-

Executive Summary

-

Scope of the Report

-

2.1

-

Market Definition

-

Scope of the

- Research Objectives

- Assumptions & Limitations

-

Study

-

Markets Structure

-

3

-

Market Research Methodology

-

Research

-

Process

-

Primary Research

-

Secondary Research

-

3.4

-

Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- Application

- Bargaining

- Bargaining Power

- Threat of Substitutes

- Intensity of Competitive Rivalry

-

Material Suppliers

-

Merchants

-

4.2

-

Porter’s Five Forces Analysis

-

4.2.1

-

Threat of New Entrants

-

Power of Buyers

-

of Suppliers

-

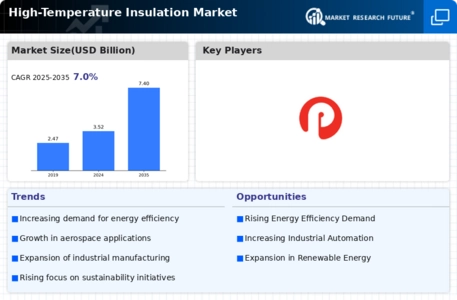

Industry Overview of the Global High Temperature

-

Insulation Market

-

Introduction

-

Drivers

-

5.3

-

Restraints

-

Opportunities

-

Challenges

-

Market Trends

-

Introduction

-

6.2

-

Growth Trends

-

Impact Analysis

-

Global High Temperature Insulation Market, by Product

-

Introduction

-

Insulating Firebrick

- Market Estimates & Forecast, 2023-2032

- Market Estimates

-

& Forecast, by Region, 2023-2032

-

Ceramic

- Market Estimates & Forecast, 2023-2032

- Market Estimates

-

Fiber

-

& Forecast, by Region, 2023-2032

-

Calcium

- Market Estimates & Forecast, 2023-2032

- Market

- Market Estimates & Forecast, 2023-2032

- Market

-

Silicate

-

Estimates & Forecast, by Region, 2023-2032

-

7.5.

-

Others

-

Estimates & Forecast, by Region, 2023-2032

-

Global

-

High Temperature Insulation Market, by Application

-

Introduction

-

Petrochemicals

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2023-2032

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2023-2032

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2023-2032

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast, by Region, 2023-2032

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast, by Region, 2023-2032

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast, by Region, 2023-2032

- Market Estimates & Forecast, 2023-2032

- Market Estimates & Forecast, by Region, 2023-2032

-

8.3

-

Refractory

-

8.4

-

Iron & Steel

-

8.5

-

Cement

-

8.6

-

Aluminum

-

8.7

-

Glass

-

8.8

-

Others

-

9.

