-

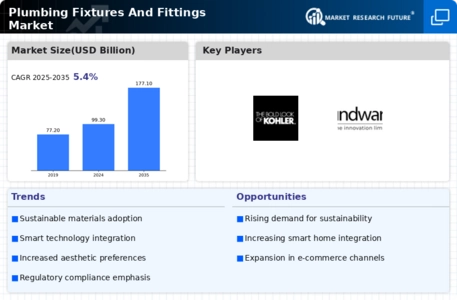

Executive Summary

-

Market Attractiveness Analysis

-

1.1.1

-

Global Plumbing Fixtures and Fittings Market, by Material

-

Global Plumbing

-

Fixtures and Fittings Market, by Product

-

Global Plumbing Fixtures and

-

Fittings Market, by Application

-

Market Introduction

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast

-

Model

-

List of Assumptions

-

Macro Factor Indicators Analysis

-

Market Insights

-

Market Dynamics

-

Introduction

-

Drivers

- Growing Construction Industry

- Eco-Friendly Plumbing Solutions

- Drivers Impact Analysis

-

Restraints

- Volatile Raw

- Restraints Impact Analysis

-

Material Prices

-

Opportunities

- Technological Innovation

-

Market Factor Analysis

-

Material Supply

-

6.1.4

-

End-Use

-

Raw

-

Product Manufacture

-

Distribution

-

Porter’s Five Forces Model

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Rivalry

-

Global Plumbing Fixtures

-

and Fittings Market, by Material

-

Overview

-

Vitreous China

- Vitreous China: Market Estimates & Forecast, by Region/Country, 2020-2027

-

Metal

- Cast Iron

- Others

- Metal: Market

-

Estimates & Forecast, by Region/Country, 2020-2027

-

Plastics

- Cast Polymer

- Others

- Plastics: Market

-

7.4.1

-

Fiber Glass

-

Estimates & Forecast, by Region/Country, 2020-2027

-

Global Plumbing Fixtures

-

and Fittings Market, by Product

-

Overview

-

Bathroom Fixtures &

- Bathroom Fixtures & Fittings: Market Estimates & Forecast,

-

Fittings

-

by Region/Country, 2020-2027

-

Kitchen and Sink Fixtures & Fittings

- Kitchen and Sink Fixtures & Fittings: Market Estimates & Forecast,

-

by Region/Country, 2020-2027

-

Toilet Fixtures & Fittings

-

8.4.1

-

Toilet Fixtures & Fittings: Market Estimates & Forecast, by Region/Country,

-

Others

- Others: Market Estimates & Forecast,

-

by Region/Country, 2020-2027

-

Global Plumbing Fixtures and Fittings Market,

-

by Application

-

Overview

-

Residential

- Residential:

-

Market Estimates & Forecast, by Region/Country, 2020-2027

-

Commercial

-

9.3.1.3

-

Hospitals & Healthcare Centers:

-

& Forecast, by Region/Country, 2020-2027

-

Office Spaces:

-

Educational Institutes:

-

Hotels & Restaurants:

-

Public Utility:

-

Others:

