-

1 EXECUTIVE SUMMARY

-

Market Attractiveness Analysis

- Global Organic Tea Market, by Type

- Global Organic

-

Tea Market, by Form

-

1.1.3.

-

Global Organic Tea Market, by Distribution Channel

-

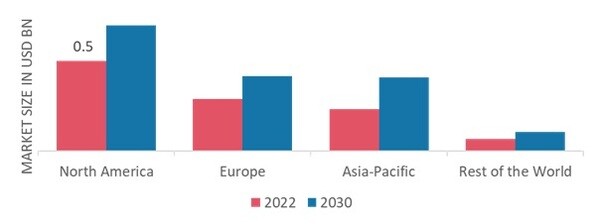

Global Organic Tea Market, by Region

-

MARKET INTRODUCTION

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Macro Factor Indicator

-

Analysis

-

3.

-

RESEARCH METHODOLOGY

-

3.1.

-

Research Process

-

3.2.

-

Primary Research

-

3.3.

-

Secondary Research

-

3.4.

-

Market Size Estimation

-

3.5.

-

Forecast Model

-

3.6.

-

List of Assumptions

-

4.

-

MARKET DYNAMICS

-

4.1.

-

Introduction

-

4.2.

-

Drivers

-

4.3.

-

Restraints

-

4.4.

-

Opportunities

-

4.5.

-

Challenges

-

5.

-

MARKET FACTOR ANALYSIS

-

5.1.

-

Value Chain Analysis

-

5.2.

-

Supply Chain Analysis

-

5.3.

-

Porter’s Five Forces Model

-

Bargaining Power of Suppliers

-

Bargaining Power of Buyers

-

Threat of New Entrants

-

Threat of Substitutes

-

Intensity of Rivalry

-

GLOBAL ORGANIC TEA

-

MARKET, BY TYPE

-

6.1.

-

Introduction

-

6.2.

-

Green

-

6.2.1.

-

Green: Market Estimates & Forecast, by Region/Country, 2022-2030

-

Black

- Black: Market Estimates

-

& Forecast, by Region/Country, 2022-2030

-

Others

- Others: Market Estimates & Forecast, by

-

Region/Country, 2022-2030

-

GLOBAL ORGANIC TEA MARKET, BY FORM

-

Introduction

-

Dried Leaf

- Dried Leaf: Market Estimates & Forecast,

-

by Region/Country, 2022-2030

-

Powder

- Powder: Market Estimates & Forecast, by Region/Country,

-

7.4.

-

Others

-

7.4.1.

-

Others: Market Estimates & Forecast, by Region/Country, 2022-2030

-

GLOBAL ORGANIC TEA

-

MARKET, BY DISTRIBUTION CHANNEL

-

Introduction

-

Store-Based

- Store-Based: Market Estimates & Forecast, by Region/Country,

- Convenience Stores

- Others

-

8.2.2.

-

Hypermarkets & Supermarkets

-

by Region/Country, 2022-2030

-

by Region/Country, 2022-2030

-

8.3.

-

Non-Store-Based

-

8.3.1.

-

Non-Store-Based: Market Estimates & Forecast, by Region/Country, 2022-2030

-

GLOBAL ORGANIC TEA

-

MARKET, BY REGION

-

9.1.

-

Introduction

-

9.2.

-

North America

-

9.2.1.

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.2.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Country, 2022-2030

-

9.2.5.1.

-

Market Estimates &

-

US

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.2.5.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Type, 2022-2030

-

& Forecast, by Distribution Channel, 2022-2030

-

9.2.7.2.

-

Canada

-

Market Estimates &

-

Market Estimates & Forecast, by Form, 2022-2030

-

Market Estimates

-

Mexico

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.3.

-

Europe

-

9.3.1.

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.3.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Country, 2022-2030

-

& Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.3.6.

-

UK

-

9.3.6.1.

-

Market Estimates &

-

Germany

-

Market Estimates & Forecast, by Type, 2022-2030

-

Market Estimates

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.3.6.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Type, 2022-2030

-

& Forecast, by Distribution Channel, 2022-2030

-

9.3.8.2.

-

France

-

Market Estimates &

-

Market Estimates & Forecast, by Form, 2022-2030

-

Market Estimates

-

Spain

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.3.9.

-

Italy

-

9.3.9.1.

