Market Trends

Key Emerging Trends in the Porous Ceramic Market

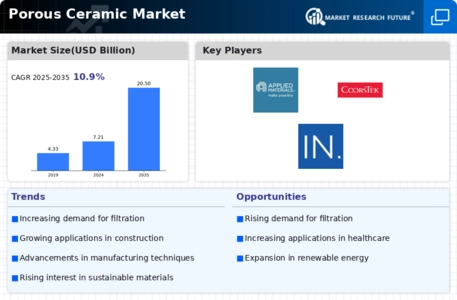

The porous ceramic market is experiencing significant trends that are reshaping the industry and influencing its growth trajectory. One prominent trend is the increasing demand for porous ceramics across various applications such as filtration, catalysis, thermal insulation, biomedical implants, and aerospace components. Porous ceramics offer unique properties such as high porosity, thermal stability, chemical inertness, and mechanical strength, making them versatile materials for a wide range of industrial and scientific applications. As industries seek innovative solutions for filtration, separation, and material processing, the demand for high-quality porous ceramics continues to rise, driving market expansion across diverse sectors.

Moreover, there is a growing emphasis on sustainability and environmental consciousness in the porous ceramic market, driven by increasing awareness of environmental issues and regulatory pressures to reduce pollution and resource consumption. Porous ceramics made from natural and eco-friendly materials such as clay, silica, and alumina offer environmental benefits such as biodegradability, recyclability, and reduced carbon footprint compared to synthetic materials. Additionally, advancements in manufacturing processes such as sol-gel, foaming, and sintering enable the production of porous ceramics with tailored pore structures, surface properties, and functionalities that meet specific environmental and performance requirements. This trend towards sustainable porous ceramics aligns with the industry's commitment to environmental stewardship and circular economy principles.

Furthermore, the market is witnessing increasing demand for porous ceramics in the field of water and air purification, driven by growing concerns about water scarcity, air pollution, and public health. Porous ceramic filters and membranes are widely used for removing contaminants such as bacteria, viruses, heavy metals, and particulate matter from water and air streams in industrial, municipal, and residential applications. Additionally, porous ceramics offer advantages such as high surface area, uniform pore distribution, and resistance to fouling and chemical degradation, making them effective and durable filtration materials. With increasing emphasis on clean water and air quality standards, the demand for porous ceramics in filtration and purification applications is expected to grow, driving market expansion in the environmental sector.

Moreover, the market for porous ceramics is experiencing a shift towards advanced applications in catalysis, energy storage, and biomedical fields. Porous ceramic catalysts are used for chemical reactions such as hydrogenation, oxidation, and hydrocracking in petrochemical, pharmaceutical, and environmental industries. Porous ceramic materials such as zeolites and metal-organic frameworks (MOFs) are gaining attention for their ability to adsorb and store gases such as hydrogen, methane, and carbon dioxide for energy storage and transportation applications. Additionally, porous ceramics are used as scaffolds for tissue engineering, drug delivery carriers, and implants in biomedical applications due to their biocompatibility, mechanical properties, and ability to support cell growth and tissue regeneration. As research and development efforts continue to expand the application scope of porous ceramics, the demand for advanced porous ceramic materials in emerging fields is expected to grow, driving market growth and fostering innovation in the industry.

Leave a Comment