-

Commercial: Market Estimates

-

Global Plumbing Fixtures and

-

Fittings Market, by Region

-

Overview

-

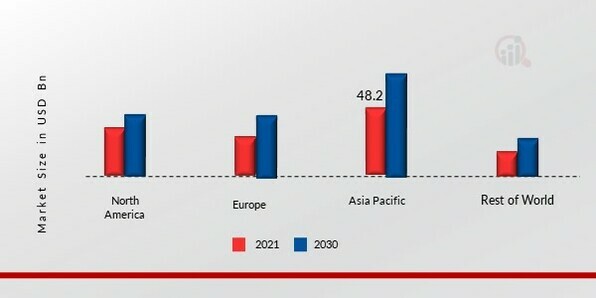

North America

- US

- Canada

- Mexico

-

10.2.1

-

Overview

-

Europe

- Overview

- Germany

- UK

- France

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Australia

- Hong Kong

- Vietnam

- Singapore

- Rest of Asia-Pacific

-

10.4.1

-

Overview

-

10.4.9

-

Philippines

-

Middle East & Africa

- Overview

- Saudi Arabia

- UAE

- South

- Rest of Middle East & Africa

-

Africa

-

South America

- Overview

- Brazil

- Argentina

- Rest of

-

South America

-

Competitive Landscape

-

Competitive Overview

-

Competitor Dashboard

-

Major Growth Strategies of Players in the

-

Global Plumbing Fixtures and Fittings Market

-

Competitive Benchmarking

-

Leading Player in Terms of Number of Developments in the Global Plumbing

-

Fixtures and Fittings Market

-

Market Share Analysis

-

Key Developments

- Mergers and Acquisitions

- Product

- Expansion

- Partnership

-

and Growth Strategies

-

Development

-

Company Profiles

-

Geberit AG

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

12.1.5

-

SWOT Analysis

-

Fortune Brands Home & Security,

- Company Overview

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Inc.

-

12.2.3

-

Products/Services Offered

-

LIXIL Group Corporation

- Company

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

Masco Corporation

- Company Overview

- Financial

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Overview

-

TOTO LTD

- Financial Overview

- Products/Services

- Key Developments

- SWOT Analysis

- Key

-

12.5.1

-

Company Overview

-

Offered

-

Strategies

-

Roca Sanitario, S.A.

- Company Overview

- Products/Services Offered

- Key Developments

- Key Strategies

-

12.6.2

-

Financial Overview

-

GWA Group Limited

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Strategies

-

12.7.4

-

Key Developments

-

Elkay Manufacturing Company

- Company Overview

- Financial Overview

- Products/Services

- Key Developments

- Key Strategies

-

Offered

-

Kohler

- Company Overview

- Financial Overview

- Products/Services

- Key Developments

- Key Strategies

-

Co.

-

Offered

-

Hindware

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

-

Homes (HSIL)

-

12.10.5

-

Key Strategies

-

Industry Insights

-

Export and Import Analysis

-

Distributors, Traders, and Dealers

-

Export Analysis: China,

- China

- Vietnam

-

Vietnam, and European Union

-

13.3.3

-

European Union

-

Import Tariffs and Duties

-

Appendix

-

14.1

-

References

-

Related Reports

-

List of Abbreviation

-

List Of Tables

-

List of Assumptions

-

Macro

-

Indicators Influencing the Global Plumbing Fixtures and Fittings Market

-

Table

-

US: Annual Value of Construction, 2013–2020 (USD Million)

-

Table 1

-

Vitreous China Market Estimates & Forecast, by Region, 2020-2027 (USD Million)

-

Metal Market Estimates & Forecast, by Region, 2020-2027 (USD Million)

-

Plastics Market Estimates & Forecast, by Region, 2020-2027 (USD

-

Million)

-

Bathroom Fixtures & Fittings Market Estimates & Forecast,

-

by Region, 2020-2027 (USD Million)

-

Kitchen and Sink Fixtures &

-

Fittings Market Estimates & Forecast, by Region, 2020-2027 (USD Million)

-

Toilet Fixtures & Fittings Market Estimates & Forecast, by Region,

-

Others Market Estimates & Forecast, by

-

Region, 2020-2027 (USD Million)

-

Residential Market Estimates &

-

Forecast, by Region, 2020-2027 (USD Million)

-

Commercial Market Estimates

-

& Forecast, by Region, 2020-2027 (USD Million)

-

Global Plumbing

-

Fixtures and Fittings Market, by Region, 2020-2027 (USD Million)

-

Table 11

-

US: Value of Construction, March 2019 (USD Million)

-

North America:

-

Plumbing Fixtures and Fittings Market, by Country, 2020-2027 (USD Million)

-

Table

-

North America: Plumbing Fixtures and Fittings Market, by Material, 2020-2027

-

(USD Million)

-

North America: Plumbing Fixtures and Fittings Market,

-

by Metal, 2020-2027 (USD Million)

-

North America: Plumbing Fixtures

-

and Fittings Market, by Plastics, 2020-2027 (USD Million) 63

-

North

-

America: Plumbing Fixtures and Fittings Market, by Product, 2020-2027 (USD Million)

-

64

-

North America: Plumbing Fixtures and Fittings Market, by Toilet

-

Fixtures & Fittings, 2020-2027 (USD Million)

-

North America: Plumbing

-

Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Table

-

North America: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027

-

(USD Million)

