Market Growth Projections

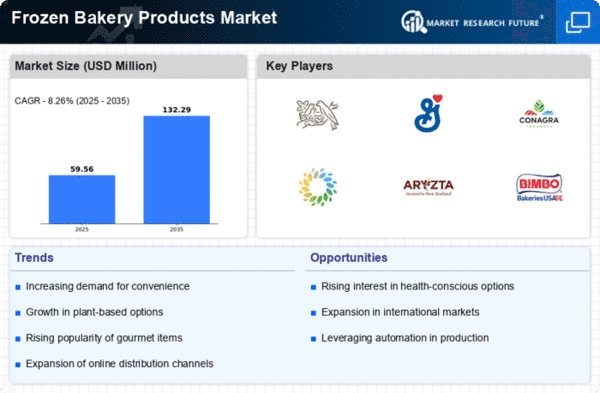

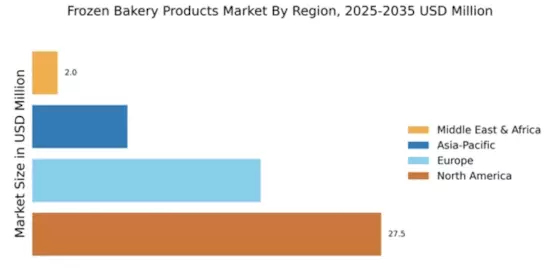

The Global Frozen Bakery Products Industry is projected to experience robust growth in the coming years. With a market value of 15.8 USD Billion in 2024, it is expected to expand significantly, reaching 37.9 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.26% from 2025 to 2035. Such projections indicate a strong market potential, driven by various factors including consumer preferences for convenience, health-conscious choices, and technological advancements in production. The Global Frozen Bakery Products Industry is likely to witness increased investment and innovation as it adapts to these evolving market dynamics.

Expansion of Retail Channels

The Global Frozen Bakery Products Industry benefits from the expansion of retail channels, including supermarkets, hypermarkets, and online platforms. The proliferation of these channels enhances product accessibility, allowing consumers to easily purchase frozen bakery items. In recent years, the rise of e-commerce has transformed shopping habits, with online grocery sales gaining traction. This shift is expected to contribute to the market's growth, as consumers increasingly prefer the convenience of online shopping. The Global Frozen Bakery Products Industry is likely to see a significant boost in sales as retailers expand their frozen food sections and offer a wider variety of products.

Rising Demand for Convenience Foods

The Global Frozen Bakery Products Industry experiences a notable surge in demand for convenience foods, driven by changing consumer lifestyles. As individuals seek quick meal solutions, frozen bakery products offer an appealing option. The market is projected to reach 15.8 USD Billion in 2024, reflecting a growing preference for ready-to-eat items. This trend is particularly evident in urban areas where busy schedules limit cooking time. Moreover, the convenience factor aligns with the increasing number of working professionals, further propelling market growth. The Global Frozen Bakery Products Industry is thus well-positioned to capitalize on this demand for convenience.

Technological Advancements in Production

Technological advancements in production processes are enhancing the efficiency and quality of frozen bakery products, positively impacting the Global Frozen Bakery Products Industry. Innovations such as automated baking systems and improved freezing techniques contribute to better product consistency and extended shelf life. These advancements not only streamline production but also reduce operational costs, allowing manufacturers to offer competitive pricing. As the industry embraces these technologies, it is likely to attract a broader consumer base. The Global Frozen Bakery Products Industry stands to benefit from these developments, which may lead to increased market penetration and growth.

Growing Global Population and Urbanization

The Global Frozen Bakery Products Industry is influenced by the growing global population and urbanization trends. As more individuals migrate to urban areas, the demand for convenient food options rises. Urban consumers often have busier lifestyles, leading to a preference for quick meal solutions such as frozen bakery products. This demographic shift is expected to drive market growth, with an anticipated compound annual growth rate of 8.26% from 2025 to 2035. The Global Frozen Bakery Products Industry is thus poised to capitalize on the increasing urban population, which is likely to sustain demand for frozen bakery items.

Health Consciousness and Product Innovation

The Global Frozen Bakery Products Industry is witnessing a shift towards healthier options, driven by rising health consciousness among consumers. Manufacturers are innovating by introducing products that cater to dietary preferences, such as gluten-free, organic, and low-calorie options. This trend aligns with the increasing awareness of nutrition and wellness, prompting consumers to seek healthier alternatives. As a result, the market is expected to grow significantly, with projections indicating a rise to 37.9 USD Billion by 2035. The Global Frozen Bakery Products Industry is thus adapting to these changing consumer preferences, ensuring a diverse range of offerings that meet health demands.