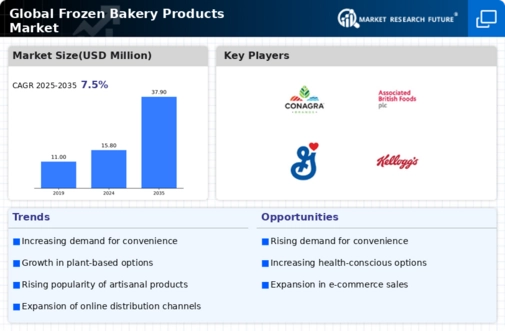

Market Share

Frozen Bakery Products Market Share Analysis

Businesses employ a variety of tactics in the ever-evolving and growing frozen bakery products industry to solidify and enhance their market share standing. One popular tactic is isolation, in which businesses focus on providing distinctive and superior firmed baked items to differentiate themselves in a crowded market. This might be developing unique details, like organic or gluten-free Frozen bakery products, or launching great and inventive flavor histories. By providing unique items, businesses hope to draw in customers looking for affordable and high-end frozen bakery choices. Another crucial tactic in the frozen bakery products market is cost leadership. Businesses work hard to become product leaders by offering competitive prices through scale economies and efficient production techniques. Firmed bakery items are consumed widely and consistently, thus offering a low price becomes crucial to drawing in budget-conscious customers as well as companies looking to outsource their work and take a sizable portion of the market. The market for frozen bakery products is still driven by innovation, as businesses are continuously experimenting with new product names, packaging concepts, and technological advancements. This may entail creating single-serve packaging that is easily accessible, launching Frozen bakery products with longer shelf lives, or investigating novel baking techniques that preserve flavor and freshness. To position themselves as leaders in a dynamic industry and satisfy the changing needs of foodservice providers and customers, businesses must remain at the forefront of invention. One of the most important components of market share positioning strategies for the frozen bakery products industry is market segmentation. Businesses usually target certain customer segments based on criteria such as aesthetic preferences, practical needs, or health preferences. For example, a business may focus on offering a variety of frozen afters that are ideal for hurried breakfasts to customers with busy schedules, or it might provide ethnic varieties to cater to a range of gastronomic tastes. By using a focused strategy, businesses may meet the various needs of customers and foodservice patrons and gain market share in specialized markets. Collaborations and strategic partnerships are essential in the frozen bakery products market. To improve their brand awareness and distribution channels, businesses might partner with feeding services, retail chains, or hospices. Through cooperative collaboration, these linkages not only increase market share growth through speeding the accessibility of Frozen bakery products but also create opportunities for joint marketing endeavors. In the ultramodern geographic context, the importance of digital marketing and e-commerce techniques for positioning market share has decreased. Businesses spend money building a solid online presence and using digital channels to promote their goods, interact with customers, and process online orders. Digital marketing has a significant influence on capturing perceptions and gaining market share during a time when online buying is popular. Following nonsupervisory guidelines and having the necessary tools on hand are essential factors in the frozen bakery products market. Due to the importance of food safety and quality in bakery goods, customers and foodservice providers give suppliers that violate strict standards priority. Businesses that exhibit a dedication to quality assurance and nonsupervisory compliance establish themselves as safe and trustworthy partners, which positively affects their market share. A smart tactic to educate customers and companies about the advantages and applications of Frozen bakery products is consumer education. Businesses spend money producing instructional materials that emphasize the quality, ease, and adaptability of their firmed immolations. Knowledgeable customers and foodservice patrons are more likely to recognize the benefits of Frozen bakery products and create well-informed judgments, which helps a business increase its market share.

Leave a Comment