Rising Demand for Petrochemical Products

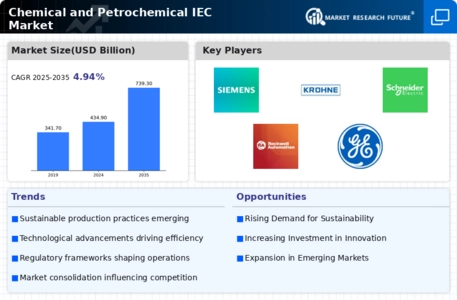

The Chemical and Petrochemical IEC Market is experiencing a notable increase in demand for petrochemical products, driven by their extensive applications in various sectors such as automotive, construction, and consumer goods. As of 2025, the demand for plastics, synthetic fibers, and other derivatives is projected to rise significantly, with estimates suggesting a compound annual growth rate of approximately 4.5% over the next five years. This surge is largely attributed to the growing population and urbanization, which necessitate more durable and versatile materials. Consequently, manufacturers within the Chemical and Petrochemical IEC Market are likely to expand their production capacities to meet this escalating demand, thereby enhancing their market presence and competitiveness.

Regulatory Compliance and Environmental Standards

The Chemical and Petrochemical IEC Market is increasingly influenced by stringent regulatory frameworks aimed at minimizing environmental impact. Governments worldwide are implementing more rigorous environmental standards, compelling companies to adopt cleaner production technologies and sustainable practices. For instance, regulations concerning emissions and waste management are becoming more prevalent, which may lead to increased operational costs for non-compliant firms. However, this shift also presents opportunities for innovation within the Chemical and Petrochemical IEC Market, as companies that invest in sustainable technologies may gain a competitive edge. The market is likely to see a rise in demand for eco-friendly products, aligning with consumer preferences for sustainability.

Technological Innovations in Production Processes

Technological advancements are playing a pivotal role in shaping the Chemical and Petrochemical IEC Market. Innovations such as advanced catalysts, automation, and digitalization are enhancing production efficiency and reducing costs. For example, the adoption of Industry 4.0 technologies is enabling real-time monitoring and optimization of production processes, which can lead to significant reductions in energy consumption and waste generation. As of 2025, it is anticipated that companies investing in these technologies will not only improve their operational efficiency but also enhance product quality. This trend is likely to attract investments into the Chemical and Petrochemical IEC Market, fostering a more competitive landscape.

Increasing Investment in Infrastructure Development

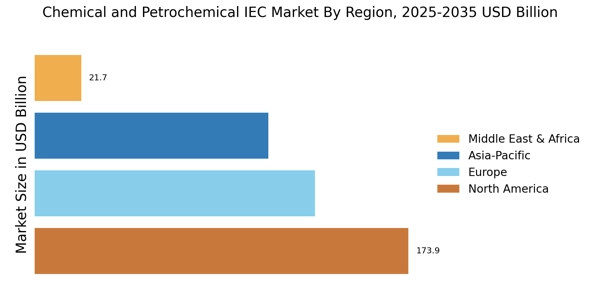

Investment in infrastructure development is a critical driver for the Chemical and Petrochemical IEC Market. As nations prioritize economic growth, substantial funding is being allocated to enhance transportation, energy, and industrial infrastructure. This trend is expected to bolster the demand for chemical and petrochemical products used in construction and manufacturing processes. For instance, the construction of new facilities and the expansion of existing ones are likely to require significant quantities of materials derived from the Chemical and Petrochemical IEC Market. As of 2025, this investment trend may lead to increased production capacities and market opportunities for companies operating within this sector.

Shifts in Energy Sources and Feedstock Availability

The Chemical and Petrochemical IEC Market is currently navigating shifts in energy sources and feedstock availability, influenced by the global transition towards renewable energy. As traditional fossil fuel sources face scrutiny, there is a growing interest in alternative feedstocks such as bio-based materials and recycled plastics. This transition may lead to a diversification of supply chains within the Chemical and Petrochemical IEC Market, as companies seek to secure sustainable and cost-effective feedstock options. The potential for innovation in feedstock sourcing could reshape market dynamics, encouraging firms to explore new partnerships and technologies that align with evolving energy policies.