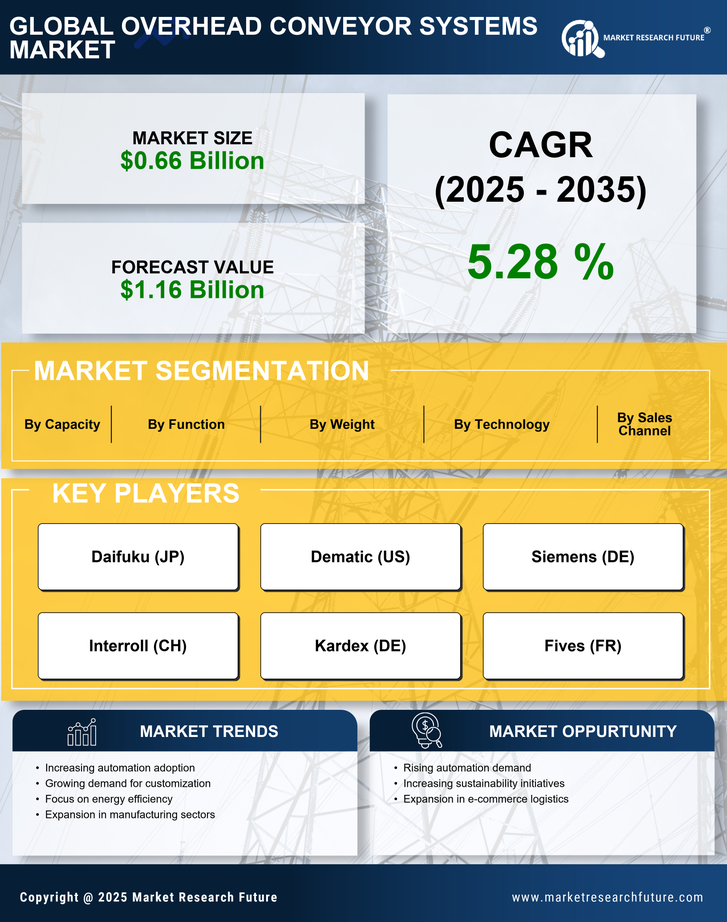

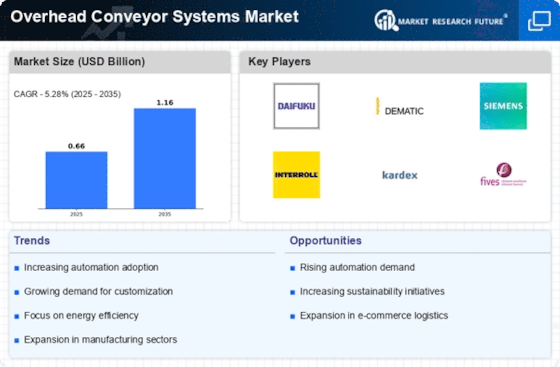

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Overhead Conveyor Systems Industry, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Overhead Conveyor Systems Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Overhead Conveyor Systems Industry to benefit clients and increase the market sector. In recent years, the Overhead Conveyor Systems Industry has offered some of the most significant advantages to medicine. Major players in the Overhead Conveyor Systems Industry, including SSI SCHAEFER AG, Dematic, TGW LOGISTICS GROUP, Vanderlande Industries, Dürkopp Fördertechnik GmbH, Daifuku Co. Ltd, Ferag AG, psb intralogistics GmbH, Jiangsu Huazhang Logistics Technology Co.

Ltd, PACLINE OVERHEAD CONVEYORS, Rapid Industries Inc., Bastian Solutions Inc., Allied Conveyor Systems Ltd, Schönenberger Systeme GmbH, Herbert Kannegiesser GmbH, OCS Overhead Conveyor System, CALDAN Conveyor A/S, KEWESTA GmbH, and JENSEN-GROUP, are attempting to increase market demand by investing in research and development operations.

Daifuku Co Ltd. (Daifuku) offers engineering, production, installation, and after-sales services for logistics systems and material handling equipment through its subsidiaries. The company's products include manufacturing and distribution systems, vehicle production lines, semiconductor production lines, flat-panel display production lines, airport technology, and car wash equipment.

In February Daifuku Co., Ltd. and the German business AFT Industries AG resolved to work together on commercial issues in order to benefit from each other's expertise in

automotive material handling.

The company DuPont de Nemours Inc (DuPont), formerly known as DowDuPont Inc., provides technology-based products and solutions. It addresses both the front and back ends of the manufacturing process by offering materials and printing systems to the advanced printing industry as well as materials and solutions for the fabrication of integrated circuits and semiconductors.

In May DuPont and Regina will introduce groundbreaking innovations.