Focus on Safety and Compliance

Safety regulations and compliance standards are becoming more stringent across various industries, which is influencing the Overhead Cranes Market. Companies are increasingly prioritizing safety measures to protect their workforce and minimize liability. In 2025, it is anticipated that investments in safety equipment and training will exceed 50 billion dollars. Overhead cranes equipped with advanced safety features, such as load monitoring systems and emergency stop functions, are gaining traction as organizations strive to adhere to these regulations. This focus on safety not only enhances operational efficiency but also fosters a culture of safety within organizations. As a result, the Overhead Cranes Market is likely to see increased demand for cranes that meet or exceed safety standards.

Growth in E-commerce and Logistics

The rapid expansion of e-commerce and logistics sectors is driving demand for efficient material handling solutions, including overhead cranes. As online shopping continues to gain traction, warehouses and distribution centers are increasingly relying on advanced equipment to manage inventory and fulfill orders swiftly. The logistics market is projected to grow at a rate of 7.5% annually, indicating a robust demand for overhead cranes in these facilities. These cranes facilitate the quick and safe movement of goods, which is essential for meeting consumer expectations in the fast-paced e-commerce environment. This trend suggests that the Overhead Cranes Market will experience sustained growth as logistics providers seek to enhance their operational capabilities.

Rising Demand in Construction Sector

The construction sector is experiencing a notable surge in activity, which appears to be a primary driver for the Overhead Cranes Market. As infrastructure projects expand, the need for efficient material handling solutions becomes increasingly critical. In 2025, the construction industry is projected to grow at a compound annual growth rate of approximately 5.5%, leading to heightened demand for overhead cranes. These cranes facilitate the movement of heavy materials, thereby enhancing productivity on construction sites. Furthermore, the integration of advanced technologies in cranes is likely to improve operational efficiency, making them indispensable in modern construction practices. This trend suggests that the Overhead Cranes Market will continue to thrive as construction projects become more complex and demanding.

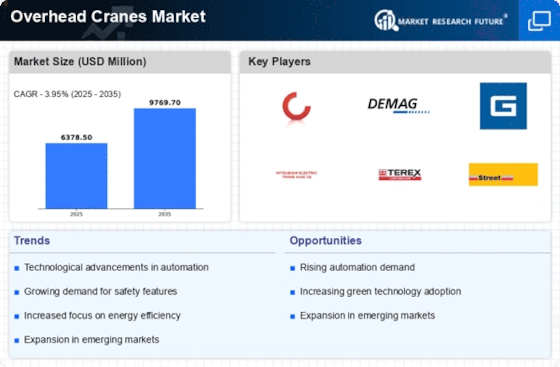

Increased Automation in Manufacturing

The manufacturing sector is progressively embracing automation, which significantly influences the Overhead Cranes Market. Automation enhances operational efficiency and reduces labor costs, prompting manufacturers to invest in advanced overhead crane systems. In 2025, it is estimated that the automation market will reach a valuation of over 200 billion dollars, with a substantial portion allocated to material handling equipment. Overhead cranes, equipped with smart technologies, are becoming essential for automating the movement of goods within manufacturing facilities. This shift towards automation not only streamlines processes but also minimizes the risk of workplace accidents, thereby promoting safety. Consequently, the Overhead Cranes Market is likely to benefit from this trend as manufacturers seek to optimize their operations.

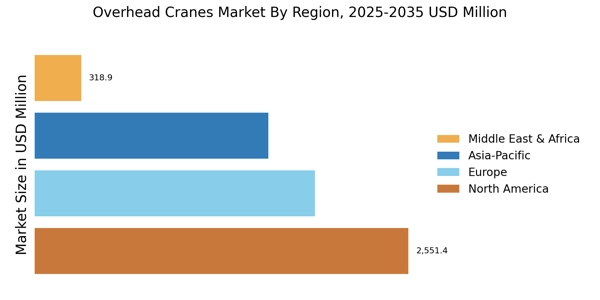

Emerging Markets and Infrastructure Development

Emerging markets are witnessing significant infrastructure development, which is likely to propel the Overhead Cranes Market. Countries in Asia and Africa are investing heavily in transportation, energy, and urban development projects. In 2025, infrastructure spending in these regions is projected to reach over 1 trillion dollars, creating a substantial demand for overhead cranes. These cranes are essential for lifting and moving heavy materials in construction and manufacturing processes. As emerging economies continue to develop, the need for efficient material handling solutions will grow, suggesting that the Overhead Cranes Market will benefit from this trend. This development may also lead to increased competition among manufacturers to provide innovative and cost-effective crane solutions.