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.3.9.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

& Forecast, by Type, 2022-2030

-

& Forecast, by Distribution Channel, 2022-2030

-

9.4.2.

-

Rest of Europe

-

Market Estimates

-

Market Estimates & Forecast, by Form, 2022-2030

-

Market Estimates

-

Asia-Pacific

- Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.4.4.

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Country, 2022-2030

-

9.4.5.2.

-

China

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.4.6.

-

Japan

-

9.4.6.1.

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.4.6.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Type, 2022-2030

-

& Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Type, 2022-2030

-

& Forecast, by Distribution Channel, 2022-2030

-

9.4.9.2.

-

India

-

Market Estimates &

-

Market Estimates & Forecast, by Form, 2022-2030

-

Market Estimates

-

Australia & New Zealand

-

Market Estimates &

-

Market Estimates & Forecast, by Form, 2022-2030

-

Market Estimates

-

Rest of Asia-Pacific

-

Market Estimates & Forecast, by Type,

-

Market Estimates & Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.5.

-

Rest of the World

-

9.5.1.

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.5.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Country, 2022-2030

-

& Forecast, by Form, 2022-2030

-

Channel, 2022-2030

-

9.5.6.

-

Middle East

-

9.5.6.1.

-

Market Estimates &

-

South America

-

Market Estimates & Forecast, by Type, 2022-2030

-

Market Estimates

-

Market Estimates & Forecast, by Distribution

-

Market Estimates & Forecast, by Type, 2022-2030

-

9.5.6.3.

-

Market Estimates & Forecast, by Form,

-

Market Estimates & Forecast, by Distribution Channel, 2022-2030

-

Forecast, by Type, 2022-2030

-

& Forecast, by Distribution Channel, 2022-2030

-

Africa

-

Market Estimates &

-

Market Estimates & Forecast, by Form, 2022-2030

-

Market Estimates

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Competitive Benchmarking

-

Development Share Analysis

-

Key Developments

-

& Growth Strategies

-

COMPANY PROFILES

-

Tata Global Beverages Limited

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Unilever

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Associated British Foods plc

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Vahdam Teas

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Celestial Seasonings,

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Inc.

-

11.5.1.

-

Company Overview

-

11.5.2.

-

Financial Overview

-

11.5.3.

-

Products Offered

-

11.5.4.

-

Key Developments

-

11.5.5.

-

SWOT Analysis

-

11.5.6.

-

Key Strategies

-

11.6.

-

Bombay Burmah Trading Corporation Limited

-

Stash Tea Company

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Bigelow Tea Company

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Shangri-la Tea

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Yogi Tea

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Republic of Tea

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mighty Leaf Tea

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Numi, Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Harney & Sons Fine Teas

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hälssen &

-

Lyon GmbH

-

11.15.1.

-

Company Overview

-

11.15.2.

-

Financial Overview

-

11.15.3.

-

Products Offered

-

11.15.4.

-

Key Developments

-

11.15.5.

-

SWOT Analysis

-

11.15.6.

-

Key Strategies

-

12.

-

APPENDIX

-

12.1.

-

General Sources & References

-

List of Abbreviation

-

-

LIST OF TABLES

-

Global Organic Tea Market, by Region, 2024-2032 (USD Million)

-

Global Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

Global Organic Tea Market, by Form, 2024-2032

-

(USD Million)

-

TABLE

-

Global Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

North America:

-

Organic Tea Market, by Country, 2024-2032 (USD Million)

-

North America: Organic Tea Market, by Type,

-

North America: Organic Tea Market, by Form, 2024-2032 (USD

-

Million)

-

TABLE

-

North America: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

US: Organic Tea

-

Market, by Type, 2024-2032 (USD Million)

-

US: Organic Tea Market, by Form, 2024-2032 (USD

-

Million)

-

TABLE

-

US: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

Canada: Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

Canada: Organic Tea Market, by Form, 2024-2032

-

(USD Million)

-

TABLE

-

Canada: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

Mexico: Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

Mexico: Organic Tea Market, by Form, 2024-2032

-

(USD Million)

-

TABLE

-

Mexico: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

Europe: Organic

-

Tea Market, by Country, 2024-2032 (USD Million)

-

Europe: Organic Tea Market, by Type, 2024-2032

-

(USD Million)

-

TABLE

-

Europe: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Europe: Organic Tea

-

Market, by Distribution Channel, 2024-2032 (USD Million)

