Overhead Cranes Size

Market Size Snapshot

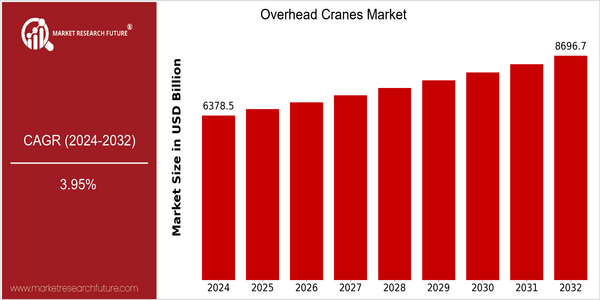

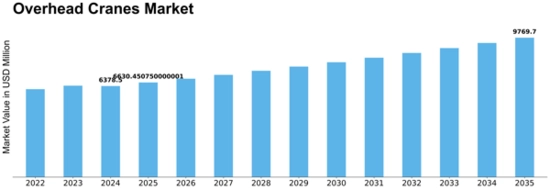

| Year | Value |

|---|---|

| 2024 | USD 6378.5 Billion |

| 2032 | USD 8696.7 Billion |

| CAGR (2024-2032) | 3.95 % |

Note – Market size depicts the revenue generated over the financial year

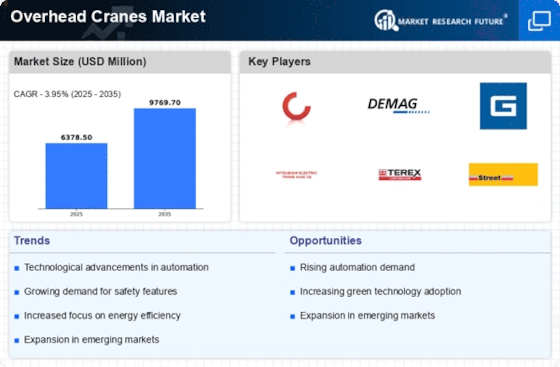

The world's overhead cranes market is expected to grow steadily, with a market size of $ 6,378,560,000 in 2024, expected to reach $ 8,696,600,000 by 2032. This represents a CAGR of 3.95% for the period from 2024 to 2032. The market is expected to grow because of the increasing automation of industrial processes, the growing demand for efficient material handling solutions, and the development of crane technology that improves efficiency and safety. And as the industries continue to develop, the integration of smart technology such as IoT and AI is expected to drive the adoption of overhead cranes and provide real-time monitoring and preventive maintenance. The key players in the overhead cranes market, such as Konecranes, Terex, and Liebherr, are continuously investing in R & D to develop new products. And companies are also forming strategic alliances to increase market share and leverage complementary technology. Recent product launches, for example, with advanced automation and energy-saving designs, show that the industry is committed to meeting the growing demand for manufacturing, construction, and logistics. In general, the global overhead cranes market is expected to benefit from the technological progress and strategic initiatives of these companies and will continue to grow in the future.

Regional Market Size

Regional Deep Dive

The global Overhead Cranes market is experiencing substantial growth across regions, owing to increasing industrialization, growing urbanization, and increasing automation in material handling. Each region has a different market character, influenced by local economic and regulatory conditions and technological developments. North America is characterized by a mature market with a focus on innovation and safety standards, whereas Europe focuses on energy efficiency and sustainable development. Asia-Pacific is characterized by rapid growth, mainly in the manufacturing sector, whereas the Middle East and Africa are characterized by slow but steady development of their economies, which is also reflected in the demand for Overhead Cranes. Latin America is a relatively new market, but it is also characterized by continuous investment in the mining and construction industries.

Europe

- European manufacturers are increasingly focusing on eco-friendly crane solutions, with companies like Demag and Liebherr investing in electric and hybrid models to meet stringent EU environmental regulations.

- The European market is also witnessing collaborations between manufacturers and technology firms to develop automated overhead crane systems, which are expected to enhance productivity in logistics and warehousing sectors.

Asia Pacific

- The Asia-Pacific region is experiencing rapid industrial growth, particularly in countries like China and India, where significant investments in infrastructure and manufacturing are driving the demand for overhead cranes.

- Local companies such as Shanghai Zhenhua Heavy Industries and Konecranes are expanding their production capabilities to cater to the increasing demand, while government initiatives aimed at boosting manufacturing are further propelling market growth.

Latin America

- Latin America is witnessing a revival in construction activities, particularly in Brazil and Mexico, which is driving the demand for overhead cranes as part of larger infrastructure projects.

- Local manufacturers are beginning to emerge, and partnerships with international companies are being formed to enhance technology transfer and improve product offerings in the region.

North America

- In North America, the market is booming for smart cranes that are connected to the Internet of Things, enhancing efficiency and safety. Konecranes and Terex are among the leaders in integrating new technology into their crane systems.

- Regulatory changes in safety standards, particularly OSHA regulations, are pushing manufacturers to innovate and improve the safety features of overhead cranes, thereby increasing the overall market competitiveness.

Middle East And Africa

- In the Middle East, large-scale infrastructure projects, such as the NEOM city in Saudi Arabia, are creating substantial demand for overhead cranes, with companies like Al Jaber Group actively involved in these developments.

- The African market is gradually evolving, with increased investments in mining and construction sectors, leading to a growing need for efficient material handling solutions, including overhead cranes.

Did You Know?

“Did you know that overhead cranes can lift loads weighing up to 1,000 tons, making them essential for heavy industries such as shipbuilding and steel manufacturing?” — International Crane and Rigging Conference

Segmental Market Size

The market for overhead cranes is experiencing steady growth, primarily driven by the increasing demand for efficient material handling solutions across industries. Also driving the market is the growing need for automation in manufacturing processes, and stringent safety regulations that require advanced lifting equipment. The growing number of construction and logistics projects worldwide is also driving the market. This market is currently at a mature stage of development, with key players such as Konecranes and Demag offering advanced solutions. North America and Europe are the most advanced regions, with many companies deploying smart crane systems that optimize productivity. Heavy-duty cranes are mainly used in production plants, warehouses, and shipyards, where precision and safety are critical. The growing trend toward sustainable development and the implementation of Industry 4.0 is also driving the market, as companies seek to integrate smart technology into their operations. The development of the Internet of Things and artificial intelligence is enabling the smart operation of overhead cranes, with predictive maintenance and remote monitoring.

Future Outlook

From 2024 to 2032, the global Overhead Cranes market is expected to grow at a CAGR of 3.95%. It is driven by the growing automation in the manufacturing and logistics industries, where overhead cranes play a key role in enhancing operational efficiency and safety. By 2032, the penetration of smart cranes with IoT capabilities will be higher than the current level of about 15%. It is expected that the use of modern lifting equipment will increase, mainly due to the development of the industry and the construction industry, especially in emerging economies. The trend towards sustainable development is also expected to drive the development of energy-efficient cranes and new materials, which are in line with the trend of reducing the carbon footprint of products. In view of these trends, the Overhead Cranes market will continue to evolve, with a focus on integrating digital solutions and improving the user experience, and will become an important part of the future of industrial operations.

Leave a Comment