Home Security Camera Size

Market Size Snapshot

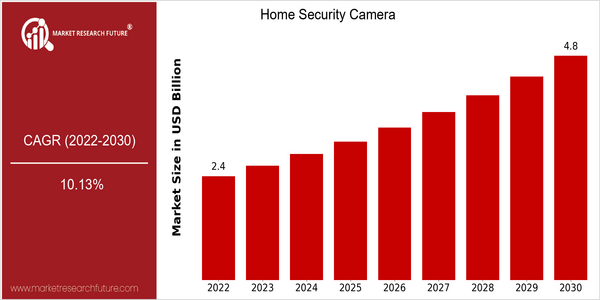

| Year | Value |

|---|---|

| 2022 | USD 2.4 Billion |

| 2030 | USD 4.8 Billion |

| CAGR (2024-2030) | 10.13 % |

Note – Market size depicts the revenue generated over the financial year

The Home Security Cameras Market is valued at about $ 2.4 billion in 2022 and is projected to reach $ 4.8 billion by 2022, growing at a robust CAGR of 10.13% from 2024 to 2026. This growth trend is attributed to the growing demand for security solutions owing to rising concerns regarding safety and security. As the pace of urbanization continues to increase, the popularity of smart home technology continues to rise, and the need for securing properties increases, the use of home security cameras is also expected to increase. There are several factors that are driving the growth of this market, such as the integration of the Internet of Things (IoT) and the application of artificial intelligence (AI) in the home security camera industry, which increases the functionality and accessibility of the camera. The increasing popularity of mobile applications that allow users to monitor their homes remotely is also expected to drive the growth of this market. The key players in this market, such as Ring, Arlo and Nest (a subsidiary of Google), are investing in the launch of new products and strategic alliances to enhance their offerings. Ring, for example, has widened its product range to include not only surveillance cameras, but also home security systems. Arlo, on the other hand, has focused on integrating artificial intelligence to enhance the ability to detect threats. These initiatives highlight the competitiveness of the home security camera market.

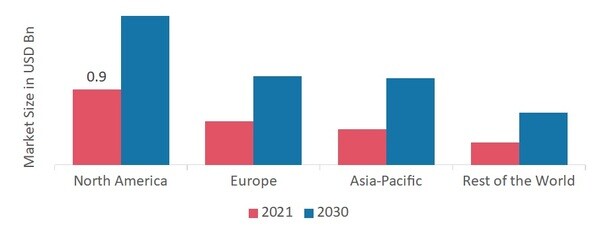

Regional Market Size

Regional Deep Dive

The market for home security cameras is growing at a fast pace, driven by the growing concerns for home security, technological advancements, and the rising adoption of smart home devices. In North America, the market is characterized by a high penetration of advanced surveillance technologies and a strong consumer preference for integrated security solutions. Europe is characterized by a diverse regulatory framework that influences the product standards and the consumers’ preferences. The Asia-Pacific region is emerging as a major player in the market, driven by the growing urbanization and rising disposable income. The Middle East and Africa are characterized by a low level of developed infrastructure and a high demand for security solutions.

Europe

- The European Union's General Data Protection Regulation (GDPR) has led to increased scrutiny on data collection practices by home security camera manufacturers, pushing companies like Arlo and Bosch to innovate in privacy-focused features.

- There is a growing trend towards sustainability, with companies like Netatmo focusing on energy-efficient products and eco-friendly materials, which is appealing to environmentally conscious consumers.

Asia Pacific

- Rapid urbanization in countries like India and China is driving demand for affordable and efficient home security solutions, with local companies such as Hikvision and Dahua Technology leading the market.

- The rise of smart cities initiatives in Asia-Pacific is fostering partnerships between technology firms and government agencies to enhance public safety through integrated surveillance systems.

Latin America

- Rising crime rates in countries like Brazil and Mexico are leading to increased consumer demand for home security cameras, with companies like Intelbras focusing on affordable solutions for the mass market.

- Government programs aimed at improving public safety are encouraging investments in home security technologies, creating opportunities for both local and international manufacturers.

North America

- The integration of artificial intelligence (AI) in home security cameras is gaining traction, with companies like Ring and Nest introducing features such as facial recognition and motion detection that enhance user experience and security.

- Regulatory changes in data privacy laws, such as the California Consumer Privacy Act (CCPA), are prompting manufacturers to adopt more transparent data handling practices, which is expected to build consumer trust and drive market growth.

Middle East And Africa

- In the UAE, government initiatives such as the Smart Dubai project are promoting the adoption of smart home technologies, including security cameras, to enhance urban safety and security.

- The increasing prevalence of crime in urban areas is driving demand for home security solutions, with local players like AxxonSoft providing tailored products to meet regional security needs.

Did You Know?

“Approximately 60% of burglaries occur in residential properties, making home security cameras a crucial investment for homeowners looking to deter crime.” — FBI Uniform Crime Reporting Program

Segmental Market Size

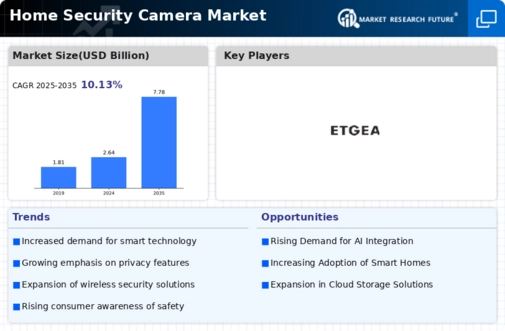

Home security camera is a very important part of the home security market, which is experiencing rapid growth, driven by the growing demand for security and surveillance. Rising property crimes and the increasing popularity of home automation are the main driving forces. The government's support for smart home devices has also attracted more consumers to use home security systems with remote monitoring capabilities. The current market is dominated by the Ring and Arlo companies in North America and Europe. These brands represent the trend towards smart and connected devices that support cloud services and real-time alerts. The main applications are to monitor the safety of residential areas, to protect vulnerable areas, and to integrate with smart home systems. The current situation of the global influenza epidemic and the increasing demand for home security solutions are also accelerated. More and more consumers are concerned about security and remote monitoring. The development of artificial intelligence and machine learning has made it possible to achieve features such as facial recognition and motion detection, which greatly enhance the security and usability of products.

Future Outlook

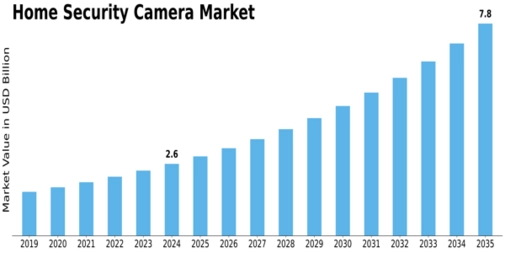

The home security camera market is expected to see a growth of over 10 per cent between 2022 and 2030. The market value is expected to double from $ 4.8 billion to $10.4 billion, which is a compound annual growth rate (CAGR) of 10.13 per cent. This is due to the increasing awareness of the need for home security, technological advancements and the increasing popularity of smart home devices. It is estimated that by 2030, approximately 30 per cent of households in developed regions will have installed home security cameras, up from 15 per cent in 2022. This is a significant increase in market penetration. Artificial intelligence and machine learning will be the main technological drivers, with facial recognition, motion detection and real-time alerts as some of the main features. In addition, the integration of the Internet of Things (IoT) will facilitate the connection of home security cameras with other smart home devices, which will further drive adoption. Subscription-based cloud services and advanced analytics will also help to shape the market, offering consumers added value and security. As the world continues to urbanise and concerns about security increase, the home security camera market will continue to grow.

Leave a Comment