Market Share

Introduction: Navigating the Competitive Landscape of Home Security Cameras

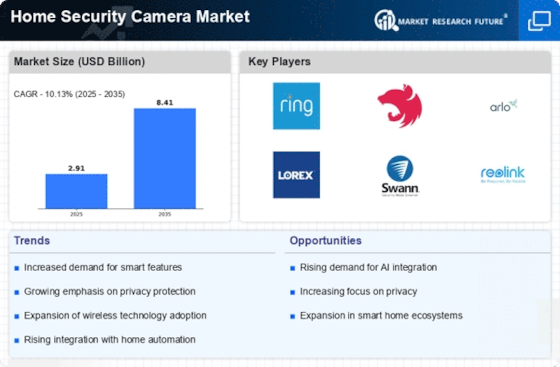

The home security camera market is experiencing unprecedented growth and competition, driven by a combination of rapid technology adoption, changing customer expectations, and new regulations on data privacy and security. This market is populated by a variety of players, including original equipment manufacturers, IT system integrators, cloud platform companies, and cutting-edge AI startups. IT system integration companies are focusing on a high level of system integration and automation, while original equipment manufacturers are focusing on the use of smart devices and the Internet of Things to improve the customer experience. While some of the new players are focusing on the use of biometrics and green technology to meet the expectations of green consumers. The strategic deployment of cloud platforms and subscription models is also changing, aiming to meet the needs of smart home integration and real-time monitoring in the next few years.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive security solutions, integrating hardware and software for a complete home security experience.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ADT Security Services (U.S.) | Established brand with extensive service network | Integrated security systems | North America |

| FrontPoint Security Solutions LLC (U.S.) | User-friendly DIY security solutions | Home security systems | North America |

Specialized Technology Vendors

These companies focus on innovative technology solutions, providing advanced features and functionalities in home security cameras.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Hangzhou Hikvision Digital Technology Co. Ltd (China) | Leading in video surveillance technology | CCTV and IP cameras | Global |

| Shenzhen Leshi Video Tech. Co. Ltd (China) | Strong focus on smart home integration | Smart video surveillance | Asia, expanding globally |

Infrastructure & Equipment Providers

These vendors supply essential hardware and networking equipment that support home security camera systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Netgear Inc. (U.S.) | Robust networking solutions for smart homes | Networking equipment and cameras | North America, Europe |

| Motorola Home (U.S.) | Strong brand recognition in consumer electronics | Home monitoring cameras | North America |

Emerging Players & Regional Champions

- ——Wyze Labs (USA): This company has recently teamed up with major retailers for a wider distribution and with its low price, high-quality offer, challenges established vendors like Ring and Arlo.

- Reolink (China): Specializes in high-resolution IP cameras and solar-powered devices, has recently entered the European market with successful applications in the residential sector, complementing the established players with its eco-friendly, new-generation solutions.

- It is a security camera that emphasizes privacy and has local storage, and has gained traction in North America by selling direct to consumers. It is a competitor of Nest and Arlo.

- Blink (USA): Offers budget-friendly, battery-operated security cameras with easy installation, recently launched a subscription service for cloud storage, challenging established brands by appealing to cost-conscious consumers.

- Sricam (India): Provides affordable surveillance solutions tailored for the Indian market, recently secured contracts with local businesses for comprehensive security setups, complementing larger players by focusing on regional needs and pricing.

Regional Trends: In 2022, a sharp rise in the use of home security cameras was noted in North America and Europe, prompted by increasing safety concerns and a desire to integrate these devices into smart-home systems. In the face of this trend, new players were quick to make their mark, with a combination of AI, cloud storage and eco-friendly solutions. Also, the growing interest in data security and privacy is influencing the way consumers think and feel, with the result that they are turning away from the old players in favour of those that offer a more transparent data policy.

Collaborations & M&A Movements

- Amazon acquired the home security camera company Blink in early 2022 to enhance its smart home ecosystem and compete more effectively against rivals like Google Nest, thereby increasing its market share in the home security segment.

- ADT Inc. partnered with Google Nest in mid-2022 to integrate advanced AI features into its security offerings, aiming to leverage Google's technology to improve customer experience and strengthen its competitive positioning in the market.

- Amazon's Ring subsidiary cooperated with the police departments of several cities in the United States in 2022, and enhanced the safety of the community. This not only improved its brand image, but also increased the market share of Ring.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Video Quality | Nest, Ring, Arlo | HDR enables better visibility in all light conditions. It records in 4K UHD resolution with HDR. Ring's cameras have 1080p HD resolution and a high-quality night vision, while Arlo's Ultra model has 4K UHD resolution and HDR with a 180° field of view, making it a good choice for general surveillance. |

| Smart Home Integration | Google Nest, Amazon Ring, Samsung SmartThings | Nest works perfectly with the Google Assistant and allows you to control your home with your voice. Amazon Ring works with Alexa and allows you to manage your security system with your voice. Samsung SmartThings works with a large number of devices, thus increasing interoperability. |

| Mobile App Functionality | Arlo, Ring, Wyze | The Arlo app provides instant notifications and cloud storage, enhancing the overall experience. Ring’s app includes two-way talk and live-streaming. Wyze’s app is simple and easy to use, with cheap cloud storage, making it the choice for consumers on a budget. |

| AI and Motion Detection | Nest, Arlo, Eufy | The Nest Cam uses an advanced A.I. to detect people and minimize false alarms. Arlo’s A.I. can distinguish between people, animals, and vehicles, and will send you notifications accordingly. The A.I. on the Eufy camera lets you set up motion zones, which can help you manage security. |

| Storage Options | Ring, Arlo, Blink | Cloud storage is the only option for the Ring, while Arlo offers both cloud and local storage, so as to meet the needs of different users. The cheapest Blink cloud storage service has won the favor of cost-conscious users. |

| Installation and Setup | Ring, Arlo, Nest | Ring cameras are known for their easy, do-it-yourself installation. They come with clear instructions and don’t require any special tools. Arlo is similarly easy to set up, while Nest, with its focus on a more integrated approach, may require professional installation to work at its best. |

Conclusion: Navigating the Home Security Camera Landscape

The home security camera market in 2022 will be characterized by intense competition and significant fragmentation. Both established and new players will compete for market share. In North America and Europe, the demand for advanced features will increase, while in Asia-Pacific, the rapid growth in the market will be driven by low prices and innovations. In order to achieve a strategic advantage, vendors will need to strategically position themselves, focusing on artificial intelligence to enhance surveillance, automation to enable seamless integration and compliance to meet consumers' demands. And the flexibility of the product portfolio will be crucial to the market, as consumers' preferences change. These companies that are able to master these capabilities will be the leaders in the home security camera market in 2022 and will shape the future of home security solutions.

Leave a Comment