Market Share

Introduction: Navigating the Competitive Landscape of Overhead Cranes

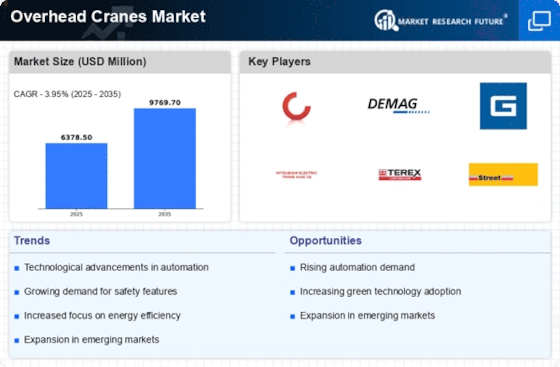

The Overhead Cranes Market is witnessing a transformative shift, which is being influenced by rapid technological developments and regulatory frameworks. This is compelling the industry players to adopt new business strategies in order to meet changing customer requirements. In this market, the key players such as original equipment manufacturers, system integrators, and technology companies are vying with one another to acquire a leadership position by deploying advanced technology such as artificial intelligence, automation, and IoT. These technological advancements not only enhance the operational efficiency but also enable the industry leaders to conduct real-time monitoring and preventive maintenance. The upcoming players, especially the artificial intelligence-based startups, are disrupting the existing industry paradigms by introducing smart and sustainable solutions. The Asia-Pacific and North America regions are expected to witness significant growth in the coming years. This is due to the presence of a large number of industry players. However, the dynamic nature of the market demands for a thorough understanding of the competitive scenario and the strategic maneuvers that will determine the future course of the market.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions, integrating various technologies and services for overhead crane systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Konecranes Plc | Strong global presence and service network | Complete crane solutions and services | Global |

| Cargotec | Innovative cargo handling solutions | Integrated cargo and lifting solutions | Global |

| Terex Cranes | Diverse product portfolio and expertise | Lifting and material handling equipment | Global |

Specialized Technology Vendors

These vendors focus on niche technologies and solutions tailored for specific overhead crane applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Ergonomic Partners | Focus on ergonomic lifting solutions | Ergonomic lifting equipment | North America |

| Columbus McKinnon Corporation | Expertise in hoisting and rigging | Hoisting and lifting solutions | North America, Europe |

| EMH Inc | Customizable overhead lifting solutions | Overhead cranes and hoists | North America |

Infrastructure & Equipment Providers

These vendors supply essential equipment and infrastructure components for overhead crane systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Eilbeck Cranes | Custom crane manufacturing capabilities | Custom overhead cranes | Australia, Asia-Pacific |

| Weihua Group | Leading manufacturer in China | Heavy-duty cranes and lifting equipment | Asia-Pacific, Global |

| ABUS Kransysteme GmbH | High-quality German engineering | Crane systems and components | Europe, Global |

Emerging Players & Regional Champions

- Konecranes (Finland): Specializes in smart lifting solutions and automation technology, has recently received a large order for an automatic crane system for a European factory, has challenged established suppliers with advanced IoT integration and predictive maintenance features.

- Gorbel (USA): specializes in the design and manufacture of lifting devices and crane systems for small and medium-sized enterprises. The company has recently supplied a custom-made crane system to a regional car supplier.

- Kito Corp. (Japan): This company has been making a series of light, portable cranes. It has recently established a new distribution partnership in Southeast Asia, and has been able to offer cost-effective solutions to small-scale operators.

- Cranesmart (USA): a pioneer in crane monitoring and safety systems. Its new software platform for real-time monitoring of crane performance complements traditional crane manufacturers by improving safety and efficiency.

Regional Trends: In 2024, the tendency towards automation and the integration of smart technology in the crane market will be reflected, especially in North America and Europe. In order to improve the efficiency and safety of the work, companies are increasingly adopting IoT solutions. The demand for a specialized and ergonomic solution is growing in Asia-Pacific, which is mainly driven by the expansion of the manufacturing industry and the focus on worker safety.

Collaborations & M&A Movements

- Konecranes and Demag formed a strategic partnership to enhance their product offerings in the overhead cranes market, aiming to leverage each other's technological advancements and expand their market reach.

- Terex Corporation acquired the overhead crane division of a regional competitor to strengthen its position in North America and increase its market share in the industrial sector.

- Mitsubishi Electric and Hitachi partnered to develop smart overhead crane systems that integrate IoT technology, aiming to improve operational efficiency and safety in manufacturing environments.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Automation and Control Systems | Konecranes, Demag | Konecranes has developed and introduced advanced automation solutions that increase efficiency. This has been demonstrated in the recent implementation of such a solution at a large automobile plant. The Demag controllers have a reputation for being reliable and easy to operate, and have a proven track record in heavy industry. |

| Load Monitoring and Safety Features | Gorbel, Street Crane | Gorbel offers new monitoring systems that improve both safety and compliance. They have been integrated in various sites. The Street Crane's safety devices are known for their robustness, as demonstrated by their installation in a steelworks. |

| Customization and Flexibility | Cranesmart, P&H | Cranesmart has developed a highly specialized crane solution, tailored to the specific needs of a particular industry. This was illustrated by the company's recent project in the aircraft industry. |

| Sustainability Initiatives | Atlas Copco, MHE-Demag | Atlas Copco has installed energy-saving equipment in its cranes, which reduces their carbon footprint, as is indicated in its annual reports on sustainable development. MHE-Demag is concentrating on using eco-friendly materials and methods, and is achieving success in the field of green building. |

| After-Sales Support and Service | Hoist UK, Cargotec | Hoist UK is renowned for its exceptional after-sales service, ensuring minimum downtime for its clients, as is attested by customer testimonials. Cargotec offers comprehensive maintenance packages that ensure the longevity of its equipment and is a major player in the logistics sector. |

Conclusion: Navigating the Overhead Cranes Landscape

The Overhead Cranes Market in 2024 will be characterized by high competition and considerable fragmentation, with both traditional and new players competing for market share. Moreover, the regional trend is towards the expansion of demand in Asia-Pacific and North America, mainly driven by industrial expansion and the construction of new roads and railways. Suppliers will have to strategically position themselves to gain a competitive advantage by focusing on advanced capabilities such as automation, digitalization, and flexibility. The major suppliers are focusing on improving their technological and sustainable offerings, while new players are launching new products to win over niche markets. Suppliers will have to prioritise investments in these key capabilities to ensure their long-term leadership and their ability to respond to rapid changes in the market.

Leave a Comment