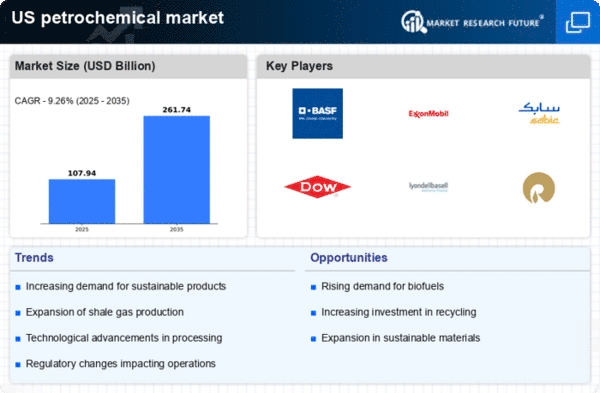

The US petrochemical market exhibits a complex competitive landscape characterized by a blend of established players and emerging innovators. Key growth drivers include the increasing demand for sustainable products, advancements in technology, and the ongoing shift towards digital transformation. Major companies such as ExxonMobil (US),

Dow (US), and Chevron Phillips Chemical (US) are strategically positioned to leverage these trends. ExxonMobil (US) focuses on enhancing its operational efficiency through digital technologies, while Dow (US) emphasizes sustainability in its product offerings. Chevron Phillips Chemical (US) is actively pursuing partnerships to expand its market reach, collectively shaping a competitive environment that prioritizes innovation and sustainability.The market structure appears moderately fragmented, with several key players exerting considerable influence. Business tactics such as localizing manufacturing and optimizing supply chains are prevalent among these companies. This approach not only enhances operational efficiency but also allows for greater responsiveness to market demands. The collective influence of these major players fosters a competitive atmosphere where agility and adaptability are paramount.

In October Dow (US) announced a significant investment in a new facility aimed at producing bio-based chemicals. This strategic move underscores Dow's commitment to sustainability and positions the company to meet the growing demand for environmentally friendly products. The facility is expected to enhance Dow's competitive edge by diversifying its product portfolio and reducing its carbon footprint, aligning with global sustainability goals.

In September ExxonMobil (US) unveiled a partnership with a leading technology firm to develop advanced AI solutions for optimizing its petrochemical operations. This collaboration is poised to enhance operational efficiency and reduce costs, reflecting ExxonMobil's focus on integrating cutting-edge technology into its processes. The strategic importance of this partnership lies in its potential to streamline operations and improve decision-making, thereby strengthening ExxonMobil's market position.

In August Chevron Phillips Chemical (US) expanded its joint venture with a prominent Asian company to enhance its production capabilities in the region. This expansion is indicative of Chevron Phillips' strategy to capitalize on growing demand in Asia while reinforcing its global footprint. The strategic significance of this move lies in its ability to increase production capacity and improve supply chain resilience, positioning the company favorably in a competitive market.

As of November current competitive trends in the petrochemical market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to navigate the evolving landscape. Looking ahead, competitive differentiation is likely to shift from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This evolution suggests that companies prioritizing these aspects will be better positioned to thrive in an increasingly complex market.