-

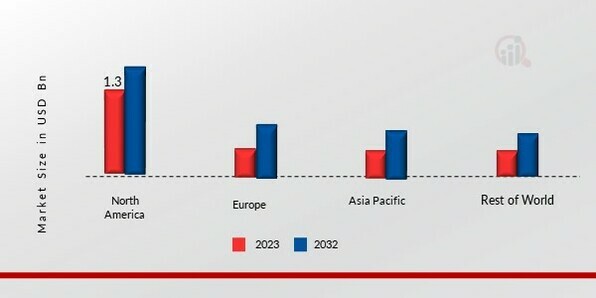

Global High Temperature Insulation Market, by Region

-

9.1

-

Introduction

-

North America

- Market Estimates

- Market Estimates & Forecast by Product

- Market Estimates & Forecast by Application, 2023-2032

- US

- Canada

-

& Forecast, 2023-2032

-

, 2023-2032

-

Estimates & Forecast by Application, 2023-2032

-

& Forecast by Product , 2023-2032

-

by Application, 2023-2032

-

Europe

- Market

- Market

- Germany

- France

- Italy

- UK

- Russia

- Netherlands

-

9.3.1

-

Market Estimates & Forecast, 2023-2032

-

Estimates & Forecast by Product , 2023-2032

-

Estimates & Forecast by Application, 2023-2032

-

& Forecast by Product , 2023-2032

-

by Application, 2023-2032

-

Estimates & Forecast, 2023-2032

-

by Product , 2023-2032

-

Forecast, 2023-2032

-

9.3.9

-

Spain

-

9.3.9.2

-

Market Estimates & Forecast by Product , 2023-2032

-

& Forecast by Application, 2023-2032

-

9.3.10.1

-

Market Estimates & Forecast, 2023-2032

-

Forecast by Product , 2023-2032

-

Application, 2023-2032

-

& Forecast, 2023-2032

-

, 2023-2032

-

9.3.13

-

Rest of Europe

-

9.3.13.2

-

Market Estimates & Forecast by Product , 2023-2032

-

& Forecast by Application, 2023-2032

-

Asia-Pacific

- Market Estimates & Forecast, 2023-2032

- China

- Japan

- Australia

- South Korea

- Rest of Asia-Pacific

-

9.4.2

-

Market Estimates & Forecast by Product , 2023-2032

-

9.4.5

-

Market Estimates & Forecast by Application, 2023-2032

-

Estimates & Forecast by Application, 2023-2032

-

9.4.7

-

India

-

9.4.7.2

-

Market Estimates & Forecast by Product , 2023-2032

-

& Forecast by Application, 2023-2032

-

9.4.8.1

-

Market Estimates & Forecast, 2023-2032

-

by Product , 2023-2032

-

Forecast, 2023-2032

-

9.4.10

-

Malaysia

-

9.4.10.2

-

Market Estimates & Forecast by Product , 2023-2032

-

9.4.10.5Market Estimates

-

& Forecast by Application, 2023-2032

-

& Forecast by Product , 2023-2032

-

by Application, 2023-2032

-

& Forecast by Product , 2023-2032

-

9.4.12.5Market Estimates & Forecast

-

by Application, 2023-2032

-

Middle East & Africa

- Market Estimates & Forecast, 2023-2032

- Saudi Arabia

- Africa

- Rest of the Middle East

-

9.5.2

-

Market Estimates & Forecast by Product , 2023-2032

-

9.5.5

-

Market Estimates & Forecast by Application, 2023-2032

-

9.5.7

-

UAE

-

Estimates & Forecast by Product , 2023-2032

-

Forecast by Application, 2023-2032

-

& Forecast by Product , 2023-2032

-

9.5.8.5Market Estimates & Forecast

-

by Application, 2023-2032

-

& Africa

-

9.5.9.2

-

Market Estimates & Forecast by Product , 2023-2032

-

& Forecast by Application, 2023-2032

-

Latin America

- Market Estimates & Forecast, 2023-2032

- Market Estimates &

- Market Estimates & Forecast by Application,

- Brazil

- Argentina

- Rest of Latin

-

Forecast by Product , 2023-2032

-

& Forecast, 2023-2032

-

, 2023-2032

-

9.6.6

-

Mexico

-

9.6.6.2

-

Market Estimates & Forecast by Product , 2023-2032

-

& Forecast by Application, 2023-2032

-

America

-

9.6.7.2

-

Market Estimates & Forecast by Product , 2023-2032

-

& Forecast by Application, 2023-2032

-

Competitive

-

Landscape

-

Introduction

-

10.2

-

Market Key Strategies

-

Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

Company Profiles

-

3M Company

- Company

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

11.1.3

-

Product/Business Segment Overview

-

Dyson Group

- Company Overview

- Financial Updates

- Product/Business

- Key Developments

- Key Strategies

- Company Overview

- Financial Updates

- Product/Business

- Key Developments

- Key Strategies

- Company Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Segment Overview

-

11.2.5

-

SWOT Analysis

-

11.3

-

Hi-Temp Insulation Inc.

-

Segment Overview

-

11.3.5

-

SWOT Analysis

-

11.4

-

Insulcon Group

-

11.4.2

-

Financial Updates

-

Isolite Insulating

- Company Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Products Company Ltd.

-

11.5.2

-

Financial Updates

-

Pacor Inc.