-

US: Plumbing Fixtures and Fittings Market, by Material,

-

US: Plumbing Fixtures and Fittings Market,

-

by Metal, 2020-2027 (USD Million)

-

US: Plumbing Fixtures and Fittings

-

Market, by Plastics, 2020-2027 (USD Million)

-

US: Plumbing Fixtures

-

and Fittings Market, by Product, 2020-2027 (USD Million)

-

US: Plumbing

-

Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD

-

Million)

-

US: Plumbing Fixtures and Fittings Market, by Application,

-

US: Plumbing Fixtures and Fittings Market,

-

by Commercial, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures

-

and Fittings Market, by Material, 2020-2027 (USD Million)

-

Canada:

-

Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Table

-

Canada: Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Canada: Plumbing Fixtures and Fittings Market, by Product, 2020-2027

-

(USD Million)

-

Canada: Plumbing Fixtures and Fittings Market, by Toilet

-

Fixtures & Fittings, 2020-2027 (USD Million)

-

Canada: Plumbing

-

Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Table

-

Canada: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027 (USD

-

Million)

-

Mexico: Plumbing Fixtures and Fittings Market, by Material,

-

Mexico: Plumbing Fixtures and Fittings Market,

-

by Metal, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures and Fittings

-

Market, by Plastics, 2020-2027 (USD Million)

-

Mexico: Plumbing Fixtures

-

and Fittings Market, by Product, 2020-2027 (USD Million)

-

Mexico:

-

Plumbing Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027

-

(USD Million)

-

Mexico: Plumbing Fixtures and Fittings Market, by Application,

-

Mexico: Plumbing Fixtures and Fittings Market,

-

by Commercial, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures

-

and Fittings Market, by Country, 2020-2027 (USD Million)

-

Europe:

-

Plumbing Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD

-

Million)

-

Europe: Plumbing Fixtures and Fittings Market, by Plastics,

-

Europe: Plumbing Fixtures and Fittings Market,

-

by Product, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures and

-

Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Europe: Plumbing Fixtures and Fittings Market, by Application, 2020-2027

-

(USD Million)

-

Europe: Plumbing Fixtures and Fittings Market, by Commercial,

-

Germany: Plumbing Fixtures and Fittings Market,

-

by Material, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures and

-

Fittings Market, by Metal, 2020-2027 (USD Million)

-

Germany: Plumbing

-

Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Table 52

-

Germany: Plumbing Fixtures and Fittings Market, by Product, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures and Fittings Market, by Toilet Fixtures

-

& Fittings, 2020-2027 (USD Million)

-

Germany: Plumbing Fixtures

-

and Fittings Market, by Application, 2020-2027 (USD Million)

-

Germany:

-

Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures and Fittings Market, by Material, 2020-2027 (USD

-

Million)

-

UK: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027

-

(USD Million)

-

UK: Plumbing Fixtures and Fittings Market, by Plastics,

-

UK: Plumbing Fixtures and Fittings Market,

-

by Product, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures and Fittings

-

Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Table 61

-

UK: Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

UK: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027

-

(USD Million)

-

France: Plumbing Fixtures and Fittings Market, by Material,

-

France: Plumbing Fixtures and Fittings Market,

-

by Metal, 2020-2027 (USD Million)

-

France: Plumbing Fixtures and Fittings

-

Market, by Plastics, 2020-2027 (USD Million)

-

France: Plumbing Fixtures

-

and Fittings Market, by Product, 2020-2027 (USD Million)

-

France:

-

Plumbing Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027

-

(USD Million)

-

France: Plumbing Fixtures and Fittings Market, by Application,

-

France: Plumbing Fixtures and Fittings Market,

-

by Commercial, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures and

-

Fittings Market, by Material, 2020-2027 (USD Million)

-

Spain: Plumbing

-

Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Spain:

-

Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Spain: Plumbing Fixtures and Fittings Market, by Product, 2020-2027 (USD

-

Million)

-

Spain: Plumbing Fixtures and Fittings Market, by Toilet

-

Fixtures & Fittings, 2020-2027 (USD Million)

-

Spain: Plumbing

-

Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Table

-

Spain: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures and Fittings Market, by Material,

-

Rest of Europe: Plumbing Fixtures and Fittings

-

Market, by Metal, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing

-

Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Table 80

-

Rest of Europe: Plumbing Fixtures and Fittings Market, by Product, 2020-2027 (USD