-

Germany: Organic Tea Market, by Type, 2024-2032

-

(USD Million)

-

TABLE

-

Germany: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Germany: Organic Tea

-

Market, by Distribution Channel, 2024-2032 (USD Million)

-

France: Organic Tea Market, by Type, 2024-2032

-

(USD Million)

-

TABLE

-

France: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

France: Organic Tea

-

Market, by Distribution Channel, 2024-2032 (USD Million)

-

Italy: Organic Tea Market, by Type, 2024-2032

-

(USD Million)

-

TABLE

-

Italy: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Italy: Organic Tea Market,

-

by Distribution Channel, 2024-2032 (USD Million)

-

Spain: Organic Tea Market, by Type, 2024-2032

-

(USD Million)

-

TABLE

-

Spain: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Spain: Organic Tea Market,

-

by Distribution Channel, 2024-2032 (USD Million)

-

UK: Organic Tea Market, by Type, 2024-2032

-

(USD Million)

-

TABLE

-

UK: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

UK: Organic Tea Market, by Distribution

-

Channel, 2024-2032 (USD Million)

-

Rest of Europe: Organic Tea Market, by Type, 2024-2032 (USD

-

Million)

-

TABLE

-

Rest of Europe: Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Rest of Europe:

-

Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

Asia-Pacific: Organic

-

Tea Market, by Country, 2024-2032 (USD Million)

-

Asia-Pacific: Organic Tea Market, by Type,

-

Asia-Pacific: Organic Tea Market, by Form, 2024-2032 (USD

-

Million)

-

TABLE

-

Asia-Pacific: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

China: Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

China: Organic Tea Market, by Form, 2024-2032

-

(USD Million)

-

TABLE

-

China: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

India: Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

India: Organic Tea Market, by Form, 2024-2032

-

(USD Million)

-

TABLE

-

India: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

Japan: Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

Japan: Organic Tea Market, by Form, 2024-2032

-

(USD Million)

-

TABLE

-

Japan: Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

Rest of Asia-Pacific:

-

Organic Tea Market, by Type, 2024-2032 (USD Million)

-

Rest of Asia-Pacific: Organic Tea Market,

-

by Form, 2024-2032 (USD Million)

-

Rest of Asia-Pacific: Organic Tea Market, by Distribution

-

Channel, 2024-2032 (USD Million)

-

Rest of the World (RoW): Organic Tea Market, by Country, 2024-2032

-

(USD Million)

-

TABLE

-

Rest of the World (RoW): Organic Tea Market, by Type, 2024-2032 (USD Million)

-

Rest of the

-

World (RoW): Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Rest of the World (RoW):

-

Organic Tea Market, by Distribution Channel, 2024-2032 (USD Million)

-

South America: Organic

-

Tea Market, by Type, 2024-2032 (USD Million)

-

South America: Organic Tea Market, by Form,

-

South America: Organic Tea Market, by Distribution Channel,

-

Middle East: Organic Tea Market, by Type, 2024-2032 (USD Million)

-

Middle East:

-

Organic Tea Market, by Form, 2024-2032 (USD Million)

-

Middle East: Organic Tea Market, by Distribution

-

Channel, 2024-2032 (USD Million)

-

Africa: Organic Tea Market, by Type, 2024-2032 (USD Million)

-

Africa: Organic

-

Tea Market, by Form, 2024-2032 (USD Million)

-

Africa: Organic Tea Market, by Distribution

-

Channel, 2024-2032 (USD Million)

-

LIST OF FIGURES

-

Global Organic Tea Market Segmentation

-

Forecast Research

-

Methodology

-

FIGURE

-

Porter’s Five Forces Analysis of the Global Organic Tea Market

-

Value Chain

-

of Global Organic Tea Market

-

Share of the Global Organic Tea Market in 2022, by Country

-

(%)

-

FIGURE

-

Global Organic Tea Market, by Region, 2024-2032,

-

Global Organic Tea Market Size, by Type,

-

FIGURE

-

Share of the Global Organic Tea Market, by Type, 2024-2032 (%)

-

Global Organic Tea Market

-

Size, by Form, 2022

-

FIGURE

-

Share of the Global Organic Tea Market, by Form, 2024-2032 (%)

-

Global Organic Tea Market

-

Size, by Distribution Channel, 2022

-

Share of the Global Organic Tea Market, by Distribution

-

Channel, 2024-2032 (%)

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Leave a Comment