Research Methodology on Home Security Camera Market

Introduction:

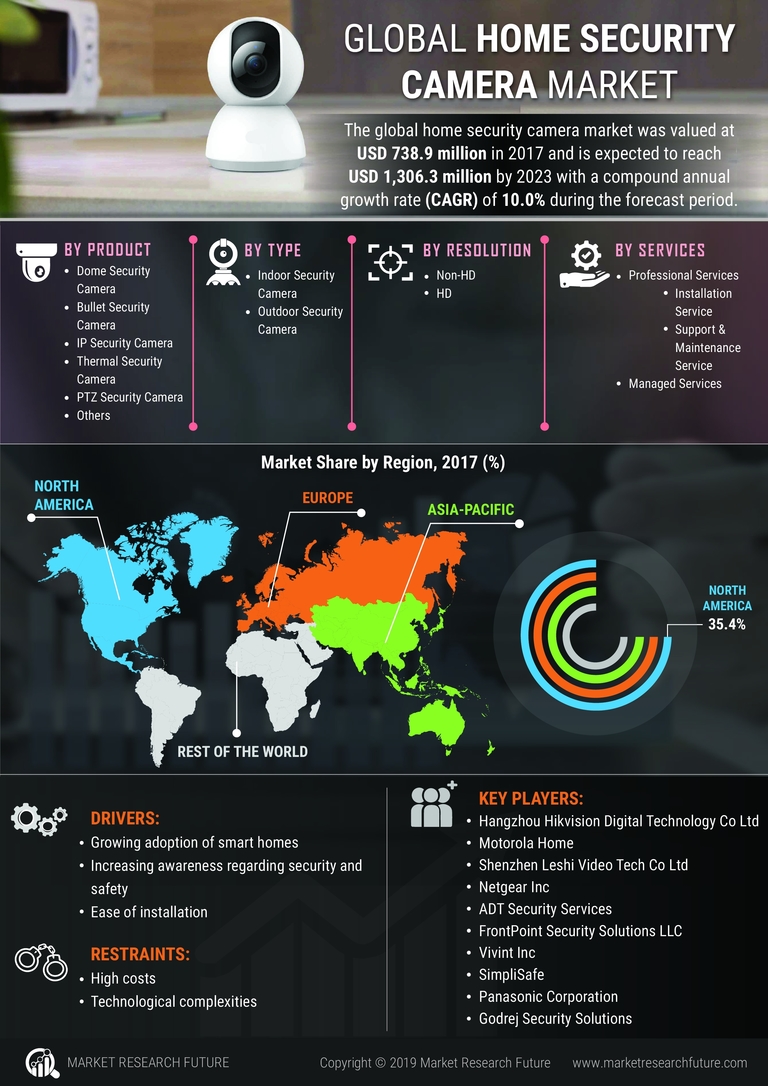

The Market Research Future report on the ‘Home Security Camera Market’ is an extensive study of the global home security camera market. The report provides a complete investigation of the drivers, restraints, trends, opportunities, and competitive landscape of the market. The findings of the study are drawn by conducting both primary and secondary research on numerous points and by considering them.

The Objective of the Study:

The primary objective of the report is to supply a detailed analysis of the global home security camera market. In addition, the report offers an in-depth assessment of the impact of the novel coronavirus and the associated economic slowdowns on the market.

Research Type:

This report is formulated through the use of extensive secondary research and primary sources. Secondary research or the desk research phase comprised the collection of data from several industry-related databases, the internet, online directories, and the review of the existing literature.

In addition, the primary sources of information included the interviews of key industry players which are executives from the company, CEOs, and industry experts from both the demand and supply sides. The primary sources were compared and contrasted with each other to validate the data collected.

Scope of the Study:

The study covers the exact analysis of market development, market dynamics, competitive landscapes, segment analysis, regional growth analysis, and market share analysis. The report is compiled by taking into consideration the present business scenarios and trends, alongside issues related to technological advancements, innovation, and fiscal policies.

Research Tools Used:

The study mainly focuses on using a mixture of primary tools such as interviews and surveys, along with secondary tools such as market research studies, comments and reviews, and technological patent analysis. Moreover, several market analysis mechanisms have been used to precisely compile the report, such as Porter’s Five Forces Model, PESTLE analysis, and BCG Matrix.