-

Million)

-

Rest of Europe: Plumbing Fixtures and Fittings Market, by

-

Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Rest of Europe:

-

Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Rest of Europe: Plumbing Fixtures and Fittings Market, by Commercial,

-

Asia-Pacific: Plumbing Fixtures and Fittings

-

Market, by Country, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing

-

Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

Table 86

-

Asia-Pacific: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures and Fittings Market, by Plastics,

-

Asia-Pacific: Plumbing Fixtures and Fittings

-

Market, by Product, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing

-

Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD

-

Million)

-

Asia-Pacific: Plumbing Fixtures and Fittings Market, by

-

Application, 2020-2027 (USD Million)

-

Asia-Pacific: Plumbing Fixtures

-

and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

China:

-

Plumbing Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

China: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD

-

Million)

-

China: Plumbing Fixtures and Fittings Market, by Plastics,

-

China: Plumbing Fixtures and Fittings Market,

-

by Product, 2020-2027 (USD Million)

-

China: Plumbing Fixtures and

-

Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

China: Plumbing Fixtures and Fittings Market, by Application, 2020-2027

-

(USD Million)

-

China: Plumbing Fixtures and Fittings Market, by Commercial,

-

Japan: Plumbing Fixtures and Fittings Market,

-

by Material, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures and

-

Fittings Market, by Metal, 2020-2027 (USD Million)

-

Japan: Plumbing

-

Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Table 102

-

Japan: Plumbing Fixtures and Fittings Market, by Product, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures and Fittings Market, by Toilet Fixtures

-

& Fittings, 2020-2027 (USD Million)

-

Japan: Plumbing Fixtures

-

and Fittings Market, by Application, 2020-2027 (USD Million)

-

Japan:

-

Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

India: Plumbing Fixtures and Fittings Market, by Material, 2020-2027

-

(USD Million)

-

India: Plumbing Fixtures and Fittings Market, by Metal,

-

India: Plumbing Fixtures and Fittings Market,

-

by Plastics, 2020-2027 (USD Million)

-

India: Plumbing Fixtures and

-

Fittings Market, by Product, 2020-2027 (USD Million)

-

India: Plumbing

-

Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD

-

Million)

-

India: Plumbing Fixtures and Fittings Market, by Application,

-

India: Plumbing Fixtures and Fittings Market,

-

by Commercial, 2020-2027 (USD Million)

-

Australia: Plumbing Fixtures

-

and Fittings Market, by Material, 2020-2027 (USD Million)

-

Australia:

-

Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Table

-

Australia: Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD

-

Million)

-

Australia: Plumbing Fixtures and Fittings Market, by Product,

-

Australia: Plumbing Fixtures and Fittings

-

Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Table 118

-

Australia: Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD

-

Million)

-

Australia: Plumbing Fixtures and Fittings Market, by Commercial,

-

Hong Kong: Plumbing Fixtures and Fittings

-

Market, by Material, 2020-2027 (USD Million)

-

Hong Kong: Plumbing

-

Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Table 122

-

Hong Kong: Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures and Fittings Market, by Product, 2020-2027

-

(USD Million)

-

Hong Kong: Plumbing Fixtures and Fittings Market,

-

by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Hong

-

Kong: Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Hong Kong: Plumbing Fixtures and Fittings Market, by Commercial,

-

Vietnam: Plumbing Fixtures and Fittings

-

Market, by Material, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures

-

and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Vietnam:

-

Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures and Fittings Market, by Product, 2020-2027

-

(USD Million)

-

Vietnam: Plumbing Fixtures and Fittings Market, by

-

Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Vietnam:

-

Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Vietnam: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027

-

(USD Million)

-

Singapore: Plumbing Fixtures and Fittings Market,

-

by Material, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures

-

and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Singapore:

-

Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures and Fittings Market, by Product, 2020-2027

-

(USD Million)

-

Singapore: Plumbing Fixtures and Fittings Market,

-

by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Singapore:

-

Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Singapore: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027

-

(USD Million)

-

Philippines: Plumbing Fixtures and Fittings Market,

-

by Material, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures

-

and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Philippines:

-

Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures and Fittings Market, by Product, 2020-2027

-

(USD Million)

-

Philippines: Plumbing Fixtures and Fittings Market,

-

by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Philippines:

-

Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Philippines: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027

-

(USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures and Fittings

-

Market, by Material, 2020-2027 (USD Million)

-

Rest of Asia-Pacific:

-

Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Table

-

Rest of Asia-Pacific: Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027

-

(USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures and Fittings

-

Market, by Product, 2020-2027 (USD Million)

-

Rest of Asia-Pacific:

-

Plumbing Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027

-

(USD Million)

-

Rest of Asia-Pacific: Plumbing Fixtures and Fittings

-

Market, by Application, 2020-2027 (USD Million)

-

Rest of Asia-Pacific:

-

Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures and Fittings Market, by

-

Country, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing

-

Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

Table 157

-

Middle East & Africa: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027

-

(USD Million)

-

Middle East & Africa: Plumbing Fixtures and Fittings

-

Market, by Plastics, 2020-2027 (USD Million)

-

Middle East & Africa:

-

Plumbing Fixtures and Fittings Market, by Product, 2020-2027 (USD Million)

-

Table

-

Middle East & Africa: Plumbing Fixtures and Fittings Market, by Toilet Fixtures

-

& Fittings, 2020-2027 (USD Million)

-

Middle East & Africa:

-

Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Middle East & Africa: Plumbing Fixtures and Fittings Market, by

-

Commercial, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures

-

and Fittings Market, by Material, 2020-2027 (USD Million)

-

Saudi

-

Arabia: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures and Fittings Market, by Plastics,

-

Saudi Arabia: Plumbing Fixtures and Fittings

-

Market, by Product, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing

-

Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD

-

Million)

-

Saudi Arabia: Plumbing Fixtures and Fittings Market, by

-

Application, 2020-2027 (USD Million)

-

Saudi Arabia: Plumbing Fixtures

-

and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

UAE:

-

Plumbing Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD

-

Million)

-

UAE: Plumbing Fixtures and Fittings Market, by Plastics,

-

UAE: Plumbing Fixtures and Fittings Market,

-

by Product, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures and Fittings

-

Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Table 175

-

UAE: Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

UAE: Plumbing Fixtures and Fittings Market, by Commercial, 2020-2027

-

(USD Million)

-

South Africa: Plumbing Fixtures and Fittings Market,

-

by Material, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures

-

and Fittings Market, by Metal, 2020-2027 (USD Million)

-

South Africa:

-

Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures and Fittings Market, by Product, 2020-2027

-

(USD Million)

-

South Africa: Plumbing Fixtures and Fittings Market,

-

by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

South

-

Africa: Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures and Fittings Market, by Commercial,

-

Rest of Middle East & Africa: Plumbing

-

Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

Table 185

-

Rest of Middle East & Africa: Plumbing Fixtures and Fittings Market, by Metal,

-

Rest of Middle East & Africa: Plumbing

-

Fixtures and Fittings Market, by Plastics, 2020-2027 (USD Million)

-

Table 187

-

Rest of Middle East & Africa: Plumbing Fixtures and Fittings Market, by Product,

-

Rest of Middle East & Africa: Plumbing

-

Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD

-

Million)

-

Rest of Middle East & Africa: Plumbing Fixtures and

-

Fittings Market, by Application, 2020-2027 (USD Million)

-

Rest of

-

Middle East & Africa: Plumbing Fixtures and Fittings Market, by Commercial,

-

South America: Plumbing Fixtures and Fittings

-

Market, by Country, 2020-2027 (USD Million)

-

South America: Plumbing

-

Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

Table 193

-

South America: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

South America: Plumbing Fixtures and Fittings Market, by Plastics,

-

South America: Plumbing Fixtures and Fittings

-

Market, by Product, 2020-2027 (USD Million)

-

South America: Plumbing

-

Fixtures and Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD

-

Million)

-

South America: Plumbing Fixtures and Fittings Market, by

-

Application, 2020-2027 (USD Million)

-

South Africa: Plumbing Fixtures

-

and Fittings Market, by Commercial, 2020-2027 (USD Million)

-

Brazil:

-

Plumbing Fixtures and Fittings Market, by Material, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD

-

Million)

-

Brazil: Plumbing Fixtures and Fittings Market, by Plastics,

-

Brazil: Plumbing Fixtures and Fittings Market,

-

by Product, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures and

-

Fittings Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Brazil: Plumbing Fixtures and Fittings Market, by Application, 2020-2027

