Market Analysis

In-depth Analysis of Frozen Bakery Products Market Industry Landscape

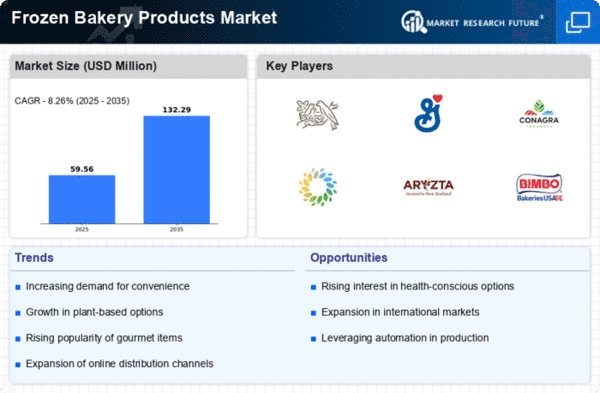

In the recent years, the demand for Frozen bakery products is changing dynamically due to a variety of significant factors that reflect evolving consumer cultures, convenience preferences, and developments in food technology. A major factor influencing this requirement is the growing need for easily available and readily consumable bakery information. The availability and time-saving convenience of Frozen bakery products appeal to consumers with busy schedules. The demand for Frozen bakery products has grown significantly as a result of the capacity to preserve these goods for a long time and singe them fresh whenever it is convenient. Market dynamics are significantly shaped by shifting consumer cultures, especially in public spaces. Urbanization sometimes results in hectic schedules that leave customers with less time for preparing traditional foods. A solution to this time issue is provided by Frozen bakery products, which enable individuals to savor the flavor of just ignited items without resorting to extensive medicine. The demand for Frozen bakery products is fueled in part by this intransigence to ultramodern civilizations. The influence of many culinary traditions and the globalization of food tastes both contribute to the inventiveness of flavor found in the market. To accommodate a range of taste preferences, manufacturers are always creating new and varied frozen bakery product alternatives. The range of taste selections, which includes traditional croissants and pastries as well as other wonderful options like matcha-seasoned afters, is crucial for drawing customers and broadening the industry. This ongoing innovation supports the market's expansion by matching the changing dairy preferences of customers. The development of freezing and food processing technology has also had a significant impact on market dynamics. The quality, texture, and flavor of firmed baked goods are maintained throughout the freezing and thawing procedures thanks to the application of modern freezing techniques. This technical innovation improves the total customer experience and propels the market for Frozen bakery products. It targets businesses associated with the novelty and caliber of baked goods. In the market for Frozen bakery products, e-commerce and online platforms have a noticeable impact on distribution and marketing tactics. Online shopping has become a crucial means of connecting with customers, offering a convenient means of perusing and purchasing an extensive range of Frozen bakery products. Online resources provide effortless brand comparison, review reading, and access to a wide choice of possibilities, all of which have an influence on opinions. In this quickly changing geographic landscape, manufacturers need to proactively use digital marketing to improve their online presence, interact with customers, and maintain their competitiveness. The Frozen bakery products industry is heavily influenced by regulatory factors, especially those pertaining to food safety regulations and labeling. Manufacturers must abide by these rules in order to guarantee consumer trust, product safety, and transparency. Following these standards becomes essential for success in the market as consumer awareness of food safety and labeling rises. The competitive geography makes the dynamics of the frozen bakery product industry more complicated. Numerous businesses compete for market share, ranging from large-scale fake bakeries to specialized food directors. These businesses use innovation, product differentiation, and strategic alliances as key tactics to obtain a competitive advantage. Strong marketing campaigns that highlight the quality, variety, and ease of use of Frozen bakery products help brands stand out in a congested market. The juggernauts of consumer education and mindfulness have a significant influence on market dynamics. Customers are more inclined to include Frozen bakery products into their shopping routines as they become more aware of their advantages, which include convenience, variety, and quality. Producers spend money teaching customers about how to properly store, use, and taste Frozen bakery products, which improves consumer comprehension and encourages consumers to give them up for other culinary ideologies.

Leave a Comment