Assumptions:

The report also makes certain assumptions to make the report easier to comprehend and comprehend the report. The assumptions include the assumption that the current market trends will remain unchanged and are expected to present the same state of affairs at the time of completion of the report.

Demographic Factors:

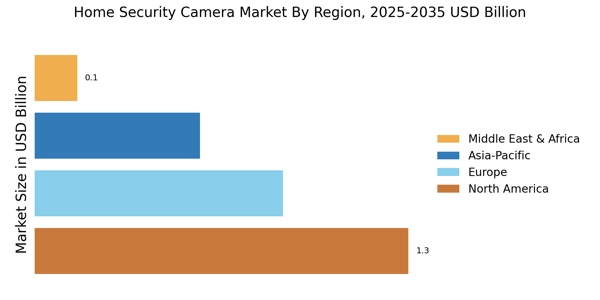

The demographic factors considered for the study included geographic segmentation, socio-economic condition, income level, and other factors. The region analyzed in the report included North America, Europe, Asia Pacific, and the rest of the world.

Advancement Analysis:

The report also offers an evaluation of the prevailing technological trends impacting the growth of the home security camera market. The advancements analyzed encompassed both software and hardware-associated advancements.

Data Analysis Methodology:

To deliver a reliable and diverse report, the data was collected from a variety of sources and the analysis process comprised both qualitative and quantitative techniques. Additionally, the analysis process consists of steps like the data triangulation method and the forecast methodology.

In Gartner’s market research methodology, the data is sourced from different sources including market surveys, industry journals and online databases, various website contents, and market experts.

In this technology report, market penetration, customer satisfaction index, customer experience index, customer loyalty index, customer service index, and market satisfaction index have been utilized as metric measures.

The market survey includes both primary and secondary research. The primary research includes the data collected from surveys and interviews with the companies in the market. Secondary research includes the data collected from industry journals and databases, published research reports, and online directories.

The research data is stratified into various categories such as market overview, market segmentation, market dynamics, market size, market growth, and market forecast.

The market analysis is conducted through modelling methodologies like SWOT analysis and Porter’s Five Forces Model. These methods help in understanding the market structure, competitive landscape, and opportunities currently available in the market.

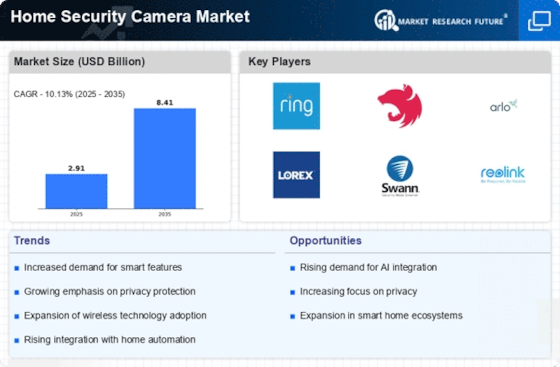

Furthermore, the analysis also takes into account the rising factors that are driving the home security camera market. These factors include developments in home automation technology, increasing utilization of wireless home security cameras, advancements in digital analytics and control systems, and rising criminal activities.

The data collected from primary and secondary sources is then processed and segmented into various categories to create the report. The report is then presented as a qualitative and quantitative assessment. The quantitative assessment is presented in the form of bar graphs, tables, and pie charts.

Finally, Market Research Future has employed several quality assurance procedures to ensure the accuracy and reliability of the final report. These procedures include data validation, industry-specific data quality check, and mathematical verifications.

Conclusion:

The report provides a comprehensive assessment of the global home security camera market and reports are created from the analysis of data collected from primary as well as secondary sources. The market size, competitive landscape, market trends, and forecast have been analyzed through Porter’s Five Forces Model, PESTLE analysis, market penetration, customer satisfaction index, customer experience index, customer loyalty index, customer service index, and market satisfaction index. Ultimately, the research report serves as a guide for stakeholders and industry professionals to understand the market dynamics, competitive landscape, and various opportunities for growth in the home security camera market for the period from 2023 to 2030.