Market Trends

Key Emerging Trends in the Fire Resistant Fabrics Market

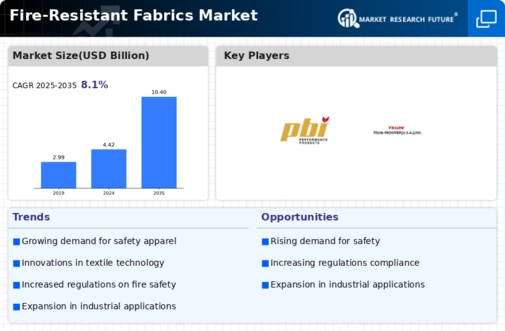

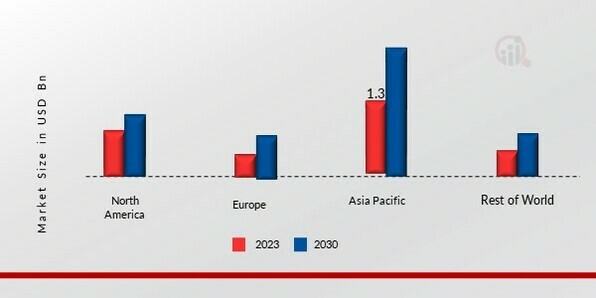

The market for fire-resistant fabrics has experienced significant growth in recent years due to increasing awareness about safety measures in various industries such as construction, automotive, and oil & gas. Fire-resistant fabrics are designed to withstand high temperatures and prevent the spread of flames, making them essential for protecting workers and assets in hazardous environments. One of the key market trends driving this growth is the stringent safety regulations imposed by governments and regulatory bodies, which require the use of fire-resistant materials in certain applications. These regulations have prompted companies to invest in fire-resistant fabrics to ensure compliance and minimize the risk of accidents.

The industry's growth is primarily driven by increased passenger traffic as a result of increased consumer spending power and improved air connectivity. This increased passenger traffic is also fueling a solid demand for additional planes.

Another important market trend is the growing demand for fire-resistant fabrics in the construction industry, particularly in high-rise buildings and infrastructure projects. As urbanization continues to expand, there is a greater need for fire-resistant materials to enhance the safety of buildings and protect occupants in the event of a fire. This has led to increased adoption of fire-resistant fabrics in construction applications such as curtains, partitions, and wall coverings.

Moreover, advancements in technology have also played a significant role in driving market growth. Manufacturers are constantly innovating to develop new and improved fire-resistant fabrics that offer better performance and durability. For example, the use of advanced fibers and coatings has enabled the development of fabrics that are not only fire-resistant but also lightweight, breathable, and comfortable to wear. These technological advancements have expanded the potential applications of fire-resistant fabrics across various industries, further fueling market growth.

Additionally, the rising awareness about the importance of workplace safety has contributed to the increased demand for fire-resistant fabrics in industrial settings. Companies are increasingly investing in safety equipment and protective clothing to minimize the risk of accidents and ensure the well-being of their employees. Fire-resistant fabrics play a crucial role in this regard, offering protection against thermal hazards and reducing the likelihood of injuries in the workplace.

Furthermore, the growing focus on sustainability and environmental conservation has led to a shift towards eco-friendly fire-resistant fabrics. Manufacturers are increasingly using sustainable materials and production processes to minimize their environmental impact and meet the growing demand for eco-friendly products. This trend is driven by consumer preferences for environmentally responsible products as well as regulatory requirements aimed at reducing carbon emissions and promoting sustainability.

Leave a Comment