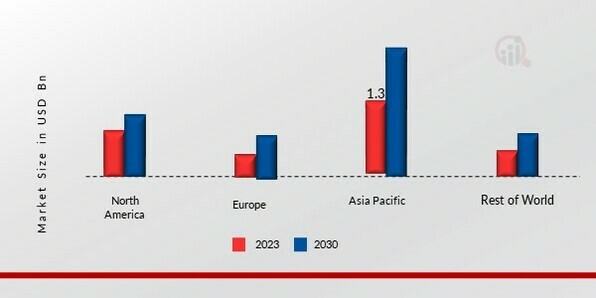

The market for fire-resistant fabrics is influenced by several key factors that shape its growth and development. One significant factor is government regulations and safety standards. As governments around the world continue to prioritize workplace safety and fire prevention, there is an increasing demand for fabrics that can withstand high temperatures and resist flames. These regulations often require specific performance standards for fabrics used in industries such as construction, oil and gas, and firefighting, driving the need for fire-resistant textiles.

Fire-resistant fabrics are textiles that have been engineered to outperform conventional materials in terms of fire resistance, either through the use of fireproof fibers or chemical treatment.

Another important market factor is the growth of industries that require fire-resistant fabrics. Industries such as automotive, aerospace, and military rely heavily on these textiles to ensure the safety of their products and personnel. As these industries expand and innovate, the demand for advanced fire-resistant fabrics continues to rise. Additionally, the increasing awareness of safety among consumers has led to a growing demand for fire-resistant clothing and home furnishings, further driving market growth.

Technological advancements also play a significant role in the fire-resistant fabrics market. As research and development efforts continue to improve the performance and durability of these textiles, manufacturers can offer innovative solutions that meet the evolving needs of various industries. Advanced materials and manufacturing processes enable the production of fabrics that are not only fire-resistant but also lightweight, breathable, and comfortable to wear, expanding their applications across different sectors.

Market dynamics such as supply and demand, pricing trends, and competitive landscape also influence the fire-resistant fabrics market. As demand for these textiles increases, manufacturers must ramp up production to meet the needs of their customers. This can lead to fluctuations in supply and pricing, particularly for raw materials and specialized equipment used in fabric production. Additionally, competition among manufacturers drives innovation and product development, as companies strive to differentiate themselves in the market and gain a competitive edge.

Environmental factors are also becoming increasingly important in the fire-resistant fabrics market. As concerns about climate change and sustainability grow, there is a growing demand for eco-friendly and recyclable materials. Manufacturers are responding to this demand by developing fire-resistant fabrics made from renewable sources or recycled materials, as well as implementing sustainable production practices to reduce their environmental impact. This shift towards sustainability is not only driven by consumer preferences but also by regulatory requirements and corporate social responsibility initiatives.

Global economic conditions and geopolitical factors can also impact the fire-resistant fabrics market. Economic downturns or geopolitical tensions can disrupt supply chains, affect consumer spending, and lead to fluctuations in demand for fire-resistant textiles. Additionally, trade policies and tariffs can impact the cost of raw materials and finished products, influencing pricing and market dynamics.

Leave a Comment