-

(USD Million)

-

Brazil: Plumbing Fixtures and Fittings Market, by

-

Commercial, 2020-2027 (USD Million)

-

Argentina: Plumbing Fixtures

-

and Fittings Market, by Material, 2020-2027 (USD Million)

-

Argentina:

-

Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Table

-

Argentina: Plumbing Fixtures and Fittings Market, by Plastics, 2020-2027 (USD

-

Million)

-

Argentina: Plumbing Fixtures and Fittings Market, by Product,

-

Argentina: Plumbing Fixtures and Fittings

-

Market, by Toilet Fixtures & Fittings, 2020-2027 (USD Million)

-

Table 211

-

Argentina: Plumbing Fixtures and Fittings Market, by Application, 2020-2027 (USD

-

Million)

-

Argentina: Plumbing Fixtures and Fittings Market, by Commercial,

-

Rest of South America: Plumbing Fixtures

-

and Fittings Market, by Material, 2020-2027 (USD Million)

-

Rest of

-

South America: Plumbing Fixtures and Fittings Market, by Metal, 2020-2027 (USD Million)

-

Rest of South America: Plumbing Fixtures and Fittings Market, by

-

Plastics, 2020-2027 (USD Million)

-

Rest of South America: Plumbing

-

Fixtures and Fittings Market, by Product, 2020-2027 (USD Million)

-

Table 217

-

Rest of South America: Plumbing Fixtures and Fittings Market, by Toilet Fixtures

-

& Fittings, 2020-2027 (USD Million)

-

Rest of South America: Plumbing

-

Fixtures and Fittings Market, by Application, 2020-2027 (USD Million)

-

Table

-

Rest of South America: Plumbing Fixtures and Fittings Market, by Commercial,

-

Most Active Player in the Global Plumbing

-

Fixtures and Fittings Market

-

Mergers and Acquisitions

-

Table

-

Product Developments

-

Expansions

-

Partnerships

-

Geberit AG: Products/Services Offered

-

Fortune Brands

-

Home & Security, Inc.: Products/Services Offered

-

Fortune Brands

-

Home & Security, Inc.: Key Developments

-

LIXIL Group Corporation:

-

Products/Services Offered

-

LIXIL Group Corporation: Key Developments

-

Masco Corporation: Products/Services Offered

-

TOTO

-

LTD.: Products/Services Offered

-

Roca Sanitario, S.A.: Products/Services

-

Offered

-

Roca Sanitario, S.A.: Key Developments

-

GWA

-

Group Limited: Products/Services Offered

-

GWA Group Limited: Key

-

Developments

-

Elkay Manufacturing Company: Products/Services Offered

-

Elkay Manufacturing Company: Key Developments

-

KOHLER

-

CO.: Products/Services Offered

-

KOHLER CO.: Key Developments

-

HINDWARE HOMES: Products/Services Offered

-

HINDWARE HOMES:

-

Key Developments

-

Export Analysis of Fittings, E.g. Joints, Elbows,

-

Flanges, of Plastics, for Tubes, Pipes and Hoses (USD Thousand)

-

Table 243

-

Import Analysis of Fittings, E.g. Joints, Elbows, Flanges, of Plastics, for Tubes,

-

Pipes and Hoses (USD Thousand)

-

Export Analysis of Sinks and Washbasins,

-

of Stainless Steel (USD Thousand) 202

-

Import Analysis of Sinks and

-

Washbasins, of Stainless Steel (USD Thousand) 203

-

Export Analysis

-

of Ceramic Sinks, Washbasins, Washbasin Pedestals, Baths, Bidets, Water Closet Pans,

-

Flushing and Others (USD Thousand)

-

Import Analysis of Ceramic Sinks,

-

Washbasins, Washbasin Pedestals, Baths, Bidets, Water Closet Pans, Flushing and

-

Others (USD Thousand)

-

Export Analysis of Ceramic Sinks, Washbasins,

-

Washbasin Pedestals, Baths, Bidets, Water Closet Pans, Flushing and Others (USD

-

Thousand)

-

Import Analysis of Taps, Cocks, Valves and Similar Appliances

-

for Pipes, Boiler Shells, Tanks, Vats and Others (USD Thousand)

Leave a Comment