Increasing Energy Demand

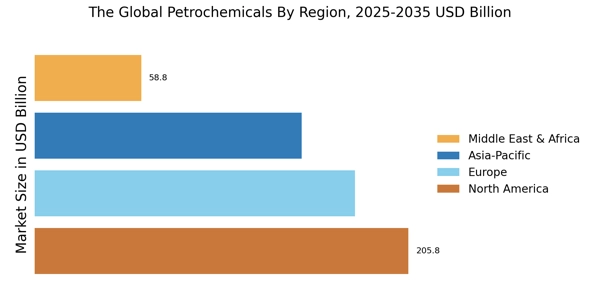

The increasing The Global Petrochemicals Industry. As economies expand and populations grow, the need for energy sources continues to rise. Petrochemicals are essential in the production of fuels and energy-related products, which are projected to see a demand increase of approximately 30% by 2025. This surge in energy requirements is likely to stimulate the petrochemical sector, as it provides the necessary raw materials for energy production. Consequently, the interplay between energy demand and petrochemical supply may significantly shape the future landscape of The Global Petrochemicals Industry.

Rising Demand for Plastics

The increasing demand for plastics across various sectors appears to be a primary driver for The Global Petrochemicals Industry. Plastics are integral to packaging, automotive, and construction industries, among others. In 2025, The Global Petrochemicals is projected to reach approximately 600 million metric tons, indicating a robust growth trajectory. This surge in demand for plastics is likely to stimulate the production of petrochemicals, as they serve as the foundational materials for plastic manufacturing. Consequently, The Global Petrochemicals Industry is expected to experience significant expansion, driven by the need to meet the rising consumption of plastic products.

Growth in Automotive Sector

The automotive sector's growth is another crucial driver influencing The Global Petrochemicals Industry. With the automotive industry projected to produce over 100 million vehicles annually by 2025, the demand for petrochemical-derived materials, such as synthetic rubber and plastics, is likely to increase. These materials are essential for manufacturing components like tires, dashboards, and fuel systems. As automotive manufacturers continue to innovate and enhance vehicle performance, the reliance on petrochemicals for lightweight and durable materials may further bolster the market. This trend suggests a sustained demand for petrochemical products, thereby propelling The Global Petrochemicals Industry forward.

Expansion of Construction Activities

The expansion of construction activities worldwide serves as a significant driver for The Global Petrochemicals Industry. As urbanization accelerates, the demand for construction materials, including insulation, pipes, and coatings, is expected to rise. In 2025, the construction industry is anticipated to reach a valuation of over 10 trillion USD, with petrochemical products playing a vital role in this growth. These materials are favored for their durability and versatility, making them essential in modern construction projects. Consequently, the increasing scale of construction activities is likely to enhance the demand for petrochemicals, thereby positively impacting The Global Petrochemicals Industry.

Technological Innovations in Production

Technological innovations in petrochemical production processes are likely to drive The Global Petrochemicals Industry. Advances in methods such as catalytic cracking and polymerization have improved efficiency and reduced costs, making the production of petrochemicals more sustainable. In 2025, it is estimated that the adoption of these technologies could lead to a 20% increase in production efficiency. This enhancement not only meets the growing demand for petrochemical products but also aligns with sustainability goals, as improved processes often result in lower emissions. Thus, the ongoing technological advancements may significantly influence the trajectory of The Global Petrochemicals Industry.