Market Trends

Introduction

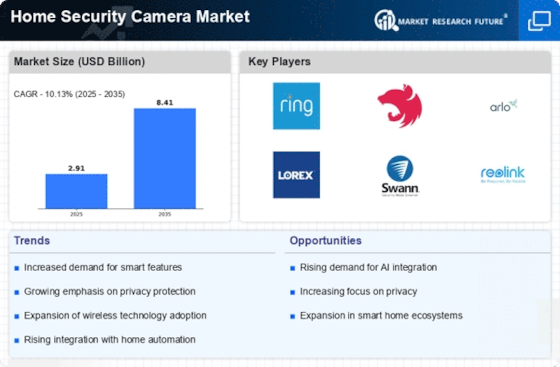

In 2022, the Home Security Camera market will experience a major transformation, driven by a confluence of macro-economic factors, such as the rapid development of technology, the changing regulatory environment, and the changing behavior of consumers. Artificial intelligence and machine learning will become an indispensable part of home security systems, and facial recognition and real-time alerts will become a reality. Also, the increasingly stringent regulatory requirements for data privacy and security will force manufacturers to adopt more stringent regulatory compliance measures, which will affect their product development and marketing strategies. The consumers' increasing awareness of personal safety and smart home integration will drive the demand for advanced security solutions. These trends are strategically important for industry players in coping with the competitive landscape, adjusting to the regulatory changes, and meeting the consumers' needs.

Top Trends

-

Increased Adoption of AI Technology

AI technology has become the core of home security cameras, and its features include facial recognition and motion detection. The number of false alarms is reduced by more than 90%. The market share of smart home security cameras has exceeded that of smart phones. The trend is enhancing the efficiency of the system and improving the user experience. With the development of AI technology, the trend is towards the application of big data for the prevention of crimes. -

Integration with Smart Home Systems

Increasingly, home security systems are being integrated with smart-home systems and can be controlled by mobile devices. The leading companies in this field are now developing cameras that can be used with the smart-home platforms Amazon Alexa and Google Assistant. This integration is expected to improve convenience and boost sales. There may be more sophisticated automation and greater interoperability in the future. -

Cloud Storage Solutions

The trend to cloud-based storage of surveillance images is gaining ground. ADT offers a subscription-based service. This enables remote access to images and ensures the security of the data. According to industry reports, cloud-based storage is expected to increase significantly, and will have a significant impact on how consumers manage their security data. Future developments could focus on improving encryption and data security. -

Enhanced Video Quality

High-definition images are driving innovation in home security cameras. With 4K and HDR becoming more common, the higher the resolution, the better. With its new line of cameras, for example, Motorola Home is delivering on superior clarity, which is crucial for identifying intruders. The better the image, the greater the likelihood of positive identification, which in turn will increase customer satisfaction and reduce manufacturers’ liability. Eventually, real-time video analysis may be used to determine the extent of a threat. -

Focus on Privacy and Data Security

As the need for privacy increases, manufacturers are making security features a priority in their products. Shenzhen Leshi, for example, has encrypted its smart camera data and uses a "two-way" encryption method to prevent the leakage of private information. This trend is reshaping both the demands of consumers and the regulatory requirements of the industry. The future may see a tighter regulatory environment and the emergence of more stringent security standards. -

Mobile App Control and Monitoring

The mobile phone is now essential for controlling and observing the camera. There are now live streaming and alerts. FrontPoint Security Solutions is improving its app in order to improve the experience of its users. This trend increases customer loyalty and the frequency of use of the app. The implications of this trend are advanced analytic tools and more convenient interfaces. -

Subscription-Based Services

The advent of the subscription model for home security cameras is changing the market, with companies offering a long-term service and new features. ADT’s subscription service provides users with a constant stream of surveillance and cloud storage. The trend is bringing steady revenue to the manufacturers and improving customer retention. The future may see a range of services to meet a variety of needs. -

Wireless Technology Advancements

Installing wireless security cameras is getting easier and easier. Netgear's latest models are Wi-Fi 6 for improved performance and range. This is a good thing for consumers and for the market. Future developments could include better battery life and lower latency for the video. -

Increased Regulatory Scrutiny

Governments are introducing stricter regulations regarding surveillance and data protection, which are affecting the way in which companies design their products. For example, the General Data Protection Regulation in the European Union has led manufacturers to introduce more privacy-enhancing features. This trend is having an effect on both product development and compliance strategies. And in the future, we may see a more comprehensive regulatory framework that shapes the industry landscape. -

User-Centric Design Innovations

This new generation of home security systems is putting an emphasis on the ease of use and the appearance of the camera. These companies are using customer research to guide their choices and are designing more intuitive interfaces. This has improved the satisfaction of the users and sales. And the next generation may be more flexible and more adapted to individual needs.

Conclusion: Navigating the Home Security Camera Landscape

In 2022 the home security camera market will be highly fragmented and characterized by intense competition. Both legacy and new players will compete for market share. The trend in the regions is a growing demand for more advanced features in North America and Europe, while Asia-Pacific is experiencing fast growth in its home security camera market. Artificial intelligence and automation are enabling new products and services, while consumers are demanding new features. Customers also want to be able to tailor their solutions. The companies that focus on these features will probably be the leaders of the future market and thereby be able to meet the diverse needs of the consumers in the rapidly changing market.

Leave a Comment