- Company Overview

- Financial

- Product/Business Segment Overview

- SWOT Analysis

-

Updates

-

11.6.4

-

Key Developments

-

11.6.6

-

Key Strategies

-

Promat International NV

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

11.7.1

-

Company Overview

-

11.7.3

-

Product/Business Segment Overview

-

Pyrotek

- Company Overview

- Financial Updates

- Product/Business

- Key Developments

- Key Strategies

- Company Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Segment Overview

-

11.8.5

-

SWOT Analysis

-

11.9

-

Skamol

-

11.9.2

-

Financial Updates

-

Unifrax

- Company Overview

- Financial

- Product/Business Segment Overview

- SWOT Analysis

-

Updates

-

11.10.4

-

Key Developments

-

11.10.6

-

Key Strategies

-

Thermal Ceramics

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

11.11.1

-

Company Overview

-

11.11.3

-

Product/Business Segment Overview

-

Conclusion

-

LIST OF TABLES

-

Global High Temperature Insulation Market, by Region,

-

North America: High Temperature

-

Insulation Market, by Country, 2023-2032

-

Europe:

-

High Temperature Insulation Market, by Country, 2023-2032

-

Table 4

-

Asia-Pacific: High Temperature Insulation Market, by Country, 2023-2032

-

Middle East & Africa: High Temperature Insulation

-

Market, by Country, 2023-2032

-

Latin America:

-

High Temperature Insulation Market, by Country, 2023-2032

-

Table 7

-

High Temperature Insulation Product Market, by Region, 2023-2032

-

North America: High Temperature Insulation Product Market,

-

by Country, 2023-2032

-

Europe: High Temperature

-

Insulation Product Market, by Country, 2023-2032

-

Table 10

-

Asia-Pacific: High Temperature Insulation Product Market, by Country,

-

Middle East & Africa: High

-

Temperature Insulation Product Market, by Country, 2023-2032

-

Table

-

Latin America: High Temperature Insulation Product Market,

-

by Country, 2023-2032

-

High Temperature Insulation

-

Application Market, by Region, 2023-2032

-

North

-

America: High Temperature Insulation Application Market, by Country, 2023-2032

-

Europe: High Temperature Insulation Application Market,

-

by Country, 2023-2032

-

Asia-Pacific: High

-

Temperature Insulation Application Market, by Country, 2023-2032

-

Table

-

Middle East & Africa: High Temperature Insulation Application

-

Market, by Country, 2023-2032

-

Latin America:

-

High Temperature Insulation Application Market, by Country, 2023-2032

-

Table

-

Global High Temperature Insulation Product Market, by

-

Region, 2023-2032

-

Global High Temperature

-

Insulation Application Market, by Region, 2023-2032

-

Table 21

-

North America: High Temperature Insulation Market, by Country, 2023-2032

-

North America: High Temperature Insulation Market,

-

by Product , 2023-2032

-

North America: High Temperature

-

Insulation Market, by Application, 2023-2032

-

Europe

-

High Temperature Insulation Market, by Country, 2023-2032

-

Table 25

-

Europe High Temperature Insulation Market, by Product , 2023-2032

-

Europe High Temperature Insulation Market, by

-

Application, 2023-2032

-

Asia-Pacific High Temperature

-

Insulation Market, by Country, 2023-2032

-

Asia-Pacific

-

High Temperature Insulation Market, by Product , 2023-2032

-

Table 29

-

Asia-Pacific High Temperature Insulation Market, by Application, 2023-2032

-

Middle East & Africa: High Temperature Insulation

-

Market, by Country, 2023-2032

-

Middle East

-

& Africa: High Temperature Insulation Market, by Product , 2023-2032

-

Middle East & Africa: High Temperature Insulation

-

Market, by Application, 2023-2032

-

Latin America:

-

High Temperature Insulation Market, by Country, 2023-2032

-

Table 34

-

Latin America: High Temperature Insulation Market, by Product , 2023-2032

-

Latin America: High Temperature Insulation Market,

-

by Application, 2023-2032

-

LIST OF FIGURES

-

FIGURE 1

-

High Temperature Insulation Market Segmentation

-

Forecast

-

Methodology

-

Porter’s Five Forces Analysis of High Temperature

-

Insulation Market

-

Supply Chain of High Temperature Insulation

-

Market

-

Share of High Temperature Insulation Market,

-

by Country, 2020 (%)

-

Global High Temperature Insulation Market,

-

Sub Segments of Product

-

FIGURE 9

-

High Temperature Insulation Market size, by Product , 2020 (%)

-

FIGURE

-

Share of High Temperature Insulation Market, by Product , 2023-2032

-

Sub Segments of Application

-

High Temperature Insulation

-

Market size, by Application, 2020 (%)

-

Share of High Temperature

-

Insulation Market, by Application, 2023-2032

Leave a Comment